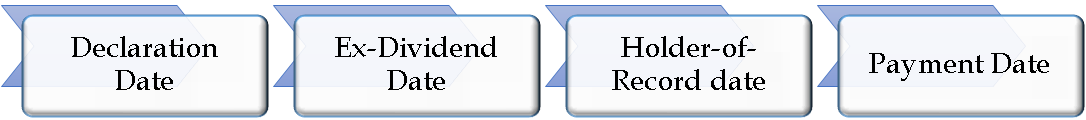

To understand the concept of Ex-dividend date, we need to first understand the dividend payment timeline. Once the company’s board approves the dividend of directors, the following timeline is commonly followed.

Dividend Payment Timeline

Declaration Date

The first date on the timeline is the declaration date. It is the date on which the company’s board of directors announced the dividend. In the declaration statement, they announce the amount of dividend and the holder-of-record date, and the payment date. These data can be found on the company’s website or some financial websites.

Ex-Dividend Date (or Ex-Date)

The next date on the timeline is the ex-dividend date. It is the first date on which the shares trade without the announced dividend in simple language. That is why it is known as “Ex-dividend,” where “Ex” stands for “without.”

For example, if the closing price of stock one day before the ex-dividend date is $ 60 and the dividend announced is $ 5. Theoretically, on the ex-dividend date, the stock price is adjusted for the dividend, i.e., $ 55 ($ 60 – $ 5). However, as the market drives this adjustment, there is no surety that the price will exactly drop by the amount of dividend. The market will reflect the dividend effect and all other information available in the stock price.

Also Read: Record Date – Meaning, Example and More

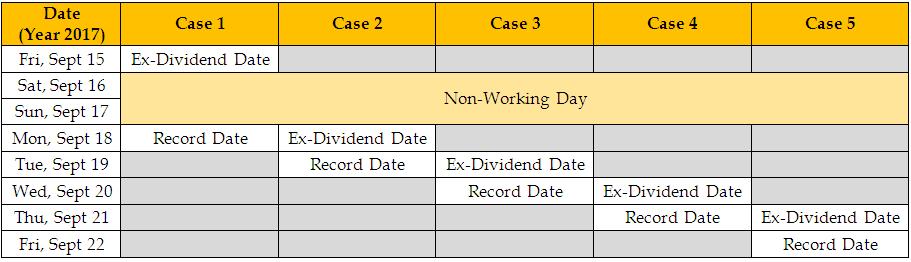

Once the company has announced the record date, the stock exchange decides the ex-dividend date. Generally, the number of days between the ex-dividend date and the record date is dependent on the trade settlement cycle, i.e., the Ex-dividend date is set one day before the record date if the settlement is done in “T+2” days.

The Ex-dividend date is important for investors because shareholders who purchased shares on or after this date are not entitled to receive the dividend. So if you want to receive the dividend, you need to purchase the shares before the ex-dividend date.

Holder-of-Record Date (or Record Date)

The next date on the timeline is the record date. The record date is when you need to be registered on the company’s records as a shareholder to receive dividends. So as on the record date, if you are not registered on the records as a shareholder, then you will not receive the dividend.

Payment Date

The last date on the timeline is the payment date. This is the date on which the payment is actually transferred to all the entitled shareholders. As the payment in most cases is electronically transferred, the payment date can be a non-working day (or holiday). The rest of the three dates are working business days.

Example

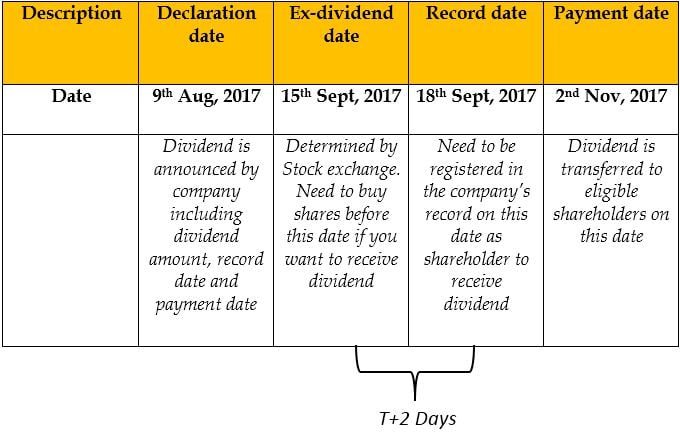

Let’s say Company X announced a dividend of $ 10/share on 9th Aug. So that would be its declaration date. The company has decided the record date and payment date to be 18th Sept and 2nd Nov respectively.

Based on the record date announced by the company, the exchange will determine the ex-dividend date. This decision is dependent on the trade settlement cycle. Since the settlement is done in T+2 days, the ex-dividend date is set as 15th Sept (one working day before the record date). So if the investor buys the share on 15th or after 15th Sept, then the settlement will be done on 19th Sept (As 16th Sept and 17th Sept will be holidays. Most of the exchanges are closed on Saturday and Sunday).

So by this logic, his name will not be on the company’s record as on the record date of 18th Sept. So, the seller of the stock will receive the dividend if the transaction happens on or after the ex-dividend date.

Based on this process, the eligible shareholders are decided. And the company mails or electronically transfers the dividend payment on the payment date.

Cum-Dividend vs. Ex-Dividend

Cum-dividend means “with dividend,” while “Ex-dividend” means “without dividend.” It is a status given to a share in which the buyer is entitled to receive the declared dividend. The stock trades with a status of “cum-dividend” till the ex-dividend date. On the ex-dividend date, it trades without the dividend.

Excellent 👌 explanation Sanjay sir.It was so helpful.I wish you a best of luck for your future endeavours in your life.