What are Provisions in Accounting?

Provisions in accounting are a way to meet an uncertain expense or an upcoming liability. For example, bad debt occurs in every business, but nobody can exactly tell how much bad debt will occur in a particular year. Therefore we set aside a specific sum of money to deal with such unenforceable expenses known as provisions. Companies do not make provisions to save money. Rather it is an allocation of funds to meet an upcoming liability.

Explanation with an Example

Suppose a company issues a guaranteed refund in case of faulty products. Based on past records, 1% guarantee claims are received every year. The company does not know the exact amount of guarantee claims against its sales for the current year. Also, it does not know the exact time when it will have to meet such an obligation. However, we know 1% of sales of the current year will be refunded as guarantee claims.

We create provisions in accounting to record such expenses. If we do not create these provisions in the current year, we will have to record these expenses in the next financial year. This will be an inappropriate and unfair presentation of the income statement. Effectively, the expense of the current year is recorded in the next year, which shows higher profitability in the current year and reduced profit in the next year.

Types of Provisions

Some of the main types of provisions in accounting are

- Provisions for bad and doubtful debts,

- Pension,

- Taxes,

- Depreciation,

- Warranties and guarantees,

- Loan losses,

- Inventory obsolescence,

- Severance payment,

- Restructuring,

- Impairment of assets, etc.

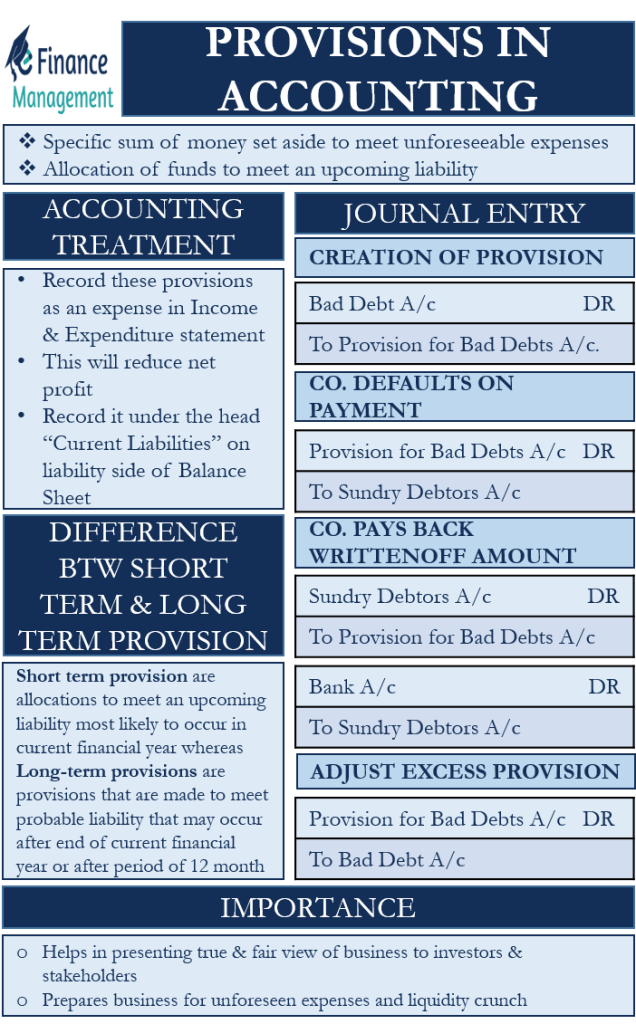

Accounting Treatment of Provisions in Accounting

Companies make a reasonable estimate of the amount of funds to allocate for creating the provisions. The basis of allocation of funds can be industry average, past experience, or recent financial statements.

Also Read: Profit and Loss Statement

For the purpose of accounting, we record these provisions as an expense in the Income and Expenditure statement. This will reduce our net profit as it is a probable expenditure which is almost certain to take place. Also, we record it under the head “Current Liabilities” on the liability side of the Balance Sheet. If that liability actually occurs, this amount will be reduced, and ultimately, if that liability does not occur, this entry can be reversed.

Journal Entries in case of Provision for Bad Debt

Suppose that a business creates a provision for bad debts of $5000. This is equal to 2% of the total probable sales for the current financial year. It uses historical data and past experience to arrive at this figure and create this provision.

Journal Entry for Creation of Provision

The journal entry for the same will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Bad Debt Expense A/c Dr. | $5000 | |

| To Provision for Bad Debts A/c | $5000 |

We will record this provision in the Income and Expenditure account as an expense.

Furthermore, this provision will reflect in the “Current Liabilities” section of the Balance

Sheet.

Journal Entry when a Co. Defaults on Payment

Now suppose that a party XYZ Ltd. defaults on a payment of $1000. We will pass a journal entry for the same as:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Provision for Bad Debts A/c Dr. | $1000 | |

| To Sundry Debtors A/c. (XYZ Ltd.) | $1000 |

This entry eliminates the bad debt amount of $1000 from the provision and is actually

charged to the defaulting party a/c. There is no further impact on the Income and Expenditure statement. In the Balance Sheet, the provision for bad debts will be reduced by $1000. The Sundry Debtors will also go down by $1000 as an offsetting entry.

Also Read: Accounting Principles

Journal Entry if a Co. Pays back Written-off amount

Suppose that XYZ Ltd. pays back $500 out of its outstanding amount within a few days. We will again have to pass 2 journal entries to record this event. The entries will be:

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Sundry Debtors A/c. (XYZ Ltd.) Dr. | $500 | |

| To Provision for Bad Debts A/c | $500 |

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Bank A/c Dr. | $500 | |

| To Sundry Debtors A/c. (XYZ Ltd.) | $500 |

Journal Entry to Adjust Excess Provision

The amount of provisions we create will never match the exact amount of the actual bad debts. If the bad debts over the period are more than the provision we have created for it, we will have to create an additional provision. Similarly, if the actual bad debts are lower than the provision we have created for it, we will have to pass a reversal entry to adjust back the provision amount.

Suppose the amount set aside as a provision for bad debts over a period of 10 years is unlikely to result in actual bad debts. As per management expectation, the current provision balance is higher by $8000. We need to eliminate this excess amount set aside as provisions. The journal entry for the same will be –

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Provision for Bad Debts A/c Dr. | $8000 | |

| To Bad Debt Expenses A/c | $8000 |

Difference between Short-term vs. Long-term Provisions

Short-term provisions are the allocations to meet an upcoming liability that is most likely to occur in the current financial year. These may include

- Provisions for taxes,

- Doubtful debts, etc.

Long-term provisions are the provisions that are made to meet a probable liability that may occur after the end of the current financial year or after a period of 12 months. These may include provisions for

- Warranties and guarantees,

- Repairs and renewals,

- Loan loss, etc.

We cannot predict the actual time of occurrence and the amount of such expenses.

Importance

- Helps in presenting a true and fair view of the state of affairs of a business to the investors and all stakeholders.

- Prepares business for unforeseen expenses and liquidity crunch, ensuring smooth operations.

Summary

Provisions in accounting make a business future-ready financially. The management need not worry all the time about how the company will meet various types of unplanned expenses. The provisions help to deal with expenditures about which neither the exact amount nor its timing is known. Also, they are flexible enough, and the management can increase or decrease the amount allocated for provisions as per their needs.

RELATED POSTS

- Adjusting Entries – Meaning, Types, Importance And More

- Income Statement

- Allowance for Doubtful Accounts – Meaning, Accounting, Methods And More

- Fundamentals of Accounting: Meaning, Principles, Categories, and Statements

- Accounting Information

- Accrued Expense – Meaning, Accounting Treatment And More