Monetary policy is a fundamental aspect of economics that plays a crucial role in managing and influencing the overall performance of an economy. It is the domain of central banks or monetary authorities, which are responsible for controlling the money supply, interest rates, and other financial variables. This introduction aims to provide students with a foundational understanding of monetary policy, its objectives, and its significance in shaping economic conditions.

Understanding monetary policy is essential for students of economics as it provides insights into how the actions and decisions of central banks influence the broader economy. By studying monetary policy, students can grasp the intricate relationship between money, interest rates, inflation, investment, and economic growth. Moreover, comprehending the objectives and tools of monetary policy allows students to analyze and evaluate the effectiveness of policy measures in achieving desired economic outcomes.

What is monetary policy?

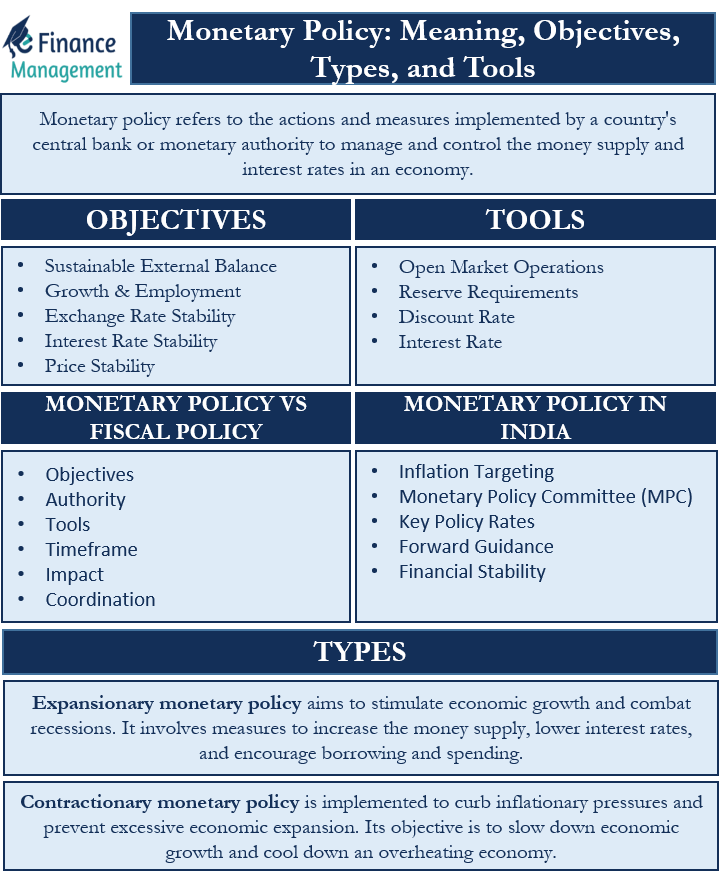

Monetary policy refers to the actions and measures implemented by a country’s central bank or monetary authority to manage and control the money supply and interest rates in an economy. The primary objective of monetary policy is to achieve and maintain price stability, promote economic growth, and stabilize financial markets. Monetary policy tools can take various forms, such as open market operations, reserve requirements, discount rates, and interest rate policies.

Objectives of Monetary Policy

Some common objectives include:

Price Stability

One of the primary objectives is to maintain price stability by controlling inflation. Price stability is crucial for economic stability and the purchasing power of money. By managing the money supply and influencing interest rates, central banks aim to keep inflation within a target range deemed appropriate for sustainable economic growth.

Economic Growth and Employment

Monetary policy also seeks to promote economic growth and reduce unemployment. By adjusting interest rates and influencing borrowing costs, central banks can stimulate or restrain economic activity. Lowering interest rates encourages borrowing and investment, which can boost economic growth and job creation. Conversely, raising interest rates can help cool down an overheating economy and reduce inflationary pressures.

Exchange Rate Stability

Some central banks consider exchange rate stability as an objective. They may intervene in foreign exchange markets to influence the value of their currency relative to other currencies. Exchange rate stability can help support international trade, investment, and overall economic stability.

Interest Rate Stability

Stability in interest rates is another objective of monetary policy. Large and rapid fluctuations in interest rates can create uncertainty, disrupt financial markets, and adversely impact borrowing and investment decisions. Central banks aim to manage interest rate movements to ensure stability and predictability in the financial system.

Sustainable External Balance

Some countries aim to achieve a sustainable external balance as part of their monetary policy objectives. This involves managing the balance of trade and payments with the rest of the world to ensure long-term economic stability and avoid excessive dependence on foreign borrowing or imbalances in international trade.

4 Tools of Monetary Policy

Central banks use various tools and strategies to conduct monetary policy. Some common tools include:

Open Market Operations

Central banks buy or sell government securities (such as bonds) in the open market to influence the amount of money in circulation. When the central bank buys securities, it adds more money to the economy, which means there is more money available. On the other hand, when it sells securities, it takes away some money from the economy, which means there is less money available.

Reserve Requirements

Think of central banks as the boss of all banks. They make rules telling commercial banks the smallest amount of money they must keep in their vaults. It’s like a teacher saying you must have at least 5 pencils in your bag at all times. By adjusting these requirements, the central bank can influence the amount of money that banks can lend and thus impact the overall money supply.

Discount Rate

The discount rate is a special interest rate that lets commercial banks borrow money from the central bank. It’s like a special rate the central bank offers to commercial banks. When the central bank changes this rate, it affects how much it costs for commercial banks to borrow money. This, in turn, affects how much money they lend out to people and businesses, which can impact the overall economy.

Interest Rate

Central banks also use interest rates to influence borrowing costs and stimulate or restrain economic activity. By adjusting the benchmark interest rate, such as the overnight lending rate, the central bank can influence market interest rates, which affect borrowing costs for individuals and businesses.

Types of Monetary Policy

The following are the most common types of monetary policy.

Expansionary Monetary Policy

Expansionary monetary policy aims to stimulate economic growth and combat recessions. It involves measures to increase the money supply, lower interest rates, and encourage borrowing and spending. Central banks implement expansionary policies by decreasing reserve requirements, conducting open market purchases, lowering the discount rate, or reducing benchmark interest rates. These actions inject liquidity into the financial system, making credit more accessible and promoting economic activity.

Contractionary Monetary Policy

Contractionary monetary policy is implemented to curb inflationary pressures and prevent excessive economic expansion. Its objective is to slow down economic growth and cool down an overheating economy. This type of policy involves measures to decrease the money supply, increase interest rates, and discourage borrowing and spending. Central banks adopt contractionary policies by raising reserve requirements, conducting open market sales, increasing the discount rate, or raising benchmark interest rates. These actions reduce liquidity in the financial system, making credit more expensive and dampening economic activity.

Monetary Policy VS Fiscal Policy

Monetary policy and fiscal policy are two distinct policy tools used by governments and central banks to manage the economy. While they both aim to influence economic activity, they differ in their objectives, implementation, and tools used. Here’s a comparison between monetary policy and fiscal policy:

Objectives

- Monetary Policy: The primary objective of monetary policy is to maintain price stability, control inflation, promote economic growth, and ensure financial stability. Central banks adjust interest rates and the money supply to achieve these goals.

- Fiscal Policy: The main objective of fiscal policy is to manage government revenue and expenditure to influence aggregate demand, stabilize the economy, and promote economic growth. Fiscal policy is primarily implemented through changes in government spending and taxation.

Authority

- Monetary Policy: Monetary policy is like a steering wheel for a car, controlled by the central bank. This bank operates on its own, separate from the government. Its job is to make decisions based on what’s best for the economy, rather than being influenced by temporary political interests.

- Fiscal Policy: Fiscal policy is determined by the government and implemented by the legislative authority. The government formulates and executes fiscal policy decisions, including taxation, spending, and borrowing.

Tools

- Monetary Policy: The tools of monetary policy include open market operations (buying or selling government securities), reserve requirements (setting minimum reserve levels for banks), the discount rate (interest rate charged by the central bank on loans to commercial banks), and interest rate policy (adjusting benchmark interest rates). These tools are used to control the money supply, influence interest rates, and regulate financial conditions.

- Fiscal Policy: Fiscal policy primarily relies on changes in government spending and taxation. It involves adjusting tax rates, and government expenditure levels, and implementing various fiscal measures such as stimulus packages or austerity measures. Fiscal policy can also include measures like public infrastructure projects, subsidies, or welfare programs.

Timeframe

- Monetary Policy: Monetary policy decisions are often more flexible and can be implemented relatively quickly. Central banks can adjust interest rates and conduct open market operations in a shorter time frame, making it a useful tool for addressing short-term economic fluctuations.

- Fiscal Policy: Fiscal policy decisions typically require more time to plan, approve, and implement. Government budgeting and legislative processes can be lengthy, making fiscal policy more suited for addressing medium to long-term economic challenges.

Impact

- Monetary Policy: Monetary policy influences overall economic conditions by affecting interest rates, credit availability, and the cost of borrowing. It aims to influence spending and investment decisions by businesses and individuals, ultimately impacting aggregate demand and economic activity.

- Fiscal Policy: Fiscal policy directly impacts the level of government spending, taxation, and public debt. Changes in fiscal policy can impact consumer purchasing power, business investment, and government revenue, thereby affecting overall aggregate demand and economic growth.

Coordination

- Monetary Policy: Central banks generally operate independently of the government, allowing them to focus on achieving price stability and long-term economic goals. However, coordination and communication between monetary authorities and fiscal authorities are important to ensure policy coherence and avoid conflicting objectives.

- Fiscal Policy: Fiscal policy is often coordinated with monetary policy to ensure overall macroeconomic stability. Close collaboration between the government and central bank is important to align fiscal and monetary policy objectives and avoid potential conflicts or inconsistencies.

Monetary Policy in the USA

The FOMC is the policymaking body of the Federal Reserve responsible for setting monetary policy. It consists of seven members of the Board of Governors and five Reserve Bank presidents. The FOMC meets approximately every six weeks to assess economic conditions and determine the appropriate stance of monetary policy.

The Federal Reserve operates under a dual mandate given by Congress, which is to promote maximum employment and stable prices. This means the Fed aims to achieve both full employment and price stability in its policy decisions.

The Federal Reserve takes a data-driven approach to monetary policy. It closely monitors economic indicators such as inflation, employment, GDP growth, and financial market conditions. The analysis of these data helps inform the Fed’s policy decisions and adjustments.

Monetary Policy in India

Monetary policy in India is like a set of rules and actions made by the Reserve Bank of India (RBI), which is like India’s financial boss. The RBI decides how much money should be in circulation, sets interest rates on loans, and manages other things to keep the country’s economy stable. The RBI’s primary objective in monetary policy is to maintain price stability while also considering the objective of economic growth. Here are some key aspects of monetary policy in India:

Inflation Targeting

The RBI operates within an inflation-targeting framework. The current inflation target set by the government for the RBI is to keep the Consumer Price Index (CPI) inflation within a range of 2% to 6%, with the target midpoint at 4%. The RBI formulates its monetary policy decisions to achieve this inflation target.

Monetary Policy Committee (MPC)

The RBI (Reserve Bank of India) makes important decisions about the country’s monetary policy. These decisions are made by a group called the MPC (Monetary Policy Committee), which has six members. The government chooses three members, and one of them becomes the leader of the group. The RBI also chooses three members. The MPC meets regularly to assess economic conditions and determine the appropriate stance of monetary policy.

Key Policy Rates

The RBI uses various policy rates to influence borrowing costs and overall financial conditions in the economy. The key policy rates include the repo rate, reverse repo rate, and the marginal standing facility (MSF) rate. The repo rate is the rate at which the RBI lends to commercial banks, while the reverse repo rate is the rate at which banks can park their excess funds with the RBI. The MSF rate is the rate at which banks can borrow overnight funds from the RBI.

Forward Guidance

The RBI provides forward guidance and communicates its policy decisions and outlook to enhance transparency and predictability. The RBI Governor’s statements, policy statements, and press conferences provide insights into the RBI’s thinking, policy direction, and future actions.

Financial Stability

The RBI also considers financial stability as an important aspect of its monetary policy framework. It monitors and takes measures to address risks in the financial system, maintain the stability of the banking sector, and ensure the smooth functioning of financial intermediation.

Conclusion

Monetary policy is a key component of economic management and governance. It encompasses the actions and measures undertaken by central banks to regulate the money supply, interest rates, and financial conditions to achieve specific economic objectives. By understanding monetary policy, students can gain insights into the dynamics of economic growth, inflation, investment, and financial stability. Furthermore, it equips them with the tools to assess the effectiveness of policy measures and contribute to informed discussions on economic policy and performance.

Frequently Asked Questions (FAQs)

In the United States, monetary policy is controlled by the Federal Reserve System, commonly known as the Federal Reserve or the Fed.

In India, monetary policy is controlled by the Reserve Bank of India (RBI).

The Federal Open Market Committee (FOMC) is the policymaking body of the Federal Reserve responsible for setting monetary policy. The FOMC typically holds eight scheduled meetings throughout the year. These meetings are held approximately every six to eight weeks, with a press release and a summary of economic projections released at the conclusion of each meeting.

Monetary policy can indirectly influence employment levels by impacting overall economic conditions. Expansionary monetary policy, which stimulates economic activity, can lead to increased job creation and lower unemployment rates. However, monetary policy alone cannot address structural unemployment or long-term labor market issues, which may require complementary fiscal and structural policies.

If a central bank increases interest rates, it may attract foreign investment, which can strengthen the domestic currency. Conversely, if a central bank decreases interest rates, it may reduce the attractiveness of the domestic currency, leading to depreciation. However, exchange rates are also influenced by various other factors, including trade flows, capital flows, and market sentiment.