What is a Budget and Budgeting Process?

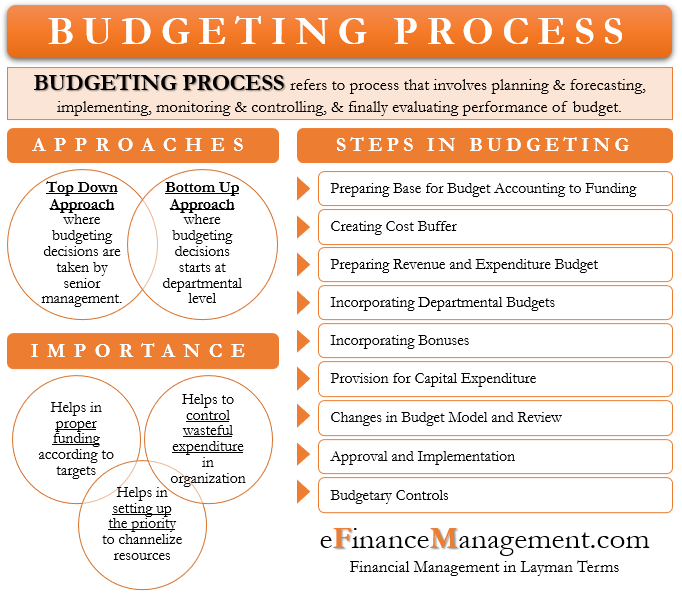

A budget is a tool for planning, implementing, and controlling activities for the optimum utilization of scarce resources in a business. It explains the company’s objectives and the course of action it will choose to achieve its goals in detail. Also, it mentions the controls to be put in place for achieving its successful implementation. The budgeting process is the process of putting a budget in place. This process involves planning and forecasting, implementing, monitoring and controlling, and finally, evaluating the performance of the budget.

Read more on What is a Budget?

What are the approaches to the budgeting process?

There are two main approaches to the budgeting process. These are:

Top-down Approach

This budgeting process involves preparing the budget by the company’s senior management based on the company’s objectives. The departmental managers are assigned the responsibility for its successful implementation. Every department can opt to create its own budget based on the company’s broader budget allocation and goals.

The top-down approach’s advantage is that the lower management saves a lot of time and gets a ready-made budget to be followed. They hardly participate in the preparation of the central budget. The senior managers’ experience, coupled with past-performance figures, comes in handy in such budgeting processes.

Bottom-up Approach

This budgeting process starts at the departmental level and moves up to higher levels. Every department within the company is required to prepare plans for its proposed activities for the next budget period and estimate the costs it will incur. These individual budgets are combined to create a bigger all-inclusive budget.

The budgeting process with this approach can be lengthy and time-consuming. However, employees and managers are more motivated to achieve the budget goals since they have prepared it. They have complete knowledge of what the budget actually expects them to do and how to achieve that. Such budgets tend to be more accurate and closer to the actual situation on the ground.

What are the Steps in the Budgeting Process?

Preparing the Base for the Budget according to Funding

The first step in preparing a budget is to identify the budget goals and how they will be achieved. Factors such as the business’s socioeconomic surroundings, sales trends, etc., have to be taken into consideration for setting goals. Also, these goals have to be set according to the economic resources available to the company. A budget will be of no use without proper funding.

Creating a Cost Buffer

The next step in a budget is to scrutinize the cost for the business. Also, evaluating factors that can affect input costs during the budget period has to be done. Revision of the compensation plans of the employees takes place every year in most companies. To make the budget realistic and achievable, proper provisions should be created for variations in these costs and compensation plans.

Preparation of Revenue and Expenditure Budgets

The next important step is to prepare different types of subsidiary budgets for the organization. Proper and realistic forecasts for the different types of budgets, such as sales, production, cash, purchase, labor and overheads, selling, and general and administrative expenses, have to be made. A realistic plan for the sources of revenue is the need for the budget period. Planning of expenditure should be done accordingly as the company cannot spend more than what it earns. Thus, the revenue target decides and dictates the expected quantum of expenses to achieve these revenue targets.

Also Read: Why is Budgeting Important?

Incorporating Departmental Budgets

Smaller departments prepare their own budget in many companies. In such cases, their collection and integration, along with the master budget, is a prerequisite.

Incorporating Bonuses

Most companies have a policy of declaring bonuses for their employees at the end of the financial year as per their financial results. Many may declare mid-year bonuses in case of exceptional performances. Such expenses can become significant in the case of big companies. Hence, due provisions have to be made in the budget for such unplanned giveaways.

Provision for Capital Expenditure

A company may plan to incur a capital expenditure or invest in a fixed asset during the budget period. These expenses are quite heavy and considerable by nature. Hence, after consultation with the top management, their inclusion should be done in the budget.

Changes in the Budget Model and Review

After finalizing all the above steps, a review of the assumptions as per the budget model should be done. Also, a thorough review of the entire budget is essential. If there is a need for any changes in the budget, it can be done now.

Approval and Implementation

The budget will then go to the top management for approval. They will check if it is proper. Makers will make any changes as per need. In case everything is fine with the budget, they will give the go-ahead for implementation.

Budgetary Controls

The implementation of the budget is not the last step in the budgetary process. The setting of proper budgetary controls comes next. This is necessary for the comparison of the actual performance with the provisions and estimates of the budget. Continuous reporting of variances has to be done. The management can take corrective actions accordingly.

Importance of Budgets

- A budget helps in identifying the key areas and taking corrective measures to improve our efficiency.

- It provides figures that help us in analyzing the variances in the income and expenditure of a particular field.

- It helps us in setting targets and provides a base for making decisions.

For more detail, refer Why is Budgeting important?

Also, read Budgeting Cycle for more.

It is an educative platform

This is very informative and educative indeed.