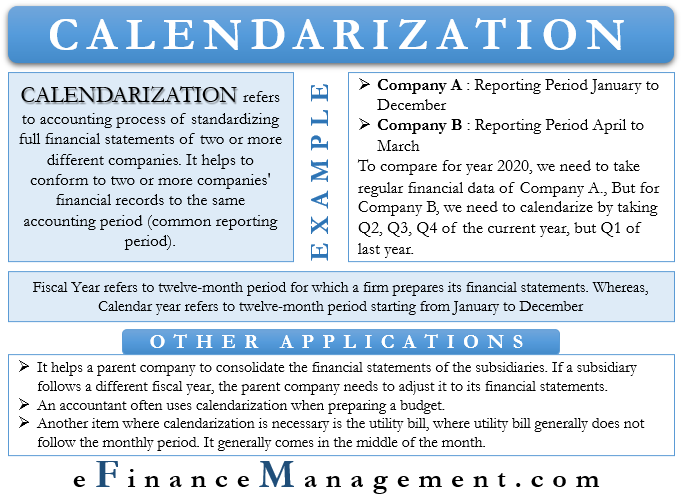

Calendarization refers to the accounting process of standardizing the full financial statements of two or more different companies. This process aims to facilitate the comparison of two or more companies’ financial statements. Thus, we can say calendarization is the process to conform to two or more companies’ financial records to the same accounting period. This technique can be useful in horizontal analysis.

As you will be aware, different companies may follow another financial year. For instance, some companies have a financial year from January to December, while others follow April to March. In such a case, if you want to compare two companies with different reporting periods, you won’t get accurate results. Thus, you will have to calendarize the financial records to a common reporting period to get a precise result.

For example, Company A has a reporting period from January to December and Company B from April to March. For the year 2020, the quarters for Company A will be – Q1 from Jan to Mar; Q2 from Apr. to Jun.; Q3 from Jul. to Sep.; and Q4 from Oct. Dec. For Company B, the 2020 quarters will be – Q1 from Apr. to Jun.; Q2 from Jun. to Sep.; Q3 from Oct. to Dec.; and Q4 from Jan. to Mar (2021).

To compare for the year 2020, we need to take regular financial data of Company A., But for Company B, we need to calendarize by taking Q2, Q3, and Q4 of the current year, but Q1 of last year. In this way, we will have the same data for both Company A and Company B, making it easy to compare.

Also Read: Operating Budget

Fiscal Year vs. Calendar Year

To better understand calendarization, we need to know the difference between a fiscal year and a calendar year. Many companies base their fiscal year on the calendar year in their country. However, some use a different fiscal year.

A fiscal year is a twelve-month period for which a firm prepares its financial statements. There are three key financial statements that every firm usually prepares for every budgetary or calendar year. These three financial statements are the balance sheet, cash flow statement, and profit & loss account.

Some common fiscal years that companies worldwide follow are – January to December, April to March, July to June., and October to September. In most countries, companies have the freedom to choose a fiscal year that may be different from the government’s fiscal year.

For instance, in the U.S., most companies have a fiscal year from January to December. The fiscal year for the U.S. federal govt. It is from October to September, while state governments may be following a different fiscal year. India has a calendar or fiscal year from April to March, and thus, most Indian companies have the same fiscal year.

Consolidation of Financial Statements

Along with helping to make financial statements easy to compare, there is another use of calendarization. It helps a parent company to consolidate the financial statements of the subsidiaries. Law requires a parent company to consolidate all its subsidiaries’ financial statements to make it easy for the stakeholders to assess the whole group’s financial performance.

Therefore, if a subsidiary follows a different fiscal year, the parent company needs to adjust it to its financial statements. It is because consolidating financial statements with different fiscal years would not give the correct picture. When a parent company makes such an adjustment, it needs to disclose the same through a note that the subsidiaries’ financial statements have been adjusted for consolidation.

Calendarization vs. LTM (Last Twelve Months)

Both LTM and calendarization help for the comparison of two or more companies. As said above, the calendarization adjusts the financial statements to make them in line with a typical fiscal year. In LTM, however, we take the last 12 months of comparable firms, irrespective of the fiscal year.

LTM gives more recent data than calendarization because the former takes the last 12 months. Also, it is more reliable because it doesn’t depend on quarterly reports and other short-term metrics. We can also term LTM as rolling 12 months.

Another Application of Calendarization

Calendarization also refers to the process of accurately allocating or standardizing the financial data for a period. This means, if the period of financial data and the financial accounting period differ, then the process of normalizing data to be in line with the financial accounting period is calendarization.

For example, assume Company A pays $15,000 rent in advance for the next quarter. Company A will initially record the full $15,000 as a prepaid expense to record this transaction. Then, it would calendarize the expense accordingly by taking $5,000 monthly.

If an expense is uneven, the best way will be to calendarize it as per the consumption level. It means charging more in the month when that expense item is heavily used and less in other months.

An accountant often uses calendarization when preparing a budget. In the budget, the revenues and expenses are usually spread evenly across the year. In reality, however, a company’s revenues and costs may follow some seasonal patterns. They may rise in some months and drop in other months. However, the overall expectation is that the actual and estimate are more or less the same when you see the full-year performance.

Another item where calendarization is necessary is the utility bill. The utility bill usually does not follow the monthly period. A utility bill often comes in the middle of the month, including some for the last month and some for the current month. With the calendarization, we can easily prorate the utility bill into the appropriate months.