The Cash to Income Ratio is a liquidity ratio. This shows the relationship between the cash flow and a firm’s operating income. In other words, it indicates how much dollars of cash actually flows per dollar of operating income of the company from its operating activities.

One easy way to calculate this is by dividing cash flow from operations by the operating income. We can use EBIT (earnings before interest and taxes) as a proxy for operating income. As it more or less equals the same.

One ratio that is very similar to this ratio is the operating cash flow ratio. This ratio also uses cash flows from operations in the numerator. But, in the denominator, the operating cash flow ratio uses net income.

Formula for Cash to Income Ratio

As said above, one can calculate it by dividing the cash flow from operations (CFO) by operating income. Putting it into a formula:

Cash to Income Ratio = Cash flow from operations (CFO)/Operating Income

CFO here is the net cash that a company generates from operating activities only. One can easily get this figure from the company’s cash flow statement. Other cash flows are ignored for this calculation.

Also Read: Cash Ratio

We can take EBIT (earnings before interest and taxes) for operating income. The operating income figure does not consider non-operating income, like interest income.

The best way to interpret this ratio is to analyze it for the past two or three years to check the trend. A single-year ratio on its own does not convey any meaning. Moreover, a single-year result could be an exception or abnormal. Hence, the trend needs to be compared.

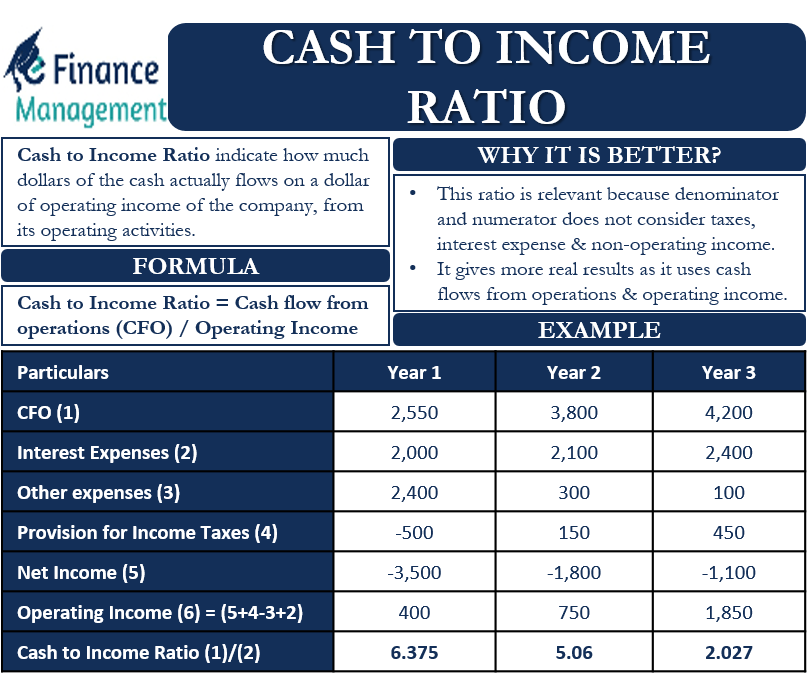

Cash to Income Ratio – Example

The net cash from operations for Company A for three years is $2,550 million, $3,800 million, and 4,200 million, respectively. The interest expenses for the three years are $2,000 million, $2,100 million, and $2,400 million, respectively. Other expenses were: $2,400 million, $300 million, and $100 million, respectively. Provisions for income taxes were: -$500 million, $150 million, and $450 million. The net income for Company A for three years is: -$3,500 million, -$1,800 million, and -$1,100 million.

Operating Income for Year 1 = -$3,500 million + (-$500) – (-$2,400) + $2,000 = $400 million

For Year 2 = -$1,800 + $150 – (-$300) + $2,100 = $750 million

For Year 3 = -$1,100 + $450 – (-$100) + $2,400 = $1,850 million

Now, let us put the figure of Operating Income so derived in the formula to calculate this ratio:

Year 1 = $2,550/$400 = 6.375

Year 2 = $3,800/$750 = 5.06

And, for Year 3 = $4,200/ $1,850 = 2.27

The ratio numbers show that the company is now generating less cash flow than earlier per dollar of net earnings. The management needs to deep dive to know the reasons, therefore, and if needed, any corrective action to be initiated because continuous reduction and that is too significant one could be a warning signal.

Why it is Better?

What makes this ratio more relevant is that both denominator and numerator figure does not consider taxes, interest expense, and non-operating income.

Operating income helps to give more accurate or actual figures. This is because other profitability numbers, such as net income or EBITDA, get influenced and affected because they are subjected to accounting policies and estimates that are on the basis of management discretion.

Also Read: Liquidity Ratios

This is why the cash to income ratio gives more realistic results, as it uses both cash flows from operations and operating income. Therefore, analysts take this ratio as an important litmus test about the cash flow availability vis-a-vis operating income. Again this should be compared with similar companies and industries. A low ratio could mean large debtors outstanding or revenue recognition is quite fast than the actual settlement. On the other hand, a high ratio may mean revenue management—late recognition and thus deferring tax liability, etc.

Refer for other types of LIQUIDITY RATIOS

Frequently Asked Questions (FAQs)

The cash to income ratio this ratio indicates how much dollars of cash actually flows, per dollar of operating income of the company, from its operating activities.

The formula for calculating the cash to income ratio is Cash flow from operations (CFO)/Operating income.

It is better because both the denominator and numerator figure does not consider taxes, interest expense, and non-operating income.