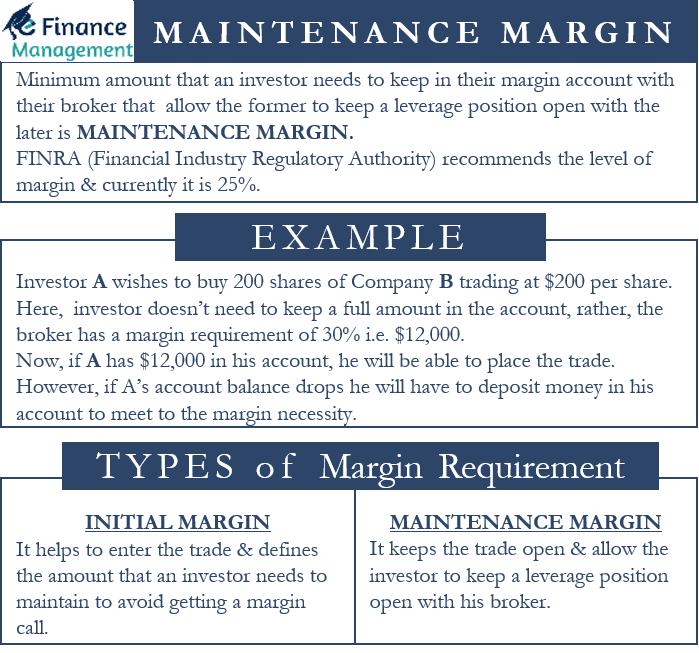

Maintenance Margin is the minimum amount that an investor needs to keep in their margin account with their broker. And this margin would allow the investor to keep a leverage position open with his broker. Basically, an investor requires this margin for the securities that he or she buys using the broker’s money, or when an investor goes for margin trading. This margin money serves as a reassurance for the broker that the investor would pay back the amount/ will not default on the expected fluctuation in the price of the security, in case of trade going against the investor.

So, we can say that brokers keep this margin requirement to lower their risk of investors defaulting on the loan amount/leveraged buying of securities. Also, this margin money ensures that investors have money to cover any running losses. We can also call this margin a variation margin or minimum maintenance margin or maintenance requirement.

FINRA (Financial Industry Regulatory Authority) recommends the level of margins that the investors need to maintain with their brokers. And currently, it suggests that the investors must maintain a minimum margin of 25% of the value of securities in their margin account. Some brokers, however, keep this margin requirement to as high as 30% to 40%.

The federal government and many other agencies regulate margin trading because it involves a high amount of money and risk. The Federal Reserve Board and FINRA are the most important agencies overseeing margin trading.

Maintenance Margin Example

Let’s consider a simple example to understand the concept of variation margin.

Investor A wishes to go long on 200 shares of Company B trading at $200 per share. In this case, the total open position would be $40,000 (200 * $200). Since this is trading on leverage, an investor doesn’t need to keep a full amount in the account. Rather, the broker has a margin requirement of 30%. So, the maintenance margin, in this case, will be $12,000 (30% of $40,000).

If A has $12,000 in his account, he will be able to place the trade. However, if A’s account balance drops (due to running losses), the broker will place A on the margin call. Now, A will have to deposit money in his account to adhere to the margin necessity as well as to take up any further trade.

Suppose the account balance for A in the above example drops to $11,000. Now A would have to put $1,000 in the account to ensure the position doesn’t close.

Initial Margin and Maintenance Margin

In leveraged trading, the margin requirements are of two types. The first one is the initial margin and the second one is the maintenance margin. The initial margin is the deposit that a trader uses to place trades. It won’t be wrong to say that the initial margin helps to enter the trade, while the variation margin helps to keep it open.

Also Read: Margin of Safety

The initial margin will always be higher as compared to the maintenance margin that normally remains lower than the initial margin. It is the amount that an investor needs to maintain to avoid getting a margin call. A margin call is basically the request from the broker to deposit additional funds in the account to meet the margin requirement.

Relationship between Initial and Maintenance Margin

Initial margin is the amount deposited by the investor in the account with the broker to initiate trade while maintenance margin is the amount deposited by the investor to continue the trade.

To clear the concept further, let`s understand this with the help of an example, where, initial margin (IM) is 50% and maintenance margin (MM) is 35%.

| Situation | No. of shares | Price per share($) | Total value($) | IM ($) | MM($) (A) | Margin Fund Balance (B) | Margin Call (B<A) |

|---|---|---|---|---|---|---|---|

| 100 | 100 | 10,000 | 5,000 | 3,500 | 5000 | ||

| 25% Fall | 100 | 75 | 7,500 | 3,750 | 2,625 | 2500 | Yes, 1250 |

| (5000-2500) | (3750-2500) | ||||||

| 5% Fall | 100 | 95 | 9,500 | 4,750 | 3,325 | 4500 | No. |

| (5000-500) |

In the example above, the investor started with buying 100 shares of 100$ each. Since the initial margin requirement is 50%, he will deposit $5000. Now, if the price of a share falls by 25%, the investor incurs a loss of $2,500 and his margin account will reduce to 2,500 and the initial margin requirement also falls to 3,750 (@ 50% of Current Value i.e. $7500) and maintenance margin to 2625 (@35% of $7500).

Since the margin fund balance has fallen below the maintenance margin requirement, the investor will receive a margin call and he will have to deposit money to set the level equals to the maintenance margin i.e. 1,250 (3,750 – 2,500).

Similarly, if the share price falls only by 5%, the IM requirement will be 4750 and MM requirement will be 3325 but the account has a sufficient balance of 4,500 (5000 – 5% of 10000) which is more than the MM requirement. In this case, the investor will not receive a margin call, is not required to deposit any money.

To conclude, margin call is received only when the balance of trader goes below maintenance margin. If this happens, in the case of futures, the investor has to deposit the money up to the level of the initial margin however, in the case of equity, the investor has to deposit the money only up to a level of maintenance margin.

Initial Margin and Maintenance Margin – Example

Let’s consider an example to better understand the difference between the two.

Suppose investor A plans to buy 200 shares of Company B trading at $30 per share. The total investment would be $6,000. If A doesn’t have the full amount, he needs to set up a margin account with the broker. It would allow A to buy the shares just by putting a certain percentage of the total cost. This certain percentage is the initial margin requirement.

Now, suppose this initial margin is 50% of the purchase price or $3,000 in this case. This means A should have $3,000 in his account to carry the trade. Suppose the variation margin requirement is 40% or $2,400 in this case.

Now assume that after entering the trade, Company A’s shares drop by 30%. This will result in a drop in the margin account balance as well in the following way:

The total value of 200 Company A shares will now be $4,200. So, the value initial margin requirement would now be $2,100 (from $3,000 earlier). But, the maintenance margin is 40%, or $2,400.

This means A’s account balance is now below the variation margin level. Thus A would get a margin call to deposit more money. Or, the broker would ask A to liquidate some of his current holdings to free cash to meet the requirement.

So, if A gets the margin call, he would have to deposit more funds to meet the initial margin requirement, i.e. 50% of the original investment amount (or $3,000). This means A would have to deposit $900 more.

Final Words

Maintenance margin is very effective in the trading world. It benefits both traders and brokers. For brokers, it helps to lower their risk, while for traders; it allows them to make bigger bets even if they don’t have money. And this is what is called leveraged trades.

Quiz on Maintenance Margin

Let’s take a quick test on the topic you have read here.