What do we mean by a Forward Interest Rate?

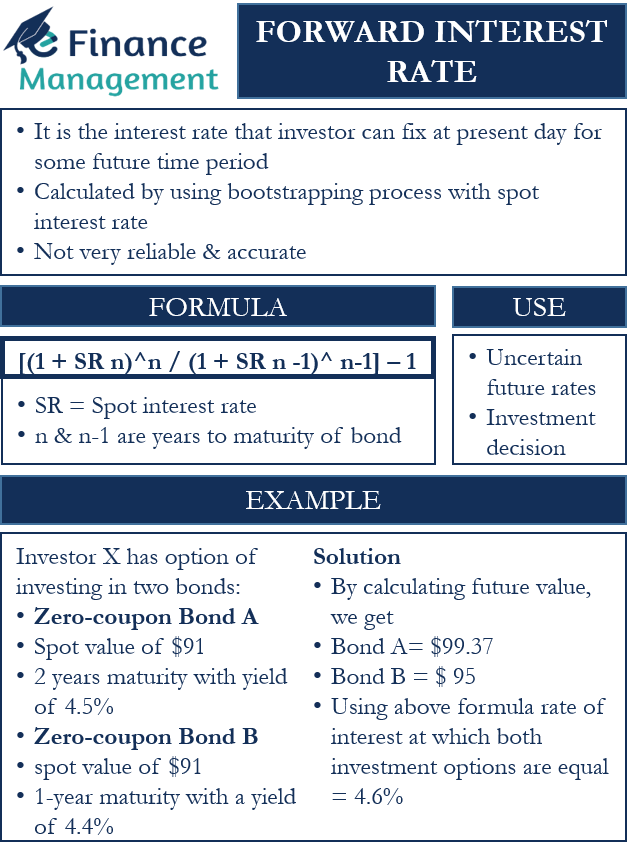

Forward interest rate is the interest rate that an investor can fix at the present day for some future time period. Investors use the process of “bootstrapping” to calculate these interest rates from the spot interest rates. In simple words, a party to a contract agrees to borrow or lend money from another party at the forward interest rate at a specific date in the future. Investors fix such rates with the help of derivative contracts, which act as a guarantee for the same.

A spot interest rate for “x” number of years until maturity is simply the expectation of interest for those x years or periods. It is the cumulative effect of forward rate for the first, second, and third-year until the x number of years of the contract. However, the interest rates are mere estimates for the corresponding periods and are not sure to compulsorily occur. Hence, they are not very reliable and accurate, especially if the time duration under consideration is quite long.

Why Do Investors Use the Forward Interest Rate?

As we all know, the rates of interest in the future are uncertain. They can rise, fall or even be the same as present time. Investors usually face the dilemma of investing in a bond with a fixed and long maturity period at the current rate or investing in a bond with a smaller maturity period and re-investing the proceeds at some forward interest rate, already fixed at the time of contract.

In the first case, the calculation is simple, and they have to simply agree to invest at a rate that the issuer is offering. However, the perception or belief of the investor may be that this current interest rate is likely to rise in the near future. In such a scenario, he may prefer to park his money for the short term at the current prevailing rate. And once the interest rates rise as per his predictions or belief, he would liquidate his current short-term investment. And re-invest the same at the higher rate of interest then.

Also Read: Spot and Forward Interest Rate

If the belief of the interest turns right, he stands to gain. However, this strategy also has a risk. What if the rates fall in the near future? The investor will stand to lose on his interest earnings. Because of the liquidation of his short-term investments, he will have to re-invest these funds at a lower rate. In such a situation and to avoid or mitigate such risks, this forward interest rate comes handy. These rates give a cushion against such a possible fall in the rate in the future.

Investors are assured of a fixed rate that they will earn on their investments in the future. They can plan their returns and their use well in advance. Also, it saves them from losses that they may suffer due to a possible fall in rates in the future.

How do we Calculate the Forward Interest Rate?

We can calculate the Forward interest rate from the spot rates. The formula for calculation is:

[(1 + SR n)^n / (1 + SR n -1)^ n-1] – 1

Here, SR = Spot interest rate, while n and n-1 are the years to maturity of the bond.

Read more on Spot and Forward Interest Rate

Example

Let us assume that investor X has the option of investing in two bonds. The first option is a zero-coupon Bond A with a spot value of $91 and 2 years maturity with a yield of 4.5%. The second option is a zero-coupon Bond B of the same spot value but 1-year maturity with a yield of 4.4%. What should be the forward interest rate for the second year to equalize the earnings in both options?

In order to find the interest rate that makes the earnings equal, let us first calculate the future value of the first option at the end of the maturity period of two years.

Also Read: Spot Interest Rate

FV a= $91 x (1+ 4.5)^2

= $99.37

Now, let us calculate the future value of Bond B at the end of the first year.

FV b= $91 x (1+4.4)

= $ 95

Using the above formula, we will find out the interest rate that makes both the investment options equal.

[$91 x (1+ 4.5)^2 / $91 x (1+4.4)^1] -1

= $99.37 / $95 – 1

= 4.6%

Therefore, 4.6% is the forward rate of interest that investor X should get at the maturity period of the first year to earn the same overall returns as bond A.

Scenario 2

Now, let us check our result with the help of an addition to the present example in hand. Investor X gets an option to re-invest his proceeds at the end of the first year at a forward rate of interest of 4.8%. Now he has to select the better option from the two that will maximize his returns.

The future value of bond A at the end of maturity period of two years =

FV a= $91 x (1+ 4.5)^2

= $99.37

Future value of Bond B at the end of the first year = $91 x (1+4.4)

= $ 95

Future value of Bond B at the end of the second year = $95 x (1+4.8)

= $ 99.56

Hence, we see that the future value of bond B at the end of the second year is higher than the future value of bond A at the end of the same time period. Therefore, investor X should go with the second option to maximize his returns. This confirms our answer in the first example that, tells us that 4.6% is the forward interest rate that will make both the investment options the same.

We can also use the above formula to find out the forward rate of interest at the end of a period x for any investment option that will give us better returns than others and maximize our earnings.

Summary

Forward rates of interest are the rates that tell us about the possible returns scenario in the future. Also, they provide an assurance for the interest rates that an investor should earn on his investment at a future date. Thus, in a way, they tell us in advance the likely return scenario in the future.

However, an investor should not blindly follow these rates as these are based on mere calculations and assumptions. They are only futuristic predictions based upon past trends and other economic factors. They can often go wrong in case of time periods extending several years or periods. Hence, they should use these rates just as a basis for reference and exercise their own judgment while choosing between alternate investment options and scenarios.

RELATED POSTS

- How is the Interest Rate related to the Required Rate of Return, Discount Rates, and Opportunity Cost?

- Interest Rate is a Sum of Real Risk-Free Rate and Compensation for 4 Types of Risks

- Forward Rate Agreement – Meaning, Features, Example, and More

- Forward Premium and Discount – Meaning, Calculation, and Example

- Types of Interest Rates

- Covered Interest Arbitrage – Meaning, Example, Drawbacks, and More