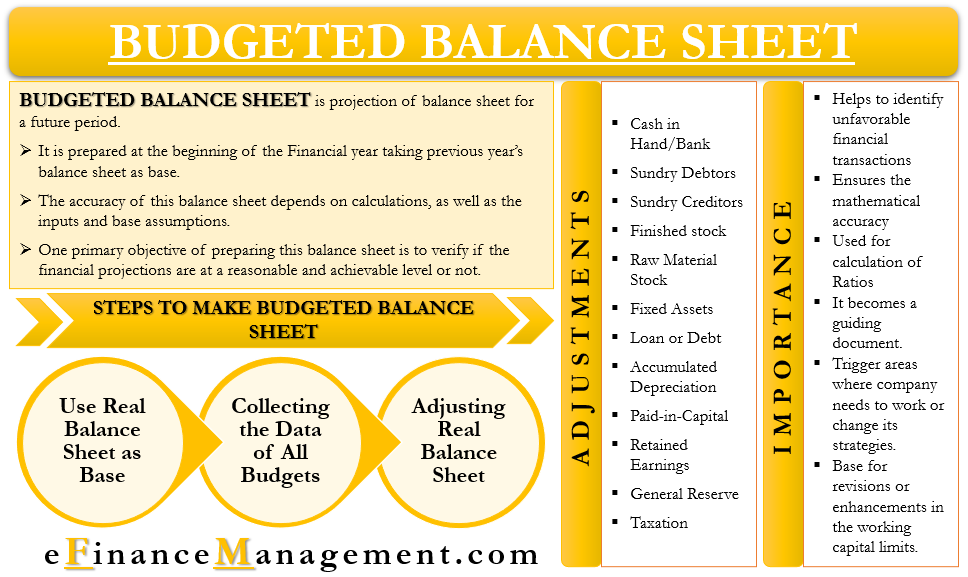

A budgeted Balance Sheet is similar to a regular balance sheet and has the same line items as well. The only difference between the two is that the budgeted BS is for a future period. In other words, we can say it is the projection of the balance sheet for a future period. It is a type of financial budget.

One generally prepares it at the beginning of a financial year. The company uses the balance sheet of the last year as the base for the budgeted BS and then makes relevant adjustments. Along with the previous year’s balance sheet, a company also uses different budgets and budgeted income statements for its preparation.

Budgeted BS involves several calculations, and thus, one needs to be careful while preparing it. The accuracy of the balance sheet depends on the calculations and the inputs, and the base assumptions.

One primary objective of preparing this balance sheet is to verify if the financial projections are at a reasonable and achievable level or not. Further, it also helps to identify scenarios that are not financially feasible, such as a large amount of Debt.

Also Read: Financial Budget

A company should usually prepare a budgeted BS for every period for which it prepares a budget, and not just for the ending period. It would assist the company in determining any discrepancies in cash flows and the steps needed to address them.

Need or Importance of Budgeted Balance Sheet

The following are the reasons why management will want to prepare a budgeted BS:

- It helps identify any unfavorable financial transactions that a company may want to get rid of.

- It also ensures the mathematical accuracy of other schedules or inputs.

- A company can use it to calculate different ratios.

- For deciding future activities and actions, it becomes a guiding document.

- It can also trigger the areas where the company needs to work or change its strategies.

- It becomes the base for revisions or enhancements in the working capital limits.

Budgeted Balance Sheet and Master Budget

For every upcoming period, management usually prepares a master budget. It, in turn, includes many smaller budgets, such as sales, production, Cash, and more. After a company completes the master budget, it uses the master budget as an input for the comprehensive financial plan. In simple words, this comprehensive financial plan is nothing but the projections of the financial statements to know how the company would fare and how the financial status would look at the end of the next financial period.

For this, the company prepares the budgeted income or profit/loss statement and the balance sheet. These two statements show the impact of all other budgets on the financial standing of the firm if the estimates meet the actual performance.

One may also take it as a sanity check. Management wants to ensure that its plans are in-line with the long-term interest of the firm or not.

Let’s take an example to know how the master budget and budgeted BS are related.

Suppose in a production budget the manager includes a loan to buy new machinery. This new machinery will boost production while maintaining the cost but will also increase the debt level. This debt level will reflect in the budgeted balance sheet, and then the management may decide if it wants to go ahead with it or not or whether there is enough financial cushion available to take care of that extra loan. And whether the ROI of that machine is acceptable.

Steps to Prepare Budgeted Balance Sheet

Following are the steps to prepare a budgeted BS:

Use Real Balance Sheet as Base

The first step is to take all the line items from the last year’s real balance sheet.

Collect the Data of All Budgets

The next step is to collect all the budgets that a company prepares at the start of the year. These budgets could be production budget, sales budget, cash budget, raw materials budget, salaries and wages budget, operating and financial expenses budget, etc.

Making Adjustments to Real Balance Sheet

Once we have all the data, including all the budgets and last year’s balance sheet, we start to make adjustments. These adjustments are made to the real balance sheet using data from different budgets. For instance, we adjust last year’s sales based on the sales and production budget for the current year.

Apart from the above three steps, a company may also need to prepare schedules to overcome the complexities in preparing the budgets and budgeted BS and income statements. These schedules help with the calculation of accounts receivable, inventories, income tax, and more. Additionally, a company also needs to consider several policies such as tax, Credit, dividend, inventory, and more while finalizing the budgeted BS.

Adjustments

Under the steps to prepare the budgeted BS, the last step was to make adjustments. But, what adjustments does one needs to make to the line items? Detailed below are some of the adjustments that a company needs to make to arrive at the budgeted BS:

Cash in Hand/Bank – for this, we take the closing figure of Cash from the last year’s real balance sheet and then use the cash budget to make the necessary adjustments.

Sundry Debtors – for this, we use the closing balance and the data from the sales and cash budget. To get the balance we need – Opening Debtors Balance plus New Credit Sale less Cash Received.

Sundry Creditors – for this, we use their closing balance and the purchase budget, and the cash budget. We use the following formula – Opening Creditors plus New Credit Purchases less New Payments Made.

Finished stock – for calculating an estimate of the finished stock, we use last years’ closing balance and the Production, Sales, and Cash Budgets. The adjustment we make is – Opening Finished Stock plus New Production less New total Sales (Cash+ Credit).

Raw Material Stock – for this, we use last years’ closing balance, as well as material, production, and Cash Budgets. The adjustment we make is – Opening Raw Material Stock plus New Purchases (both Cash + Credit) less New Consumption.

Fixed Assets – for this, we use last years’ closing balance, as well as Cash Budget, Projected Plan Report, and Plant Utilization budget. The adjustment we make is – Last Years’ Closing Balance plus New Purchase less New Sale (Cost price).

Loan or Debt – for this, we use last years’ closing balance, as well as inputs from the cash budget. The adjustment we make is – Last Years’ Closing Balance plus New Loan less Repayments.

Accumulated Depreciation – for this, we use last years’ closing balance of accumulated depreciation, as well as the overhead budget. The adjustment we make is – Last Years’ Closing Balance plus New Depreciation.

Paid-in-Capital – for this, we use last years’ closing balance of paid-in-capital, as well as the cash budget. The adjustment we make is – Last Years’ Closing Balance plus Additional Paid-in-Capital.

Retained Earnings – for this, we use last years’ closing balance of retained earnings, as well as cash budget and budgeted income statement. The adjustment we make is – Last Years’ Closing Balance plus Estimate of Profit less the Estimate of Dividend Paid.

General Reserve – for this, we make an adjustment to last years’ closing balance of general reserve for any change in the law regarding reserve requirements.

Taxation – for this, we use last years’ closing balance of tax, as well as tax returns, cash budget, and any regulatory change in tax rate or requirements. The adjustment we make is – Last Years’ Closing Balance plus New Payable Tax less (Advance tax paid plus TDS deducted).

How can i go on with budget preparation for Non profit organization if I want to prepare the annual budget?

Lual Deng Markgor