Before we explain how to calculate total debt from the balance sheet, it would be necessary to understand the various definitions of debt patiently. If you are clear on these terms, you can easily understand the calculation of debt.

Various Definitions of Debt

When we say ‘debt,’ the literary meaning is ‘owing to someone.’ But, in accounting and finance, this definition will be too vague. The literary meaning of the term would include accounts payable, also a part of the debt. In normal parlance, we associate debt with paying ‘interest.’ Considering this fact, in accounting, a short-term loan would be a part of the debt (short term) but accounts payable will be a part of current liabilities.

The terms relating to debt that we will understand here are as follows:

- Total debt,

- Long-term debt,

- Current liabilities & short-term debt,

Total Debt

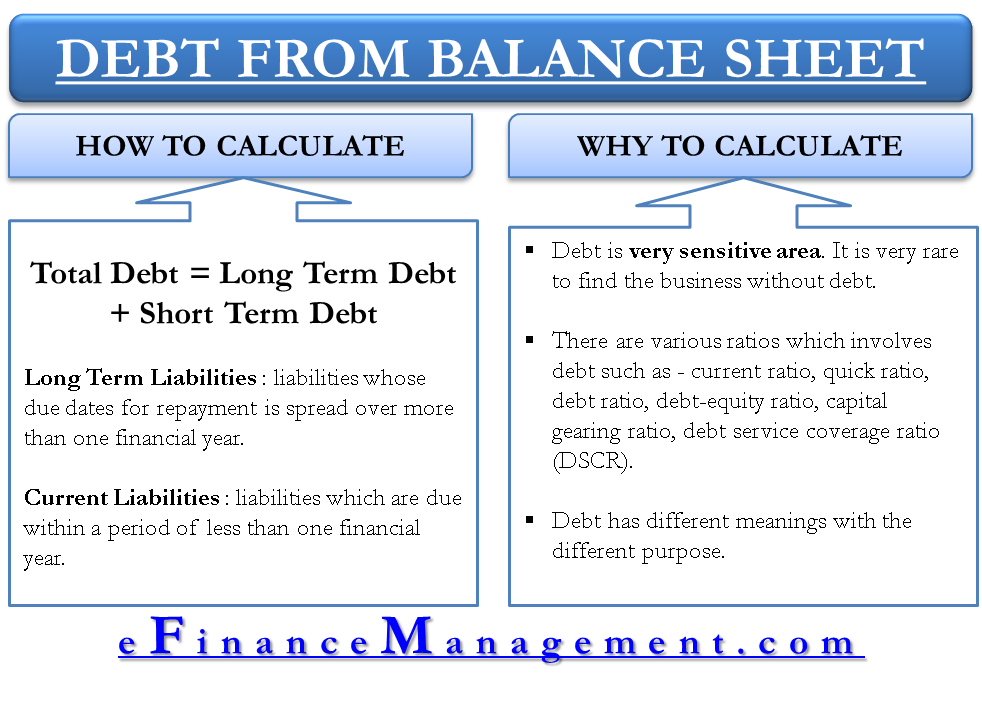

In a balance sheet, total debt is the sum of money borrowed and is due to be paid. Calculating debt from a simple balance sheet is a cakewalk. All you need to do is add the values of long-term liabilities (loans) and current liabilities.

Long Term Debt

Long-term liabilities or debt are the liabilities whose due dates for repayment are spread over more than one financial year.

Current Liabilities & Short Term Debts

Current liabilities are the liabilities that are due within less than one financial year. The important thing to note here is that short-term debt is a subset of current liabilities. In other words, short-term debts are one of the many components of current liabilities.

How to Calculate Total Debt from Balance Sheet?

The simplest formula for calculating total debt is as follows:

Total Debt Formula

Total Debt = Long Term Liabilities (or Long Term Debt) + Current Liabilities

We can complicate it further by splitting each component into its sub-components, i.e., long-term liabilities and current liabilities. For example, a detailed total debt formula is as follows:

| Total Debt = (Debenture + Long Term Loans from Banks and Financial Institutions + Mortgaged Loans ……) + (Short Term Debts + Accounts Payable + Outstanding Expenses …… ) |

We can see that the following components of the formula need an appropriate definition.

How to Calculate Long-Term Debt?

For calculating total debt, long-term debt is an important component. So, for further calculating the long-term debt or liabilities, we need to pick the following items from the liability side of the balance side.

- Debentures,

- Long-term loans from banks and financial institutions,

- Mortgage loans, etc.

They are comparatively easy to identify from the books of accounts. We can extend this list to too many items here. You should be understanding the definition/concept of long-term liabilities and try to apply them to all the items which are part of a trial balance or balance sheet. The one which falls under the definition will become part of this list.

Please note that in accounting, for reporting purposes, the part of long-term liability which is due within the coming 1 year is separately presented in Current Liabilities. They are the current part of long-term liabilities.

Also Read: Balance Sheet – Definition and Meaning

How to Calculate Current Liabilities (including Short-Term Debts)?

We need to calculate current liability, which is the other component for calculating the total debt. For calculating current liabilities, we need to include the following items from the balance sheet.

- Short term debt

- Accounts payable (creditors) balances,

- Outstanding expenses,

- Provision for taxation,

- Proposed dividend,

- Unclaimed dividend,

- Employee’s accrued salaries and wages payable,

- Taxes payable,

- Unearned revenues,

- Advances received from customers,

- Interest payable, etc.

How to Calculate Short-Term Debts?

Short-term debt is also not a single item but a category in itself. So, for calculating short-term debt, you need to include

- Loans and advances,

- Bank Overdraft

- Cash credit, etc

By their nature, they are due within less than a year and are normally associated with making interest payments.

This list can be too long and still may not be comprehensive. The best way is to understand the concept/definition of current liabilities and try to apply it to all the items which are part of a trial balance or balance sheet.

Why is Calculating Debt Important?

Debt is a very sensitive area on a balance sheet. It is very rare to find a business without debt. If I wish to define debt differently, I can say debt is an arrangement whereby entrepreneurs carry on business without having money. Financial institutions and banks provide long-term and short-term debts, whereas short-term interest-free financing is available through creditors/accounts payable of any business. Both these parties assess the credibility, capacity, and willingness to pay and evaluate the business’s genuine requirement for loans or any type of credit.

There are various ratios involving total debt, or its components include, such as current ratio, quick ratio, debt ratio, debt-equity ratio, capital gearing and ratio, and debt service coverage ratio (DSCR). Various entities use these ratios for different purposes. Understanding debt in its absolute terms is inappropriate. Debt has a different meaning for a different purpose.

For example, banks use the debt service coverage ratio to assess the future cash flow and their ability to pay the installment. Here, the definition of debt is limited to the debt given by the institution. In the current ratio, only the current liabilities help in assessing the short-term liquidity position of a business.

Frequently Asked Questions (FAQs)

The simplest formula for calculating total debt can be quoted as follows:

Total Debt = Long Term Liabilities (or Long Term Debt) + Current Liabilities

The amount of total debt can be found by totaling short-term and long-term debt under the head of liabilities.

Total debt includes long-term as well as short-term debt (current liabilities).

No, Total liabilities include total debts.

Total Debt is the sum of money borrowed and is due to be paid.

Is Outstanding Balance on Debt Facilities a true liability?

Outstanding balance of the debt facilities is a true debt of the company. However to know the true liability of the company we have to add all long term and short term debt along with the the current liabilities like creditors balances, outstanding expenses, provision for taxation, proposed dividend, unclaimed dividend, etc.

Hope it made it clear.