LTM: Meaning

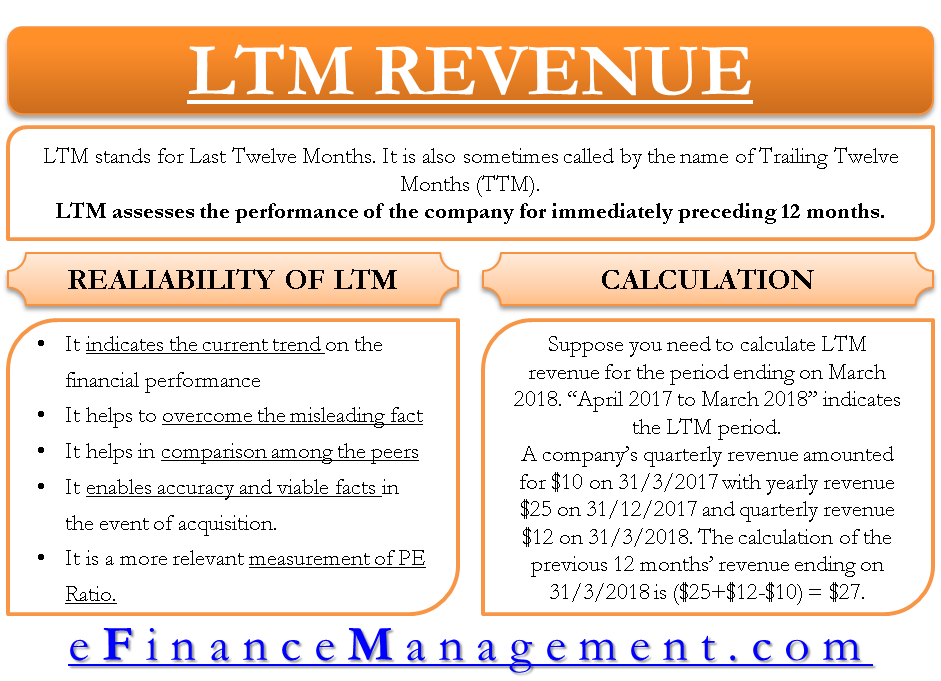

LTM (Last Twelve months) is also titled trailing or rolling twelve months (TTM). It accounts for the company’s financial performance by going through the financial ratios such as debt to equity, returns on equity, etc. LTM assesses the performance of the company for the immediately preceding 12 months. In order words, LTM acts as a mirror where the company can see its most recent performance. And enables the company to make strategies for the future. It showcases the whole past year’s performance, rather than quarterly or half-yearly, which can adjust with the yearly attainments. Though 12 months is a short span of time, it illustrates the company’s latest performance. For example, The LTM revenue of the company for the month of August entails the revenue from September previous year till August this year.

Depending on various economic and social parameters like climatic impact, conflict among unions, and others, there might be uncertainties, which could possibly have an impact on the company’s performance. Therefore, LTM draws a reliable conclusion and averages out the impact of such parameters. For example, the company’s balance sheet remains unaffected by any of such parameters, as it is framed at a static time and date.

How to Calculate LTM Revenue?

Analysts use LTM revenue to evaluate the firm’s value or rate it as neutral, below average, etc. Evaluation classifies the company’s potential growth and compares it with its peers. Furthermore, to gauge the latest trend of a company, the company’s previous 12 months’ performance is compared with the performance of the peer companies. To ascertain the company’s financial ratio, LTM assesses the latest trend. For a US-based company, LTM figures are calculated by the company’s 10-K and 10-Q reports.

Suppose you need to calculate LTM revenue for the period ending in March 2018. “April 2017 to March 2018” indicates the LTM period. A company’s quarterly revenue amounted to $10 on 31/3/2017, with yearly revenue of $25 on 31/12/2017 and quarterly revenue of $12 on 31/3/2018. The calculation of the previous 12 months’ revenue ending on 31/3/2018 is ($25+$12-$10) = $27.

Also Read: Year-over-Year (YoY) Growth

Why Does Analyst consider LTM a Reliable Parameter?

- LTM indicates the current trend of the financial performance of the company.

- It helps to overcome the misleading fact, as its figures focus on current trends and not the fiscal or annual statement numbers.

- Last twelve months are quite reliable and commonly used method by the analyst for comparison among the peers.

- LTM enables accuracy and viable facts in the event of an acquisition

- It commits a more relevant measurement of price to earnings ratio.

LTM represents an appropriate and true picture of finances without any dependence on economic and social factors. Further, LTM uses financial ratios to ascertain the company’s true value, like eps and dividend yield. An alternative method for LTM evaluation is on a Pro-Forma basis. Besides the past 12 months of performance, LTM also includes the impact of any specific event that might have occurred. This event can be the induction of a new product, acquisition, or expansion of a manufacturing unit. Pro-forma would indicate the picture of finances if a specific event had taken place.

Also, read LTM vs. Calendarization.