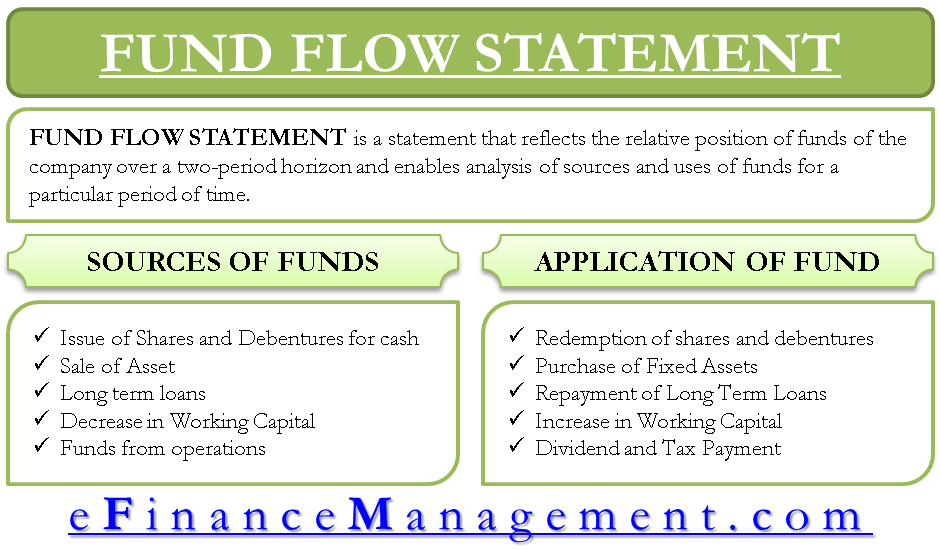

A fund flow statement is a statement that reflects the relative position of funds of the company over a two-period horizon. It enables analysis of sources and uses of funds for a particular period of time. A fund flow statement highlights where the funds have been generated and what has been put for use. This statement is also known as sources and application of funds.

Sources of Funds in Fund Flow Statement

The sources of funds would include the following:

Issue of Shares and Debentures For Cash

The only fresh issue to consider is inflow, not the case where bonus shares are issued as they do not generate any fresh inflow.

Sale of Assets

The amount received on the sale of fixed assets is to be considered a source of funds. Inflow on a sale of investments can also be considered.

Long Term Loans

Funds raised by way of long-term borrowing are to be considered a source of funds; however, funds that rise by way of short-term loans will be captured under working capital changes.

Decrease in Working Capital

Working capital is current assets, less current liabilities. A decrease in the net current assets leads to an increase in fund flow which needs to be included.

Also Read: Cash Flow Vs. Fund flow

Funds from Operations

This represents funds generated from the firm’s operating activity and excludes funds generated from investment or financing activities of the business.

Also, read Cash Flow Vs. Fund flow

Read more about other Methods of Financial Analysis

Application / Uses of Funds in Fund Flow Statement

The application of funds would include the following:

Redemption of Shares And Debentures

Premium, if any paid, also will have to be included in the outflow.

Purchase of Fixed Assets/ Investments

Any purchase made against shares or on credit shall not be included as outflows under this heading.

Repayment of Long-term Loans

Short-term repayment falls under working capital; only longer-term, which is not included in the short term, would be a part of this.

Increase in Working Capital

This would arrive from changes in the working capital statement.

Dividend/Tax Payments

One has to ensure that dividend/tax payment provisions have not been included in the working capital statement; else would amount to double counting.

The fund flow statement summarizes the list of sources made available to a firm to finance the activities and how these funds were utilized for the period under consideration. One can have a look at the difference between cash flow statements and fund flow statements to get further clarity.

You can have a look at the Advantages and Disadvantages of the Fund Flow Statement.

I would call them fun flow statements by the way you described them in such an easy manner. Kudos for including application of funds part in this post, I was looking through similar posts and was like why is nobody talking about it. I get easily lost in this terminology, thanks for explaining!

Schedule of fund flow statement

And entries schedule of fund flow statement