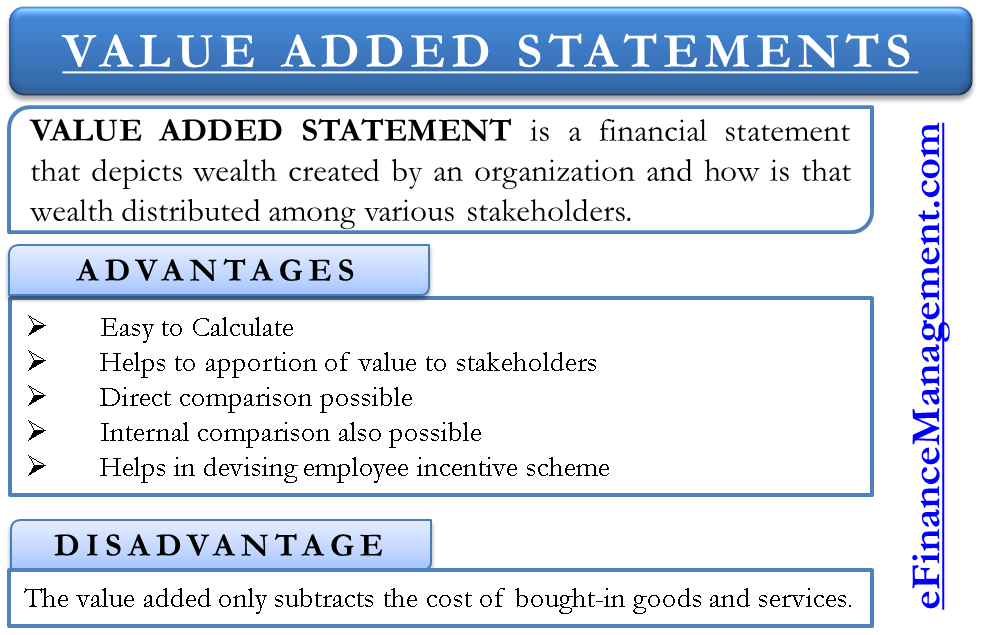

Value Added Statements are types of vertical financial statements that depict wealth created by an organization and how that wealth is distributed among various stakeholders. The various stakeholders comprise of the employees, shareholders, government, creditors, and the wealth that is retained in the business.

As per the concept of Enterprise Theory, the calculation of profit is for various stakeholders by an organization. Value Added is this profit generated by the collective efforts of management, employees, capital, and the utilization of its capacity that is distributed amongst its various stakeholders.

Consider a manufacturing firm. A typical firm would buy raw materials from the market. Process the raw materials and assemble them to produce the finished goods. The finished goods are then sold in the market. The additional work that the firm does to the raw materials for them to be sold in the market is the value added by that firm. Value-added can also be defined as the difference between the value that the customers are willing to pay for the finished goods and the cost of materials.

Example of Value Added Statement

Following is the format with an example and explanation.

| Sales Revenue | 1000 |

| Less: Cost of bought-in goods and services | 200 |

| Value Added | 800 |

| Application of Value Added | |

| Employee Benefits | 250 |

| To capital providers (Creditors and Lenders) | 100 |

| Taxes | 100 |

| Value retained (depreciation and expansion of business) | 350 |

| Value Added | 800 |

From the above illustration, the difference between sales and the cost of bought-in materials and services gives the value added by the organization. The second part of the statement provides the distribution of the value added by the organization. Of the $800 added by the firm, $250 is utilized for employee benefits, and $100 is given as interest on loans and dividends to shareholders. The contribution of another $100 is to the government in the form of taxes. Whereas $350 is retained for expansion of the current business, and part of it is kept aside for depreciation. Thus, the value-added statement gives the value added by the organization and the distribution of it across various stakeholders.

Advantages of Value Added Statements

- It is easy to calculate.

- It helps a company to apportion the value to various stakeholders. The company can use this to analyze the proportion of value-added to which stakeholder.

- Helpful in making a direct comparison with your competitors.

- Useful for internal comparison purposes and to devise employee incentive schemes.

Difference between Value Added and Profit

Profit subtracts all the costs incurred in the process of generating revenues. On the other hand, the value-added only subtracts the cost of bought-in goods and services. Profits are for shareholders, whereas value-added is for stakeholders who include shareholders also. Therefore, value-added is a wider term.

Read more about VERTICAL ANALYSIS.

Quiz on Value Added Statements

So helpful. Thank you very much, Sir.

Well explained. Thanks a lot

I obviously like your web site and I will definitely come back again.

I do love the way you have framed this issue and it does indeed provide us with some fodder for consideration. thank you for this superb piece and though I do not necessarily concur with it in totality, I regard your point of view.

Thanks for your publication.

I liked up to you’ll obtain performed proper here. The sketch is attractive, your authored material stylish.

I’m very glad to see your article.

Thank you so much and i’m looking ahead to touch you. Will you kindly drop me a mail?

Cool glasses ? ?? ??. Thank you sir, really helpful