In our last article- “What is more Liquid – Accounts Receivable or Inventory?“, we explored the concept of liquidity and delved into a comparison between the liquidity of accounts receivable and inventory. Liquidity plays a crucial role in assessing the ease with which assets can be converted into cash without significant loss of value. Today, we will delve deeper into the factors affecting the liquidity of accounts receivable, shedding light on the key elements that can impact its liquidity. Understanding these factors and how are they vital for organizations to effectively manage their accounts receivable and ensure a healthy cash flow.

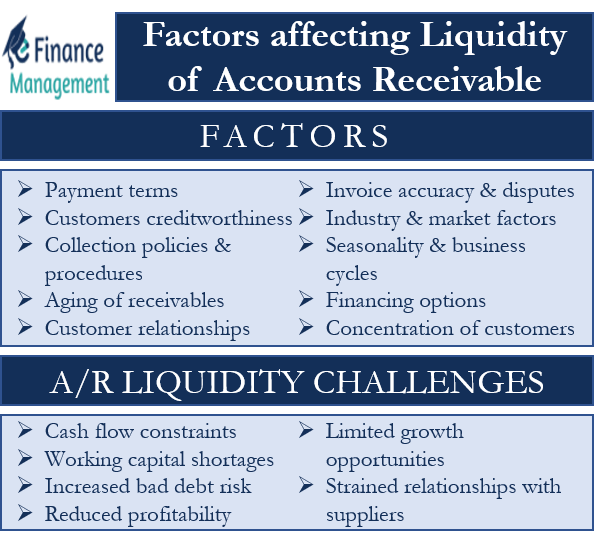

Factors Affecting Liquidity of Accounts Receivable

Several factors that affect the liquidity of accounts receivable are as follows:

Payment Terms

The agreed-upon payment terms between a company and its customers have a significant impact on liquidity. Longer payment terms, such as net 60 or 90 days, can delay cash inflows and reduce liquidity. Conversely, shorter payment terms, such as net 15 or 30 days, result in faster cash conversion and improved liquidity.

Creditworthiness of Customers

The creditworthiness of customers plays a crucial role in accounts receivable liquidity. Customers with a strong credit history and reliable payment behavior are more likely to settle their invoices promptly, thereby improving liquidity. Conversely, customers with poor creditworthiness or a history of late payments increase the risk of delayed or non-payment, negatively impacting liquidity. This impacts the accuracy of cash inflow forecasting. All decisions and plans that are based on cash flow forecasting can be delayed or spoiled if you don’t receive funds when expected.

Collection Policies and Procedures

The efficiency and effectiveness of a company’s collection policies and procedures can significantly affect the liquidity of accounts receivable. Efficient collection efforts, including timely and consistent follow-ups, reminders, and escalation procedures, can help accelerate cash collection and improve liquidity. A well-structured and proactive approach to collections minimizes the risk of delinquencies and improves overall liquidity.

Manual and inefficient processes for generating invoices, tracking payments, and reconciling accounts can result in delays and errors, reducing liquidity. Implementing streamlined and automated accounts receivable systems, utilizing technology and software solutions, can help improve efficiency, accelerate cash collection, and enhance liquidity.

Aging of Receivables

The aging of accounts receivable refers to the length of time it takes for invoice collection. As invoices age, their collectability and liquidity can decrease. Monitoring the aging of receivables and taking appropriate actions for overdue invoices, such as implementing stricter collection measures or offering incentives for early payment, can help maintain liquidity.

Customer Relationships

Strong relationships with customers can positively impact liquidity. A good rapport and effective communication can help ensure prompt payment and timely dispute resolution, thereby improving the liquidity of accounts receivable. Conversely, strained relationships or disputes with customers can lead to payment delays, impacting liquidity.

Invoice Accuracy and Disputes

Invoice accuracy and the occurrence of disputes can affect the liquidity of accounts receivable. Inaccurate or unclear invoices can lead to payment delays as customers seek clarification or request corrections. Disputes related to pricing, quality, or service issues can also prolong the payment process. Resolving disputes promptly and accurately and providing clear and detailed invoices can help minimize the impact on liquidity.

Industry and Market Factors

Industry-specific factors and market conditions can influence accounts receivable liquidity. For example, industries with longer payment cycles or customers who commonly delay payments can face lower liquidity. Additionally, economic downturns, recessions, or industry-specific challenges can affect the financial health of customers, leading to delayed payments and reduced liquidity.

Seasonality and Business Cycles

Seasonal fluctuations and business cycles can have a significant impact on accounts receivable liquidity. Businesses that experience seasonal variations in demand may face periods of reduced liquidity when sales decrease and customers delay payments. It is important for companies to anticipate and plan for these cycles, ensuring they have sufficient working capital or alternative financing arrangements in place to maintain liquidity during slower periods.

Financing Options

Utilizing financing options such as factoring or invoice discounting can impact accounts receivable liquidity. These methods involve selling the receivables to a third party at a discount in exchange for immediate cash. While they provide immediate liquidity, they also result in reduced overall receivables value.

Concentration of Customers

The concentration of customers can affect accounts receivable liquidity. If a significant portion of accounts receivable is concentrated among a few customers, any delays or non-payments from those customers can have a substantial impact on liquidity. Diversifying the customer base and reducing dependency on a few large customers can help mitigate the risk and improve overall liquidity.

Quality of Goods Sold

The Quality of Goods Sold is not directly related to the liquidity of accounts receivable. However, the quality of goods sold can indirectly impact the liquidity of accounts receivable in the following ways:

- Customer Satisfaction: If a company consistently sells high-quality goods, it is more likely to have satisfied customers who are willing to make prompt payments. Satisfied customers are generally more reliable in paying their invoices on time, which can improve the liquidity of accounts receivable.

- Return and Defect Rates: Poor quality goods may result in a higher rate of returns or customer disputes, which can delay payment or lead to non-payment. This can adversely affect the liquidity of accounts receivable, as outstanding invoices may take longer to collect or may become uncollectible.

- Acquire Cream Customers: The quality of goods sold can impact the quality of customers, you acquire and retain. If a company consistently provides high-quality goods, it may attract more creditworthy customers who are less likely to default on their payments. On the other hand, selling low-quality goods may attract customers with weaker financial positions, increasing the risk of non-payment or delays in payment.

Liquidity becomes important because it reflects the company’s ability to meet its short-term financial obligations and fund its ongoing operations. If a company’s accounts receivable are not converted into cash in a timely manner, it may face difficulties in paying its own bills, purchasing inventory, or investing in growth opportunities.

Challenges Faced by Company if Liquidity of Accounts Receivable Gets Hampered

When the liquidity of accounts receivable is hampered, organizations face several problems. Some of the common challenges include:

Cash Flow Constraints

Accounts receivable serve as an important source of cash for a company. If the liquidity of accounts receivable is hindered, it can result in cash flow constraints, making it difficult for the organization to meet its financial obligations such as paying suppliers, employees, and other operating expenses.

Working Capital Shortages

Accounts receivable are a part of a company’s working capital. If the liquidity of accounts receivable is compromised, it can lead to working capital shortages, affecting the company’s ability to manage inventory, invest in growth initiatives, or take advantage of business opportunities.

Increased Bad Debt Risk

Delayed or non-payment of accounts receivable increases the risk of bad debts. If customers are unable or unwilling to pay, the organization may have to write off these receivables as bad debt, resulting in a direct hit to the company’s profitability and financial health.

Strained Relationships with Suppliers

If an organization is unable to pay its suppliers on time due to liquidity issues with accounts receivable, it can strain relationships with suppliers. This may result in the loss of favorable payment terms or discounts, or even lead to disruptions in the supply chain.

Reduced Profitability

Liquidity issues with accounts receivable can impact a company’s profitability. When the organization delays payments, the organization may incur additional costs related to collection efforts, interest expenses, or the need for external financing. Moreover, the lack of available cash can limit the company’s ability to invest in profitable projects or take advantage of discounts offered by suppliers.

Limited Growth Opportunities

Restricted liquidity in accounts receivable can hinder an organization’s ability to pursue growth opportunities. The company may lack the necessary funds to invest in research and development, marketing campaigns, expanding into new markets, or acquiring assets that can drive growth and competitiveness.

To mitigate these problems, organizations should have effective accounts receivable management strategies in place. This includes setting clear payment terms, establishing strong credit policies, implementing efficient collection procedures, and regularly monitoring and assessing the aging of receivables. It is also important to maintain open communication with customers and promptly address any payment issues to minimize the impact on liquidity.