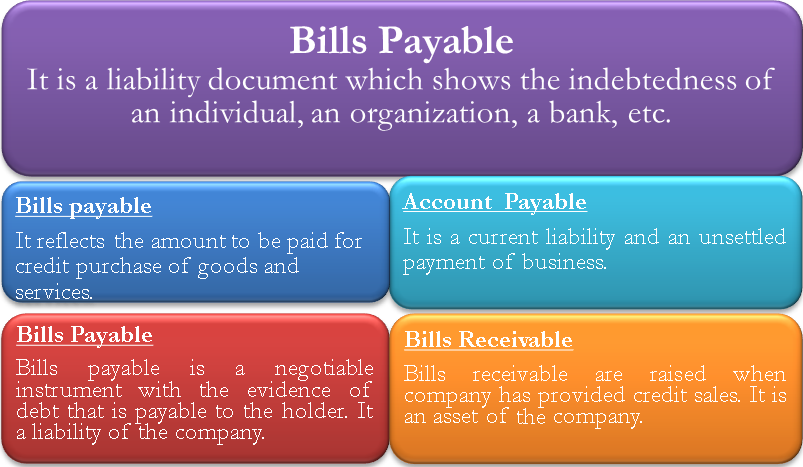

Meaning of Bills Payable

Bills Payable (B/P) is a liability document that shows the indebtedness of an individual, an organization, etc. When an individual or an organization makes a credit purchase of any goods or avails service. Generally, in a sale and purchase of goods, the seller of goods needs money during the credit term. So, it will draw a bill to the purchaser of goods. The purchaser of goods will accept the bill and returns it to the seller of goods. This becomes Bills Receivable for the drawer of bill/seller of goods and Bills Payable for drawee of bill/purchaser of goods.

Bills Payable Journal Entry

The books of accounts are prepared following the double-entry accounting system. The journal entry when goods or services are purchased on credit is:

| Particulars | Debit | Credit |

| Journal Entry (1) | ||

| Purchases | **** | |

| To Creditors | **** | |

| Journal Entry (2) | ||

| Creditors | **** | |

| To Bills Payable | **** |

The B/P will reflect as a liability in the balance sheet under the head Current Liabilities. The journal entry for B/P when the supplier makes payment:

| Particulars | Debit | Credit |

| Bills Payable | **** | |

| To Cash/Bank | **** |

The amount paid will reduce from the B/P head in the balance sheet.

Bills Payable vs. Accounts Payable

Often people use these terms interchangeably. Both represent a monetary obligation to pay to an outside party. Despite being similar, there is one difference that separates the two. Accounts payable reflect the amount outstanding for credit purchase of goods, while B/P indicates the amount of Bills Payable, i.e., the value of bills accepted by the company. B/P is covered under the Negotiable Instrument Act, and payment to be made to creditors is covered under the general contract act.

Bills Payable and Bills Receivables

Bills Receivable and payable are exactly opposite of each other. Former is the asset of the company. Like B/P, it is also a negotiable instrument with evidence of a debt that is payable to the holder. If a company has provided credit sales or services to anyone, then it will write a bill on the debtor for the amount that is payable in the future. Such bill is termed as bills receivable.

These bills appear on the asset side of the balance sheet. On the other hand, bills receivables are drawn when a vendor or seller makes any credit sale to the business. The amount mentioned in the bill is paid on a future date, and such a bill is called B/P.

Conclusion

It forms an important aspect of accountancy that falls under short-term liabilities. On the basis of such bills, the company determines its creditors (i.e., payments for goods done on a certain future date). Bills receivable help the seller get funds by discounting the bill, and the purchaser of goods will also get credit. Practically it is a very useful source of finance.

Quiz on Bills Payable

Let’s take a quick test on the topic you have read here.

More détail on accounting concerning centralized système or accounting