Meaning of a Cost Center?

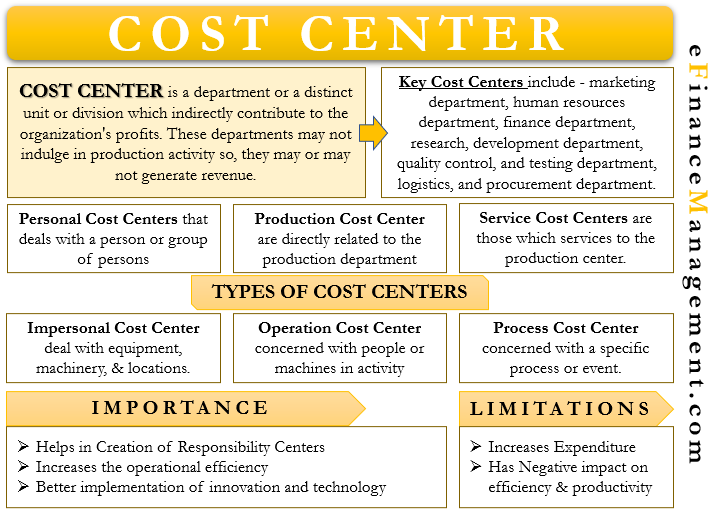

The Cost Center is a department or a distinct unit or division within the framework of a company. These cost centers indirectly contribute to the organization’s profits. For accounting, all expenses of that particular division are gathered at these cost centers’ levels. These departments are not engaged in production directly. They may assist in production or associated with other functions such as sales, marketing, human resources, research, development, etc. Many cost centers may not generate any revenue at all for the company. Therefore, they generate profits indirectly for the company.

Cost center requires money to operate, and most of them function within their pre-decided budget. The managers and other personnel in these departments are responsible for keeping their costs within the budget. They have the authority to incur expenses for regular business activities. At the same time, they work in tandem to contribute to the profitability of the company. Costs attribution can happen to each of the different cost centers as they work as separate units within the broad framework of an organization. Therefore, they act as a tool for cost control for any organization.

Key cost centers in an organization are the marketing department, human resources department, finance department, research, development department, quality control and testing department, logistics, and procurement department.

Types of Cost Centres

There are six major types of cost centers in an organization.

Personal Cost Center

Such a cost center deals with a particular person or a group of persons. Examples include sales managers, recruitment managers, etc.

Impersonal Cost Center

Such cost centers deal with equipment, machinery, or even locations. An example of such a center is the research and development department.

Production Cost Center

Cost centers directly related to the production department or assist in the production activities come under this category.

Service Cost Center

Such cost centers provide services to the production center. A few of such cost centers are the procurement department, quality control department, and logistics department.

Also Read: Profit Center vs Cost Center

Moreover, they can also provide service to other service cost centers too. For example, the maintenance department offers services to the entire company- both production and service cost centers.

Operation Cost Center

Such cost centers are concerned with people or machines engaged in similar activities.

Process Cost Center

Such cost centers are concerned with a specific process or event.

Importance of Cost Centres

Creation of a Responsibility Center

Cost centers are distinctly identifiable and separate units or departments or responsibility centers with their own set of responsibilities and duties. Each one of them is individually answerable to the management for their activities, expenditures, and results. They cannot pass on their failures to other cost centers, and identification is possible separately. Therefore, it becomes easy for the management to check and analyze the activities of every cost center separately.

Increase in Operational Efficiency

As said earlier, cost centers have their own set of duties and responsibilities carefully planned and drafted by the management. Hence, there is an exact distribution of responsibilities, which leads to creating synergies between different departments. There is increased efficiency within the organization since each department is clear about their respective scope of work and availability of resources. It helps in gaining customer trust and confidence, as well as delivering enhanced product value. Also, employee confidence and satisfaction can be achieved, which is essential for the success of any department and organization.

Better Implementation of Innovation and Technology

A company can go for the latest process-oriented technology tailor-made for an individual cost center. It is easier to implement new methodology and innovation with the work assigned to each cost center. It results in increased efficiency, higher output, and profitability for companies.

Limitations of Cost Centres

Cost centers come with a few limitations too.

Increase in Expenditure

A cost center is an expense center. If not managed properly, they can turn out to be a drain on the limited resources of an organization. Since work is spread over separate departments, each one of them requires personnel and incurs overhead expenses. Therefore, they can prove to be expensive as expenses will shoot up with every additional department. On the other hand, if a company opts to work without different cost centers, it will require a lesser workforce. Also, set-up and overhead costs will go down considerably.

Negative Impact on Efficiency and Productivity

Individual cost centers do not themselves generate profits but incur costs. Therefore, it isn’t easy to assess and determine their contribution to the overall profitability of the company. In other words, financial achievement does not reflect; instead, it goes unnoticed. Also, some cost centers may incur high expenditures and be subject to criticism in the organization, even though they might be contributing positively to productivity and profitability. Such instances lead to hampering the morale of the employees, which leads to a loss of efficiency and productivity.

Difference between the Cost Center, Profit Center, and an Investment Center

As discussed above, a cost center incurs costs and helps indirectly to generate profits in an organization. Their main goal is the minimization of cost. A profit center incurs costs as well as generates revenues, and hence profits. The performance of a profit center is measurable in financial terms, and its relevance in the organization is more easily identifiable than a cost center. Their main goal is to maximize profits. A department producing and marketing its products is an example of a profit center.

An investment center goes a step forward than a profit center. The managers in such a center have a say in how much money and where investment takes place. Hence, Returns on investment (ROI) or Returns on capital employed (ROCE) become the basis for performance measurement. They are accountable for the financial performance of their respective units. A subsidiary company responsible for its investments, costs, and profits is an example of an investment center.

Read Cost vs. Profit Center to learn more about it in detail.

Final Words

A cost center is the basis of all accounting systems. All expenses are booked and then allocated at the cost center level. It allows the management to analyze the performance of the cost center in line with the organization’s objectives and also with the given budgets. It also provides the managers with a clear-cut direction and responsibilities to manage their performance within the given budgetary allocation,

Quiz on Cost Center

Great explanation. Thanks!!