Meaning of Perpetuity

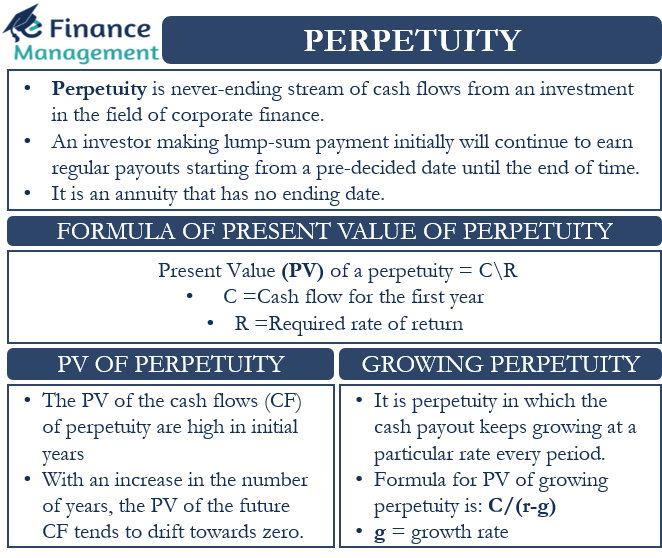

Perpetuity is a never-ending stream of cash flows from an investment in the field of corporate finance. Such cash flows do not have a termination date. An investor making a lump sum payment, in the beginning, will continue to earn regular payouts starting from a pre-decided date until the end of time. In other words, it is an annuity that has no ending date. An investor gets a fixed cash payout regularly in the case of annuities as well. The main difference between perpetuity and an annuity is the fact that while an annuity has a fixed maturity date for when the arrangement will come to an end, perpetuity goes on forever and has no maturity date.

Examples

There are many investments that incorporate the features of perpetuity. Some of them are:

- The common stocks of a company that we trade in are a form of perpetuity. A company has an indefinite life in the eyes of the law. Hence, an investor will continue to earn dividends on the stocks he holds indefinitely.

- Similarly, real estate investments are a form of perpetuity. Investors buy a property with a view to earning rentals from it for an infinite period of time.

- Financial institutions sometimes issue bonds with the feature of perpetuity. However, the issuance of such bonds in the current period is a rarity.

- Endowment funds of universities also incorporate the features of perpetuity. Their founders must have invested in some sort of perpetuity while setting up the fund. These funds continue to pay scholarships to students without stopping.

Present Value of Perpetuity

Perpetuities continue to provide payouts indefinitely. This feature compels us to believe that it can never have a finite value. However, this is not the case. The present values (PV) of the cash flow that an investor earns on perpetuity are high in the initial years. But the effect of inflation results in a substantial fall in the real value of the future cash flows from perpetuity. As the number of years in consideration keeps increasing, the present value of the future cash flows tends to drift toward zero. Though ideally, it never touches zero but gets very close to it. Since in the later years at the fag end, the present value becomes negligible. Hence, it is possible to calculate its present value at least theoretically.

Formula for Calculating PV of Perpetuity

Any investor will be keen to find the present value of perpetuity in order to correctly judge an investment option. If his investment option costs more than the present value, he should avoid investing in it. If it costs the same or lesser than the present value, he can invest in it.

Let us have a look at the formula for the same.

Present Value of Perpetuity = C/r

In the above equation, C is the cash flow amount that an investor will receive every period, and r is the required rate of return.

Example

Let us suppose that a company ABC Inc. comes up with an investment proposal in which an investor has to invest $1000 in a lump sum.

Scenario 1

Assume that the company promises to pay him an amount of $30 at the end of every year indefinitely. Also, the average rate of return that an investor expects from his investments is 5%.

We have to find out if the above investment proposal is worth investing in or not. For this, we will calculate its present value.

PV = $30/ 5%

= $600.

The Present Value comes out to be $600, which is much lesser than the asking price of $1000 of the company. Therefore, an investor should avoid investing in this scheme.

Scenario 2

Let us suppose that the company promises to pay back a sum of $60 at the end of every year indefinitely. All other things are the same. Now let us find out if the investment opportunity is profitable for an investor or not.

Also Read: Present Value of Annuity

PV = $60/ 5%

=$1200

The Present Value is $1200. An investor is getting it at $1000. Therefore, he should invest in the proposal.

Growing Perpetuity

A growing perpetuity is one in which the cash payout keeps growing at a particular rate every period. Along with the cash flow, the growth also goes on indefinitely. For example, continuing with the above example, suppose the investment proposal offers a $60 cash payout at the end of the first year and promises a rise of 3% for cash payout every year. Such a scenario or arrangement will fall within the definition of growing perpetuity.

Present Value of a Growing Perpetuity

Let us continue with the earlier example where an investor will have to invest $1000 in a lump sum initially. He will get a regular stream of cash flow of $60 at the end of every year, and the rate of return that is required on this investment is 5%. The only thing that has changed is that now it is growing perpetuity. His stream of cash flows is supposed to grow at the rate of 3% every year. We have to find out whether the investment is profitable to an investor or not.

The formula for finding the present value of growing perpetuity is:

Cash flow for the first year/(Required rate of return – Growth rate)

Hence, PV = $60/ (5%- 3%)

= $3000

The present value of this comes out to be $3000. The company is only asking for $1000 as the initial payment that has to be made in one go. Therefore, an investor should invest in this proposal as it will be profitable to him.

Read difference between growing perpetuity and growing annuity to learn more.

Frequently Asked Questions (FAQs)

It is a never-ending stream of cash flows from an investment in the field of corporate finance having no termination date.

The main difference between perpetuity and annuity is: that an annuity has a fixed maturity date while perpetuity goes on forever and has no maturity date.

Perpetuity in which the cash payout keeps growing at a particular rate every period till infinity is termed as growing perpetuity.