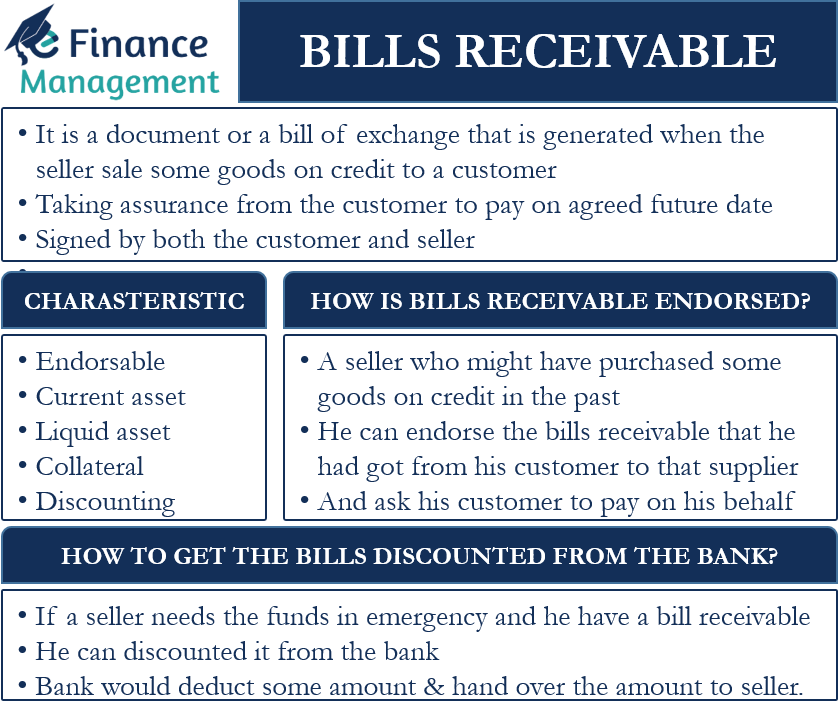

Meaning: Bills Receivable

Bills receivable is a document or a bill of exchange that is generated when the seller sells some goods on credit to a customer. It is a type of evidence giving assurance to the seller from the customer that they will pay the amount on an agreed future date to the seller. It is generally created by the seller and signed by both the customer and seller accepting the terms and conditions written in the bills receivable.

Journal Entry of Bills Receivable

| Particulars | Amount | |

|---|---|---|

| Bills Receivable A/c | Dr. | XXXX |

| To Customer’s A/c | XXXX |

Characteristics of Bills Receivable

Evidence

It is a type of evidence or proof that a seller use against the customer to whom he had sent goods on credit. At the time of the dispute, this bill becomes the base document for any legal recourse.

Endorsable

A bill of exchange is a negotiable document. Hence, a seller can endorse this bill to any of his creditors from whom he had purchased anything on credit in the past. This would act as a bill payable for him at the time of endorsement.

Current Asset

Bills receivables are recorded on the assets side under the subheading current assets in the balance sheet of the company or firm because bills are made for a short and a particular period.

Also Read: Bills Payable

Liquid Asset

Bills receivables also qualify as liquid assets because it is easier to convert them into cash.

Collateral

Bills receivables can also be kept as collateral for short-term loans, and thus it can generate/arrange cash inflow for the company/firm.

Discounting

A seller who requires some immediate cash. Or if the seller is not willing to wait till the period of the bills receivable’s maturity date, then he can get the bills receivables discounted from the bank. Of course, discounting will do incur some charges. However, the cash will be readily available to the firm. Once the bill is discounted, the customer who had accepted bills receivable now had to pay the full amount to the bank. Thus, on maturity, the original customer/drawer of the bill needs to make a payment to the Bank.

How is Bills Receivable Endorsed?

As we discussed, Bills Receivables are treated as a negotiable instrument. Hence, the parties can use these to clear off their liabilities by endorsing those bills. Therefore, a seller in the discharge of his liabilities towards his creditors can pay them off by endorsing these bills in his favor instead of discharging the liability by paying in cash. So here again, the original customer/drawer of the bill needs to pay to the supplier/party in whose favor the bills have been endorsed, instead of the original drawee/supplier. Let us attempt to understand this endorsement part with an example.

Example of Bills Receivable Endorsement

Mr. A, the seller of readymade stitched cloths, sold the goods worth Rs. 1,00,000 on credit to Mr. B, who is the owner of a designer Clothes Shop, on 15th November 2021. Instead of making the payment in cash, Mr. B asked Mr. A to make a bill receivable which he will accept and pay the amount after 3 months. Mr. A accepted the offer and made a bill receivable of Rs. 100,000 for 15th February 2022. This bill was accepted by both Mr. A and Mr. B.

Now, Mr. C, which is the supplier of the fabric that is the raw material for Mr. A, has been asking for the payment of Rs. 100,000. Mr. A told Mr. C that he did not have that much cash ready to pay. However, he suggested to Mr. C that he will (Mr. A) endorse the bill that he had received from one of his customers (Mr.B) for Rs.100,000 on 15th February 2022 in his favor. And Mr. C ( supplier) agrees to the condition, and thus Mr. A endorsed that bills of Rs.100000 in favor of Mr. C.

After 3 months, Mr. B came with the payment to Mr. A. Now Mr. A told Mr. B that he had endorsed the bill to Mr. C, so he had to pay Mr. C instead of paying him. In short, Mr. C received payment from Mr. B instead of Mr. A, and Mr. B made payment to Mr. C instead of Mr. A.

The above example clearly shows how the bill can be endorsed between the parties having no direct relation or transaction. And how it can help to settle the payment between the 3 parties.

Journal Entry of Endorsed Bill

| Particulars | Dr. Amount | Cr. Amount | |

|---|---|---|---|

| Bills receivable A/c | Dr. | 100,000 | |

| To Mr. B A/c | 100,000 | ||

| Dr. | |||

| Mr. C A/c | 1,00,000 | ||

| To Bills Receivable | 1,00,000 | ||

How to get the Bills Discounted from the Bank?

If a seller needs the funds or if there is an emergency requirement, in that case, if he has a bill receivable, then he can approach the bank for bill discounting. He will ask the bank to fund him by discounting the bills that are in his possession. The bank will discount the bill if the transaction looks good on the bank’s various funding parameters. And thus, after deducting some amount towards discounting charges, the rest of the money will be paid to the seller against those bills. Moreover, the seller needs to endorse all those bills in favor of the bank for getting this money. Further, at the time of maturity, the payments will flow to the bank directly from the drawer of the bills.

Example of Bills Discounted from the Bank

Mr. X, the seller of furniture, sold the goods worth Rs. 80,000 on credit to Mr. Y, who is the owner of a Furniture Shop, on 20th September 2021. Instead of making the payment in cash, Mr. Y asked Mr. X to make a bill receivable which he will accept and pay the amount after 2 months. Mr. X accepted the offer and made a bill receivable of Rs. 80,000 for 20th November 2021.

Now, Mr. X urgently needs the amount for some medical emergency. Mr. X went to the bank on 20th October and asked them to pay in cash in return for bills receivable. The bank agreed to provide the funds against the bill, but after the deduction of the discounting charges, that is 15% p.a., Mr. X agreed and got his bills receivable discounted from the bank, and after that, asked Mr. Y to pay the same amount (Rs. 80,000) to the bank.

Journal entry of Bill Receivable Discounted from Bank

| Particulars | Dr. Amount | Cr. Amount | |

|---|---|---|---|

| Bills Receivable A/c | Dr. | 80,000 | |

| To Mr. Y A/c | 80,000 | ||

| Cash A/c | Dr. | 79,000 | |

| Bank Discounting Charges | Dr. | 1,000 | |

| To Bills Receivable A/c | 80,000 | ||

In simple words, bills receivable is a useful document that can be used in multiple ways for completing credit transactions. And also to use that bills for generating cash as and when needed.