What is a Growing Annuity?

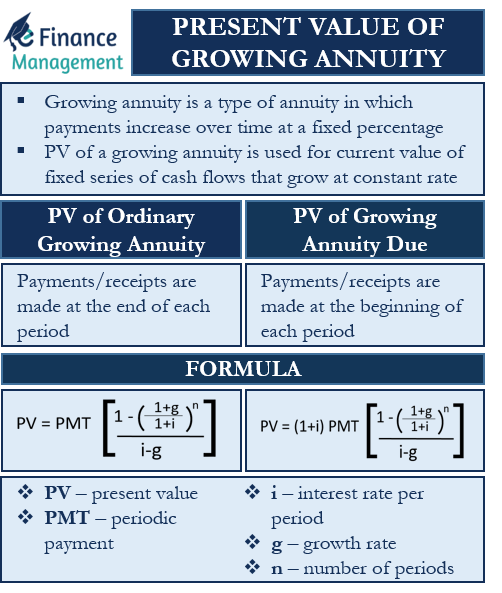

A specific type of annuity in which payments increase over time at a fixed percentage is referred to as a “growing annuity.” Graded annuity is another name for a growing annuity. A growing annuity differs from a regular annuity in that the periodic income flows grow continuously as opposed to remaining constant in an annuity. The rise in expected income, or economic inflation, is the basis for the constant rate of annuity increases. Rental contracts, investing guidelines, a company’s multi-stage dividend growth scheme, insurance schemes, etc., are typical instances of increasing annuities.

Present Value of Growing Annuity

The calculation of the present value of an annuity relies on the concept of the time value of money. This means that the specific value of a sum of money is worth more today than at a future date. Moreover, the present value of a growing annuity is used for the current value of a fixed series of cash flows that grow at a constant rate.

The periods in a growing annuity are fixed, unlike in perpetuity. Hence, a compound interest rate is used to calculate the PV of a growing annuity. A discount rate is applied to calculate the value of each payment back to its original value at the start of the first period.

Present Value of Ordinary Growing Annuity

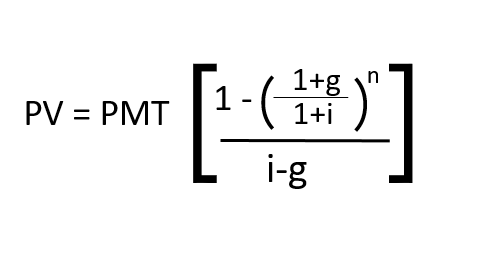

In an ordinary annuity, the payments or receipts are made at the end of each period. It uses a simple formula for the calculation of the present value. The following is the formula for the calculation of the present value of an ordinary growing annuity:

PV – present value

PMT – periodic payment

i – interest rate per period

g – growth rate

n – number of periods

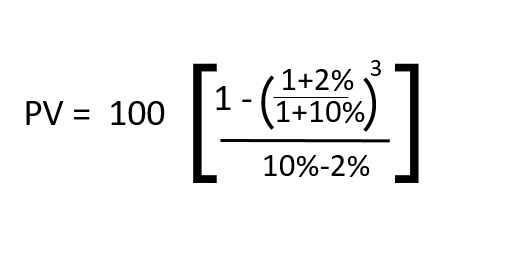

Example: Assuming that a payment of $100 is made over 3 periods with an interest rate of 10% and a growth rate of 2%. Calculating the present value, or PV of the growing annuity.

Therefore, PV is calculated at $253.38

Present Value of Growing Annuity Due

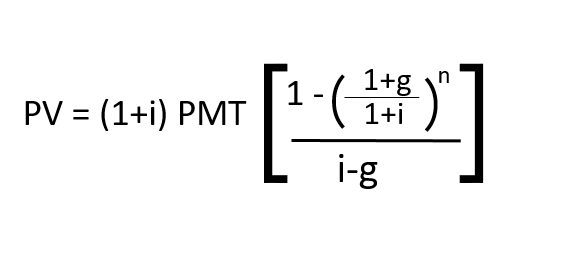

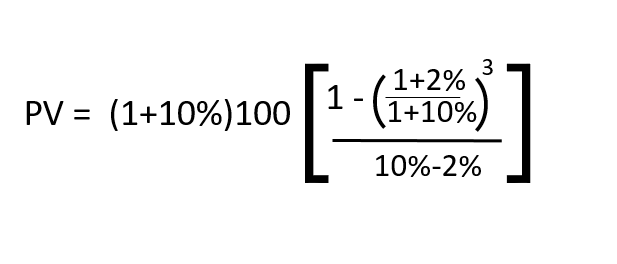

In a growing annuity due, the payments or receipts are made at the beginning of each period. The formula for the calculation of present value needs to be adjusted for a growing annuity due. The following is the formula:

PV – present value

PMT – periodic payment

i – interest rate per period

g – growth rate

n – number of periods

Example: Assuming that a payment of $100 is made for 3 periods with an interest rate of 10% and a growth rate of 2%. The payments are made at the beginning of each period. Calculating the present value or PV of the growing annuity due.

Therefore, PV is calculated at $278.71

The PV calculated for the growing annuity due is greater than the ordinary growing annuity. This difference is because the payment is made at the beginning of each period, and the interest income of that period is also included in the calculation of the present or future value of the annuity.

Read difference between growing perpetuity and growing annuity to learn more.