Meaning Of Leveraged Buyout

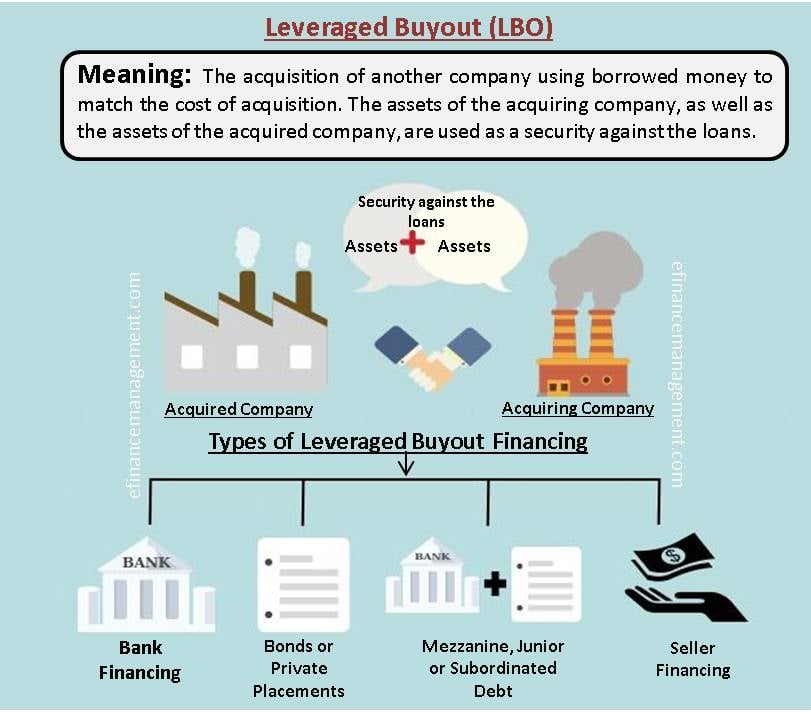

A leveraged buyout (LBO) involves the acquisition of another company using borrowed money to match the cost of the acquisition. The assets of the acquiring company and the assets of the acquired company are used as a security against the loans. The aim of leveraged buyouts is to enable companies to make large acquisitions without the need for a lot of capital. It is a corporate restructuring strategy.

After understanding the meaning, let us know how to analyze a leveraged buyout.

Leveraged Buyout Analysis

The LBO analysis helps in determining the maximum price that a buyer can pay for a target entity. This analysis considers the current market scenarios and the returns a target company will generate.

The leveraged buyout analysis justifies the highest price on the basis of the following:

- The target company’s current and projected free cash flows.

- The financing structure, banking covenants, and interest rates required by lenders.

- The required hurdle rate for equity investors.

However, the LBO analysis only determines the floor valuation of an entity. This analysis does not consider the premium paid by the acquiring entity for the synergies in business.

Let us now see how LBO is financed:

Leveraged Buyout Financing

Buyers often use borrowed funds to comprise the total purchase price while accomplishing a buyout.

The following are the types of financing that could be considered for a LBO:

Bank Financing

Funds can be borrowed from an individual bank, or a group of banks called a syndicate. The banks lend money to the buyer for the working capital and to pay out the existing ownership of the target company.

Also Read: Leveraged Buyout (LBO) Model

Bonds or Private Placements

Private notes and bonds can be utilized as a source of financing for an LBO.

Mezzanine, Junior or Subordinated Debt

This form of financing often occurs in combination with bank financing or bonds.

Seller Financing

In this form of financing, the acquiring entity lends money to the company being sold. The acquiring entity then takes a delayed payment, thereby creating a debt-like obligation. This process, in turn, creates financing for the buyout.

After knowing the concept of a leveraged buyout, let us look at an example to understand.

Example of Leveraged Buyout

Gibson Greeting Cards

The acquisition of Gibson Cards by Wesray Capital in the year 1982 proves to be the most successful example of LBO in history. The purchase price of the deal was $80 million, of which $1 million was financed in cash, and the remaining amount was borrowed by issuing junk bonds. This leveraged buyout benefited Wesray Capital and its investors when Gibson Cards was sold for $220 million a year later.

Conclusion

Private equity groups mainly execute leveraged buyouts to purchase and later sell an entity, thereby assisting in profit maximization. Entities use LBO as a part of their mergers and acquisitions strategies to acquire competitors and gain access to new markets.

Continue reading – Leveraged Buyout (LBO) Model.