“Why net present value (NPV) is the best measure for investment appraisal?” This question is as good as another question – “How NPV is better than other investment appraisal methods? There are many methods for investment appraisal. Such as accounting (book) rate of return, payback period (PBP), internal rate of return (IRR), and Profitability Index (PI). And to answer the above question, one must know the differences – NPV vs IRR/PBP/PI.

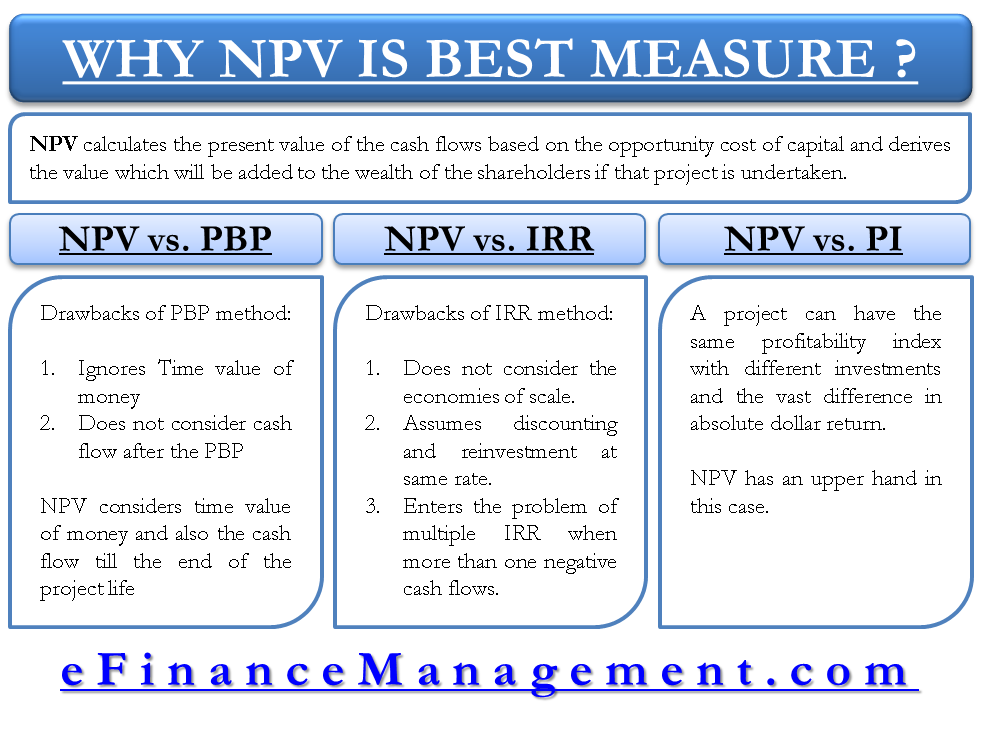

Before comparing NPV, let’s recapitulate the concept again. The net present value method calculates the present value of the cash flows based on the opportunity cost of capital. And derives the value that will be added to the shareholders’ wealth if that project is undertaken.

Let us discuss each of these methods in comparison with the net present value (NPV) to reach a conclusion.

Net Present Value vs. Payback Period (NPV vs. PBP)

Payback period calculates a period within which the project’s initial investment is recovered.

The criterion for acceptance or rejection is just a benchmark decided by the firm, say 3 Years. If the PBP is less than or equal to 3 Years, the firm will accept the project and else will reject it. There are two major drawbacks to this technique –

- It does not consider the cash flows after the PBP.

- Ignores the time value of money.

The second drawback is still covered a bit by an extended version of PBP, commonly called Discounted Payback Period. The only difference is that the cash flows used are discounted cash flows, but it does not consider the cash flows after PBP.

Also Read: NPV vs IRR vs PB vs PI vs ARR

Net present value considers the time value of money and takes care of all the cash flows until the end of the project’s life.

Net Present Value vs. Internal Rate of Return (NPV vs IRR)

The internal rate of return (IRR) calculates a rate of return offered by the project irrespective of the required rate of return and any other thing. It also has certain disadvantages discussed below:

- IRR does not understand economies of scale and ignores the dollar value of the project. It cannot differentiate between two projects with the same IRR but vast difference between dollar returns. On the other hand, NPV talks in absolute terms, so this point is not missed.

- IRR assumes discounting, and reinvestment of cash flows at the same rate. If the IRR of a very good project is 35%, it is practically impossible to invest money at this rate in the market. At the same time, NPV assumes a borrowing and lending rate near the market rates and is not absolutely impractical.

- IRR enters the problem of multiple IRR when we have more than one negative net cash flow, and the equation is then satisfied with two values; therefore, we have multiple IRRs. Such a problem does not exist with NPV.

Net Present Value vs. Profitability Index (NPV vs. PI)

Profitability index is a ratio between the discounted cash inflow to the initial cash outflow. It presents a value that says how many times the investment is the returns in the form of discounted cash flows.

The disadvantage associated with this method again is its relativity. A project can have the same profitability index with different investments and a vast difference in absolute dollar return. NPV has the upper hand in this case.

Why is NPV the Best Method?

We have noted that almost all the difficulties are survived by net present value, and that is why it is considered to be the best way to analyze, evaluate, and select big investment projects. At the same time, the estimation of cash flows requires carefulness because if the cash flow estimation is wrong, NPV is bound to be misleading.

Also Read: Can We Use Net Present Value Method to Compare Projects of Different Sizes and Durations?

A small problem with NPV is that it also considers the same discounting rate for cash inflow and outflows. We know that there are differences between borrowing and lending rates. Modified internal rate of return is another method that is a little more complex but improved, which takes care of the difference between borrowing and lending rates also as it discounts cash inflows at lending rates and cash outflow at borrowing rates.

Also, read How is Risk related to Net Present Value?

Very educative and simple to understand

Thanks

IRR is the best criterion: Neither NPV nor MIRR is useful

1. NPV is nothing more than the unutilised or unallocated NCF and if fully allocated it will become zero and the IRR will be the maximum at Zero NPV (see papers in the link attached).

2. MIRR should not be used as the results might lead to wrong advice to the investors and potentially law suit for the wrong advice, because:

a. MIRR assume reinvestment but in reality there is no reinvestment as discussed in the papers …Link attached).

b.MIRR can be misleading in the case of multiple IRR situation. In those situations the non-normal cash flow will indicate the net cash flow before discounting is either zero or negative and that being the case how come MIRR manipulate to get a higher rate of return. MIRR is dubious manipulation.

c. If you keep on increasing the reinvestment rate the MIRR limitlessly will increase without any relationship to the capacity of the NCF to support such a higher return. Again a dubious return by MIRR.

1. “A New Method to Estimate NPV from the Capital Amortization Schedule and an

Insight into Why NPV is Not the Appropriate Criterion for Capital Investment

Decision”. paper link:

A New Method to Estimate NPV and IRR from the Capital Amortization Schedule and an Insight into Why NPV Is Not the Appropriate Criterion for Capital Investment Decision

This paper introduces a new method to estimate the NPV based on Capital Amortization Schedule (CAS) and not the conventional DCF method. The new method is more transparent. This paper questions the validity of the NPV as a preferred criterion than IRR. The results also clarify that there is no reinvestment of intermediate income, as CAS does not involve reinvestment. When there is no reinvestment, the MIRR estimate is also redundant.

2. IRR Performs Better than NPV: A Critical Analysis of Cases of Multiple IRR and

Mutually Exclusive and Independent Investment Projects.

IRR Performs Better than NPV: A Critical Analysis of Cases of Multiple IRR and Mutually Exclusive and Independent Investments

3. The Controversial Reinvestment Assumption in IRR and NPV Estimates: New Evidence Against Reinvestment Assumption (February 16, 2017).

The Controversial Reinvestment Assumption in IRR and NPV Estimates: New Evidence against Reinvestment Assumption

These papers present evidence to identify the most appropriate investment criterion (IRR vs NPV) with emphasis on the controversial multiple, negative and no IRR, mutually exclusive investment and

independent projects. The analysis is based on the estimated return on capital (ROC), return on invested capital (ROIC) and capital amortization schedule (CAS). Numerical evidence is furnished to recommend IRR as the best criterion and not the NPV.

The analytical results presented in these papers question some of the conventional wisdoms advocated by most finance and economic texts or project analysis guide or publications or teaching materials and therefore the contents will enable the respective authors or organization to revise or update their publications accordingly. The current practice is to prefer NPV but the evidence does not support such preference.

Dr Kannapiran c. Arjunan, PhD, MBA [email protected]

Good write-up, I am normal visitor of one’s blog, maintain up the excellent operate, and It’s going to be a regular visitor for a long time.