Bad Debts Meaning

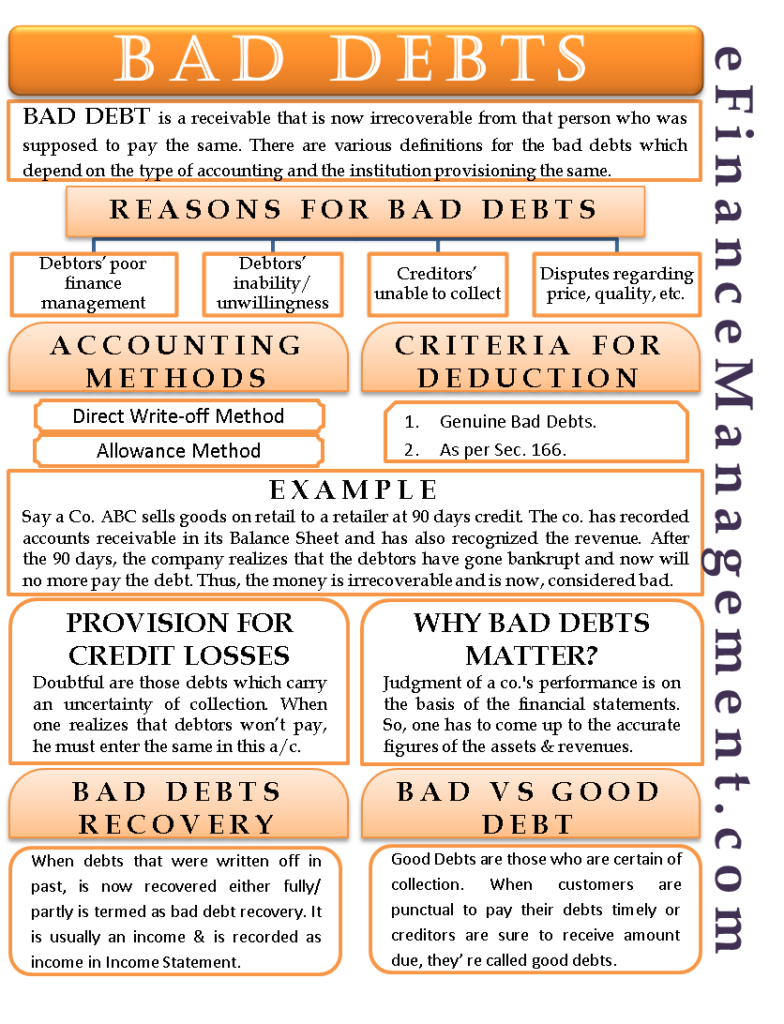

Bad debt is a receivable that is now irrecoverable from that person who was supposed to pay the same. The reason for nonpayment by the debtors is that either they go bankrupt, have financial problems, or collection by the creditors due to various reasons is not possible. There are various definitions for bad debts, depending on the type of accounting and the institution provisioning the same.

Bad Debt is allowed as a deduction in taxation. When there is a credit sale, most people make an estimated percentage of sales they expect to become bad. The estimation is based on the past performance of the debtors depending on various factors. A provision for the same is created, namely, “Provision for Credit Losses.” This forms a part of selling and administration expenses.

Two Methods to Account for Bad Debt

- Direct Write-off Method: When a receivable is considered not collectible, it is directly expensed in the Income Statement.

- Allowance Method: This is an estimate of the receivable made at the end of each fiscal year. These amounts are then accumulated in a provision account. The specific receivables are reduced every year by these amounts as per the requirement. (Read Allowance for Doubtful Accounts).

Criteria for Deduction

- When they are genuine and,

- When the receivables become worthless in the taxable year, either fully or partially, partially worthless receivables are those that we can expect to receive in the near future. Fully worthless receivables are those that cannot be received at all.

- According to U.S. Code Sec 166, there is a limitation on the amount of deduction. A non-business debt has to be fully worthless to be deductible. At the same time, business debt is allowed as a deduction no matter fully or partly worthless.

Reasons for Bad Debt

- When the debtors have poor financial management, they cannot timely pay their debt.

- Debtors inability or unwillingness to pay is one of the major reasons for the debts to become bad.

- When the creditors are not able to collect the debts due to some of the other reasons.

- Also, when disputes arise regarding the price, quality, delivery, product, credit term, etc., the debts become bad.

Example of Bad Debt

Say a Company ABC sells goods on retail to a retailer at 90 days credit. The company has recorded accounts receivable in its Balance Sheet and has also recognized the revenue. After 90 days, the company realizes that the debtors have gone bankrupt and now would no more pay the debt. Thus, the money is irrecoverable and is now considered bad.

Hence, the company has both bad debts and a provision account (Provision for Credit Losses). The company has to maintain such accounts as it is not necessary that all of their accounts receivable will pay their debt. Hence, the company will enter this irrecoverable amount into its books of accounts on the debit side of the Income Statement as an expense. In the balance sheet, the accounts receivable will also get reduced by the same amount as they are now irrecoverable.

Provision for Credit Losses / Provision for Doubtful Debts

Doubtful are those debts that carry an uncertainty of the collection of the debts. When one realizes that debtors will not pay that part of the debt, he must record the same in this account. Later, when he receives the amount, he must deduct the amount from the provisions account; if he doesn’t receive the amount, he must consider them bad and hence write them off. The recordation gives an accurate picture of the debtors actually receivables. Hence, we avoid the current assets from being overstated and revenue too.

Bad Debts Accounting

Bad Debts form a part on the debit side in the Income Statement as an Expense. They are recorded in the year when they become irrecoverable or when the debtors seem to not pay their debt. Its second entry would be its deduction from the debtors in the balance sheet since they are now not recoverable. And hence, the current assets would decrease (receiving lesser cash).

Why do Bad Debts Matter?

Since we are aware of the fact that not all debtors pay their part of the debt, we expect some debts to be irrecoverable. Also, we judge a company’s performance on the basis of the financial statements. So, we have already adjusted the bad debts to derive an accurate financial position.

Bad Debts Recovery

When the debts that were written off in the past years are now recovered either fully or partly is termed as bad debt recovery. It is usually an income, and hence, its recordation is on the credit side of the Income Statement. However, if one doesn’t want to recognize this portion of income, he may then not show that portion of the income in his financial statements. Also, only that amount of income written off in the past year/s is to be reported as an income.

Journal Entry for Bad Debts Recovery

Here, we debit the cash account as there is an inflow of cash as per the Nominal Account Rules (Debit what comes in). Also, we credit the bad debt recovered account and not the debtor’s account. As there is a recovery of the amount from the debtors who have been written off by us, so the balance of the debtors has also become nil. Therefore, we credit this account.

| Cash or Bank A/c Dr | – |

| To Bad Debts Recovered A/c | – |

Similarly, we would debit the bad debt recovered account to make the account balance nil for closing this account. We would then credit it to the profit and loss account at the year-end while preparing the financial statements.

Bad Debt vs. Good Debt

The opposite of bad debt is good debt. Good Debts are those who are certain of the collection. When the customers are punctual enough to pay their debts timely or the creditors are sure to receive the amount due from debtors, they are called good debts.

Read our article on What is Expense to learn about various other types of expenses.

Quiz on Bad Debts

This quiz will help you to take a quick test of what you have read here.

It’s good to find come across an article like this, that shows the author has common sense! You honestly made me think! TY-I wouldn’t have seen things from that angle otherwise. I have to share this…