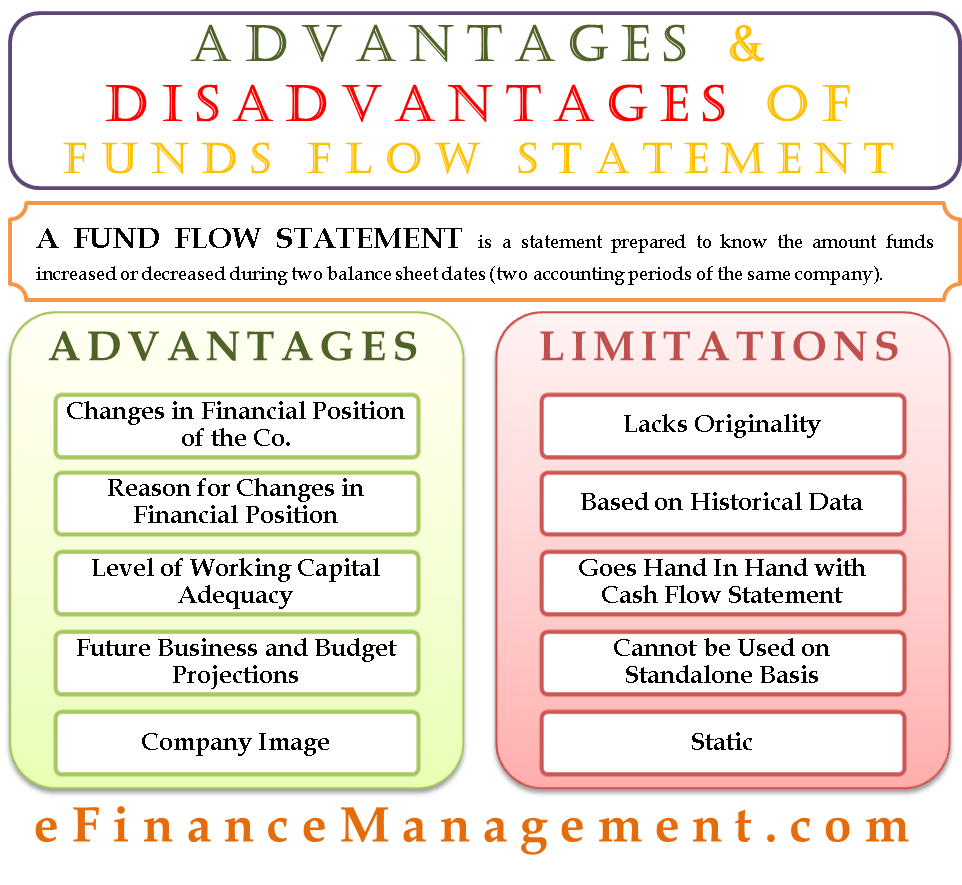

There are various advantages and disadvantages of the fund flow statement. One should consider them before forming any view of the sources and uses of funds.

Fund Flow Statement in Brief

A balance sheet states the company’s position as on a particular date, whereas a fund flow statement is a statement that reflects the inflow and outflow of funds over two balance sheet dates. Since fund flow is a statement that shows the flow of funds over two periods, it is also called a statement of changes in financial position. It shows the sources and application of funds of a particular company. This statement shows the increase in working capital or a decrease in the working capital of the company.

Read more on FUND FLOW STATEMENT

Advantages and Disadvantages of Fund Flow Statement

A detailed analysis of the fund flow statement can provide substantial insight into a company, given the benefits one can draw from it. Let us look at the advantages and disadvantages of the statement.

Advantages of Fund Flow Statement

Shows Changes in The Financial Position of the Company

The fund flow statement portrays the movement of the funds and changes in the company’s financial position between two accounting periods, which the balance sheet or the profit and loss statement fails to provide.

Also Read: Fund Flow Statement

Reason for Changes in the Financial Position between Two Accounting Periods

The funds flow statement helps analyze the reasons for changes in the company’s financial position. It helps the analyst to understand if the increase in funds is due to the sale of assets or an improvement in company performance. It also does help to answer questions like why the firm is making a loss despite being financially sound and vice versa.

Level of Working Capital Adequacy

This statement shows the working capital position of the company. This statement helps test whether working capital has been effectively used or not. It helps to understand if short-term sources of funds are used to build long-term assets and vice versa. Overall it aids in better working capital management for the firm.

Future Business and Budget Projections

Projected fund flow statements can be used for putting up necessary controls and budgetary allocations. Projected statements aid in deciding future financial policies like credit period, inventory requirement, etc., for the company.

Company Image

A well-managed working capital firm earns high respect among shareholders and increases creditworthiness among creditors. An effectively managed fund flow activity of the firm can help the company to build a good reputation for itself with respect to its efficiency and creditworthiness.

Disadvantages of Fund Flow Statement

Although the fund flow statement is very important and has a lot of advantages, there are some limitations also. Let’s discuss them in detail.

Lacks Originality

The fund Flow statement is said to lack originality because this statement is merely a systematic rearrangement of items in financial statements over two accounting periods. Because of this, many companies avoid the preparation of fund flow statements.

Based on Historical Data

This statement only shows how the company has performed in the previous year and does not give much clarity on the current and future costs of the company. Hence, it does not reveal a realistic comparison of the profit position of the company. Also, the projected fund flow statement is not very accurate.

Goes Hand In Hand with the Cash Flow Statement

The fund flow statement does not give the cash position of the company. It does not even classify the financing and investing activities of the company. Hence, most of the time, a fund flow statement is prepared by a company along with the cash flow statement to get an idea about the company’s liquidity position.

Cannot be Used on Standalone Basis

Since this statement only gives an idea of changes in the company’s working capital, it cannot be used standalone without a balance sheet and profit and loss statement. Hence, a fund flow statement can, in no way, substitute financial statements.

Static

A fund flow statement takes into consideration two particular time periods for the purpose of analysis of working capital. Hence, it cannot depict continuous changes. Also, it does not consider non-cash items in the company, which, in actual accounting, play an important role in many companies.

Thanks for sharing this article. I think that Fund Flow Statement is very important for business. I think that this article is very helpful to understand it well.

Thanks for sharing the advantage and disadvantages of fund flow statement. This will definitely help me to understand it well. This is a very helpful and informative article.