Forward Contracts

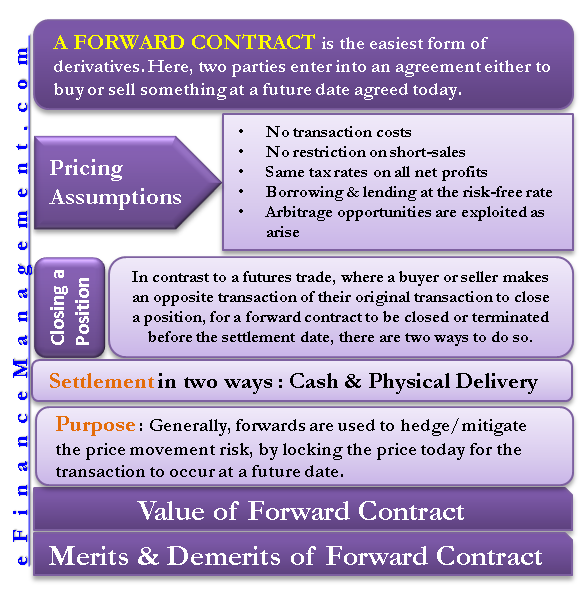

A forward contract is the most elementary form of derivatives. Over here, two parties enter into an agreement either to buy or sell something at a future date agreed today. It can be customized to cater to the need of both parties entering into the contract. The contract specifies the underlying asset’s contract size or a lot, forward interest rate, settlement date, specified quality, and quantity, and other items to be fulfilled to satisfy the contract.

The assets often traded in forward contracts include commodities, precious metals, electricity, oil, natural gas, foreign currencies, and financial instruments.

Pricing Assumptions for Forward Contract

The following assumptions are used to compute forward prices:

- There are no transaction costs.

- No restriction on short sales.

- There are the same tax rates on all net profits.

- Borrowing and lending at the risk-free rate

- Arbitrage opportunities are exploited as they arise.

Closing a Position

In contrast to a futures trade, where a buyer or seller performs an opposite transaction of their original transaction to close a position, for a forward contract to be closed or terminated before the settlement date, there are two ways to do so. Either transfer the contract to a third party or get into a new forward contract with the opposite trade. It is typically complicated to terminate a contract and might attract a penalty. (Read more about Forwards vs Futures).

Settlement for Forward Contract

Forwards can be settled in either of two ways:

Cash

It requires the counterparties to exchange the cash difference in the value of their positions. The appropriate party receives the cash difference.

Physical Delivery

It requires the counterparties to exchange the underlying asset. Herein, the actual quantity of the underlying asset, along with other specifications as stipulated in the contract, are delivered to settle the contract.

After a settlement, there are no further obligations to either party.

Purpose

Generally, forwards are used to hedge/mitigate the price movement risk by locking the price today for the transaction to occur at a future date.

Value

The initial value of a forward contract is zero. The forward contract can possess a non-zero value only after the contract is entered into and the obligation to buy or sell has been made. Since the forward price is regularly computed to prevent arbitrage, the value must be zero at the inception of the contract.

Merits of Forward Contract

A forward contract has the following merits:

- They are easy to understand.

- It is a tailor-made contract and is flexible to adjust to the needs of both parties.

- Offer a complete hedge (i.e., delta neutral hedge) and helps in mitigating the risk.

- It can be matched with the time period and cash flows of exposure.

- As it is an over-the-counter (OTC) contract, the price of contracts is not known to others, hence providing price protection.

- There are no immediate cash outflows before the settlement of the contract but might require an upfront fee, i.e., margin.

- It is a tool for speculation.

- Payoffs are symmetrical, meaning thereby, there is a distinction as one party will gain while the other makes a loss of an equivalent amount.

- There is no daily marking to market requirements as mandatory in the futures contract.

Demerits of Forward Contract

Like every other derivative, forwards also have some demerits as follows:

- As it is a private contract, there is no liquidity.

- Counterparty risk of defaulting on the contract is excessively high.

- The market of forward contracts is extremely unorganized as it is traded over the counter.

- It may be challenging to find a counterparty to enter into a contract.

Continue reading – Types of Forward Contracts.