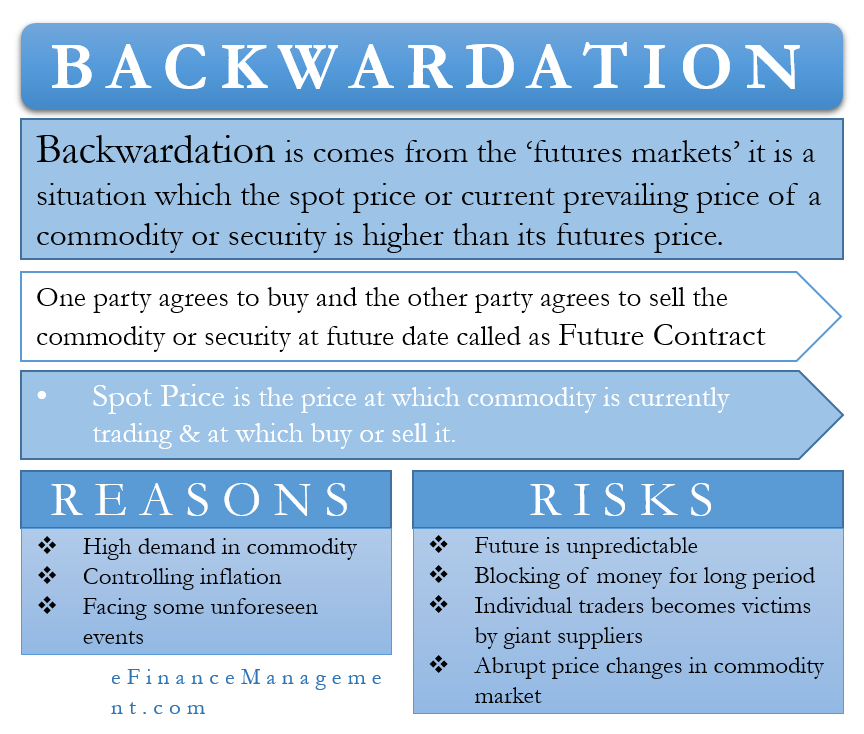

Backwardation is a situation in which the spot price or current prevailing price of a commodity or security is higher than its futures price. In other words, backwardation is when the forward price or futures contract price of the commodity is less than its current market price. Backwardation is a concept that comes from the futures markets. So, for a proper understanding of this concept, let’s first revisit and understand the world of futures contracts.

Futures Contracts

Simply put, a futures contract is an agreement in a futures market. Here one party agrees to buy, and the other party agrees to sell the commodity or security in the future. This contract specifies the future date and the price at which this contract can be executed. This price they set today will be the prevailing futures price of the commodity. So, basically, both the parties have set the date of the transaction, the price at which the transaction will take place, and also the quantity of the transaction. It’s just that the actual delivery of the commodity will take place in the future.

So, if a farmer agrees to sell XYZ corporation 50,000 kgs of wheat at $100 per ton 2 months from now, then the farmer and the corporation are entering into a futures contract. It’s just that these futures contracts trade on futures platforms/exchanges. Futures exchanges seek to standardize future transactions and provide a uniform platform to buyers and sellers.

Defining Spot Price and Backwardation

Now, the spot price of a commodity is the price at which a commodity is currently trading. It is the price at which you can buy or sell a commodity today. So, backwardation is a situation in which the spot price of a commodity is higher than its futures price. Once again, consider our farmer and XYZ corporation’s example. Suppose that the current price/spot price of a ton of wheat is $120. If the futures contract price of wheat is $80 per ton, this situation is called backwardation.

Also Read: Contango vs Backwardation

Reasons for Backwardation

So, what can be the possible reasons for this situation, wherein the current price is higher, but the future prices are lower? The common reasons when a situation like backwardation arises are:

- The commodity may be witnessing unusually high demand currently. Traders in the futures market may expect the demand to go down in the coming months. This can be due to seasonal factors. Demand for some commodities goes high during some seasons and then goes down again. When the demand goes down, prices will come down again.

- Another reason can be that the traders expect a glut of supply of the commodity in the coming months. For example, if the spot price of wheat is very high, it may happen that the government will import large quantities of wheat in the coming months to control inflation. With the import of wheat, its prices are bound to go down again.

- Due to some sudden unforeseen events, the supply of the commodity may become scarce. For example, a flood in major parts of the country destroying crops of this commodity will make the commodity scarce for the time being. As a result, the price of the commodity will go up or increase. With time, as more and more farmers grow their crops and harvest it after some months, the demand and supply will balance, and the prices will come down.

How do Traders Benefit out of this Situation?

So, we know that for some reason, the spot price of a commodity or an asset is high, and it is expected to go down in the coming months/years. Now, how do traders in the futures market use this situation to their advantage? It is simple for them. They sell the commodity in the futures market (at today’s futures price). And, in the coming months, when the price goes down, they purchase it at those lower prices to make the delivery. So, the farmer in our previous example will sell wheat to XYZ corporation at $100 per ton. After two months, when the price of wheat goes down to $80 per ton, he will purchase wheat from the market and make the delivery, making a profit of $20 per ton. This trading method is called ‘short-selling.’

Another way in which traders can use backwardation is when they see that the current fall in futures price is due to a short-term factor and that the prices will improve after some time. So, they can buy a security or commodity through a futures contract and wait for the spot prices to rise again. This technique is called taking a ‘long position’ in the futures market. The trader, in this case, is displaying a bullish sentiment on the security.

Risks in Backwardation

As is true in the case of other investments, backwardation comes with its own share of risks. When a trader uses backwardation to make capital gains, he may end up making capital losses. Following are the risks in both short selling and a long position in backwardation.

- We learnt that a trader could take a long position during backwardation if he expects the futures prices to increase. It may also happen that the futures prices continue to go down because of negative sentiment regarding that commodity among the traders or due to a recession in the market. So, the trader who purchases a commodity thinking its prices will go up in the futures market, may end up selling it at an even lower price.

- Another risk in holding a long position is the potential of locking your money for a long period of time. Here the investor may miss out on other highly promising alternative opportunities because he holds a long position in his current investment.

- It is common in the commodity markets to witness abrupt price changes. So, a trader may take a long position in the future of a commodity whose prices are rising. He expects that the prices will keep rising due to a shortage of supply. But the government may unexpectedly import a large quantity of that commodity. Now, the commodity is no more in short supply making the prices to crash.

- Similarly, a trader may short sell a commodity, thinking that the prices will go down in the future. He plans to purchase the commodity at those lower prices. But a sudden event such as a major flood can make the commodity in short supply, leading to a spike in prices. Here the trader will have to purchase at even higher prices to fulfill the contract.

- Many times, individual traders become a victim of manipulation by giant suppliers. These suppliers may artificially keep the prices high for their advantage. An individual investor or retailer may not now about these manipulations coming his way. He may, as a result, end up losing money, even after knowing the demand and supply equations.

- Another risk is when the trader knows the movement of the price in the future but cannot accurately predict the timing of the market. Now, futures contracts have a defined date for the fulfillment of the contract. So, a contract may expire before the favorable movement in prices is seen by the trader.

Continue reading – Contango vs. Backwardation.