Present Value Interest Factor of Annuity (PVIFA)

The PVIFA Calculator is a tool to quickly calculate the current value of the cash flows from an annuity with just one click. The present value interest factor of the annuity calculates the present value of a number of annuities. This concept of the present value from the time value of money determines that the value of a single penny that is received today is more than the value that it will be in the future. PVIFA is useful for calculating the present value of the annuities to be received in the future.

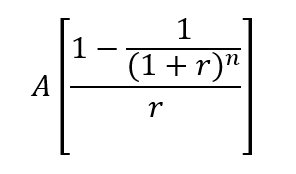

The formula for Calculating PVIFA

The formula for calculating PVIFA is:

where A = Amount Invested

r = Interest Rate

and n = Duration of Annuity.

About the Calculator / Features

This calculator helps calculate the present value interest factor of annuity instantly with just one click. The user only has to provide the following data:

- Interest rate

- Number of period

PVIFA Calculator

How to Calculate using PVIFA Calculator

You simply have to insert the following data into the calculator.

Interest Rate

It is denoted by ‘r.’ Interest rate means the rate of return you get on your investment.

Number of Period

It is denoted by ‘n,’ which is the period for which you have invested.

Example of PVIFA

Let us understand this concept using a simple example. Calculate the annuity for a period of 5 years at an interest rate of 10%.

Here A = $10,000, r = 10% and n = 5.

Therefore, PVIFA = 1-[1/(1+0.10)5]/0.10 = 3.7908

And the PV of this series of cash flow / annuities will be = $10000*3.7908 = $37908.

Interpretation of PVIFA

This only implies that the value of $1 today is higher than the value after 5 / 10 years or the given future period.

PVIFA is a derivative indicator that proposes the present value of the series of cash flows that the investor receives over the period at a given rate of interest. This interest rate could be the risk-free rate of return or the interest rate with the risk premium for the additional risk related to the issuer and the investment period that the investor is willing to take or the return that the issuer offers. This factor will tell what would be the present amount if the investor has alternate options. He can calculate the present value from that option rate.

Finally, after comparing the two values, the investor may choose the option that provides the better Net Present Value. Here Net Present Value is the difference between the present value of the proposed investment and the current cash outflow. Preferably, the investment option that has the maximum NPV should be chosen. Of course, this is subject to various other factors.