Money’s time value is one of the core concepts of finance. The time value of money helps in calculating the present and future value of the sum of the money. Timeline helps to ease this calculation. In this article, we will learn how is a timeline useful in the time value of money.

What is a Timeline?

A timeline is a graphical representation of the cash flows of an investment and the timing of these cash flows. It makes it easier to present or visualize the present or future value of a series of cash flows.

Cash flows for an annuity are of a fixed amount and paid or received at uniform intervals. It can be calculated and explained using a simple formula and does not require a timeline. However, in case of irregular or unequal cash flows, the calculation can be tricky. Hence, the representation of cash flows using a timeline is essential to understand the problem better.

Example 1 (For Discounting)

Let’s jump straight into an example to learn how is a timeline useful in the time value of money.

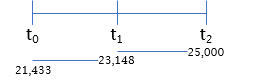

Suppose you want to deposit a sum of money today so that you have a total of $25,000 at the end of 2 years. The rate of interest in your bank is 8% p.a. Look at the timeline below to understand its significance in calculating the amount to be deposited today.

Also Read: Present and Future Value

So, first of all, we have calculated the amount required to be deposited at the end of 1st year (t1) using the present value formula. This comes to $23,148. Again, we will calculate the present value of this amount to arrive at the amount required to be deposited today (at t0). Hence, you are required to deposit $21,433 today to get $25,000 at the end of 2 years (t2).

Timeline not only helps simplify the calculation, but it also provides an idea about how the formulas for calculating present value and future value for more than 1 period have been derived.

Example 2 (For Compounding)

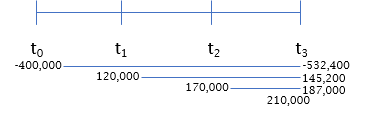

Assume that an investment of $400,000 is made today with a forecasted revenue of $120,000 at the end of the first year, $170,000 at the end of the second year, and $210,000 at the end of the third year. Let us use a timeline to calculate how much the project will be worth at the end of 3rd year. Assume the cost of capital to be 10%.

The timeline helps clarify the number of periods you need for compounding. And then, you can simply apply the formula of future value. From the diagram above, it is very clear that the future value of the project is $9,800.

Conclusion

A timeline helps to better understand the overall structure of a given situation. There are many instances, even in real life, when cash flows related to an investment or loan can be uneven or irregular. There are various examples, such as repayment of loans, pension funds, provident funds, etc., where cash flows can be uneven. In these scenarios, using a basic time value formula is impossible. Hence, the concept of a timeline becomes even more important.