A forward contract is a type of derivative instrument. This is an agreement between two investing parties wherein the parties agree to buy or sell an underlying asset or security at a future date at an agreed rate in the agreed quantity. These contracts trade OTC (over the counter), and thus they do not face many regulations and are not standardized. There are many types of forward contracts, which we will discuss later in this article.

Traders primarily use forward contracts to protect themselves from the volatility in the currency and commodity markets. But, forward contracts can involve other assets as well, including equity, treasury, real estate, and more. Forward contracts are useful as a hedging instrument. However, it is also used by investors for speculation purposes to earn profits from the movement of the security prices.

Now, as we know what forward contracts are, let us take a look at the types of forward contracts.

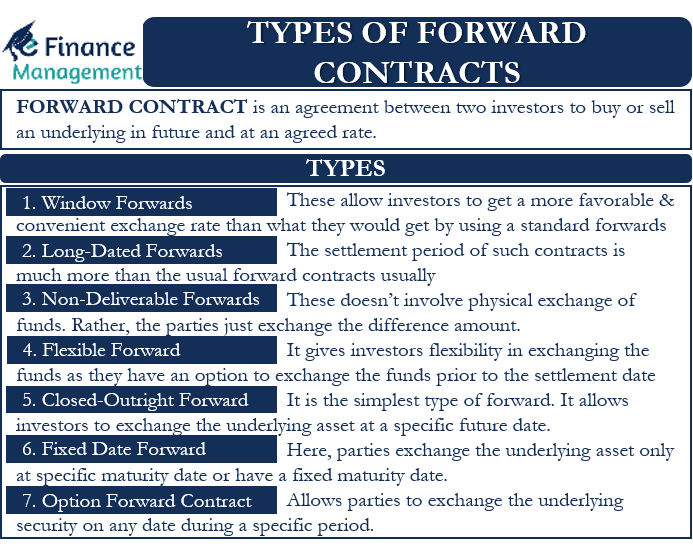

Types of Forward Contracts

Since currencies account for the bulk of forward contracts, most types of forward contracts are specific to currencies. Following are the types of forward contracts:

Window Forwards

Such forward contracts allow investors to buy the currencies within a range of settlement dates. Basically, such contracts allow investors to get a more favorable and convenient exchange rate than what they would get by using a standard forward contract.

Also Read: Forward Contract

For example, Mr. X is supposed to make a settlement with his US-based supplier after three months. However, the date is not fixed. Therefore, Mr. X opts for a window forward contract where he can trade on any day from 1st to 30th of the upcoming 4th month but not later than 30th.

Long-Dated Forwards

As the name suggests, the settlement period of such contracts is much more than the usual forward contracts. A standard forward contract usually has an expiry date of up to 12 months. In contrast, long-dated forwards can have a maturity date of up to 10 yrs. Except for a longer settlement date, all other features of long-dated forwards are the same as standard forward contracts.

Non-Deliverable Forwards (NDFs)

Non-deliverable forwards are types of forward contracts that are very different from standard forward contracts. As in such contracts, physical delivery of the security/asset of funds does not occur. Instead, the parties just exchange the difference amount at the time of the settlement. The difference amount is on the basis of the contract rate and the market rate at the time of the settlement. Generally, investors who do not have enough funds or do not want to commit funds or block huge funds go for such types of forward contracts.

Suppose XYZ Inc. will receive 1 million BRL after 3 months for sales made in the current month. It goes to a Brazilian bank in order to enter into a forward contract of selling 1 million BRL after 3 months at a rate of 4 BRL for $1.

Also Read: Non-deliverable forward (NDF)

Now, there are 2 possibilities:

Case 1: After 3 months, $1 = 3.7 BRL, or

Case 2: After 3 months, $1 = 4.25 BRL.

XYZ Inc. would receive $250,000 for sure because of entering into an NDF contract.

In case 1, amount to be received by XYZ Inc. = $270,270 (1 million BRL / 3.7). Here, the spot price turns favorable for XYZ Inc. Now the Brazilian bank will pay the difference of the spot rate and forward rate to XYZ Inc., which is $20,270 (i.e., 270,270 – 250,000).

In case 2, amount to be received = $235,294 (1 million BRL / 4.25) which is less than $250,000. Here, spot price is unfavorable for XYZ Inc. Now the difference paid by the bank is $14,706 (i.e., 250,000 – 235,294).

Flexible Forward

Such type of forward contract gives investors flexibility in exchanging the funds. Or, we can say that investors using such a contract have an option to exchange the funds before the settlement date. Using this contact, parties can either exchange the funds outright or choose to make several payments prior to the settlement date.

Assume that Mr. X imports goods in India worth $500,000 from a US-based exporter. Being aware of exchange rate fluctuation, he enters into a flexible forward contract. This will help him to make payments at different points of time during the period of the contract, whenever the exchange rates are favorable to him.

Closed Outright Forward

This is the simplest type of forward contract. We can also call such forward contracts European contracts or Standard Forward Contracts. Such types of contracts allow investors to exchange the underlying asset at a specific future date.

Say, for example, you have entered into a trade with a foreign exporter. And, the date of payment is the 24th of next month. You can lock in the exchange rate by entering into a closed outright forward contract for the 24th of next month.

Fixed Date Forward Contracts

In this type of forward contract, the parties exchange the underlying asset only at specific maturity date. Or, we can say, such contracts have a fixed maturity date. Most forward contracts are fixed-date forward contracts only.

Option Forward Contract

These types of forward contracts are similar to flexible forward contracts. An option forward contract allows parties to exchange the underlying security on any date during a specific period.

Final Words

So, these were the types of forward contracts that investors have at their disposal. They can select one or more forward contracts depending on their position, risk appetite, as well as the current market scenario.

Frequently Asked Questions (FAQs)

Following are the types of forward contracts:

1. Window forwards

2. Long-dated forwards

3. Non-deliverable forwards

4. Flexible forwards

5. Closed outright forwards

6. Fixed dates forwards

7. Option forwards

A long-dated forward differs from standard forward contracts only in terms of the time period. A standard forward contract generally expires in 12 months, while a long-dated forward has a maturity of up to 10 years.

a) Flexible forward

b) Fixed date forward

c) Non-deliverable forward

b) Fixed date forward

RELATED POSTS

- Forwards vs Futures Differences

- Types of Derivatives Instruments – All You Need to Know

- Forward Rate Agreement – Meaning, Features, Example, and More

- Hedging Strategies: Using Forwards, Futures and Options

- Derivatives Market – Types, Features, Participants and More

- Forward Premium and Discount – Meaning, Calculation, and Example