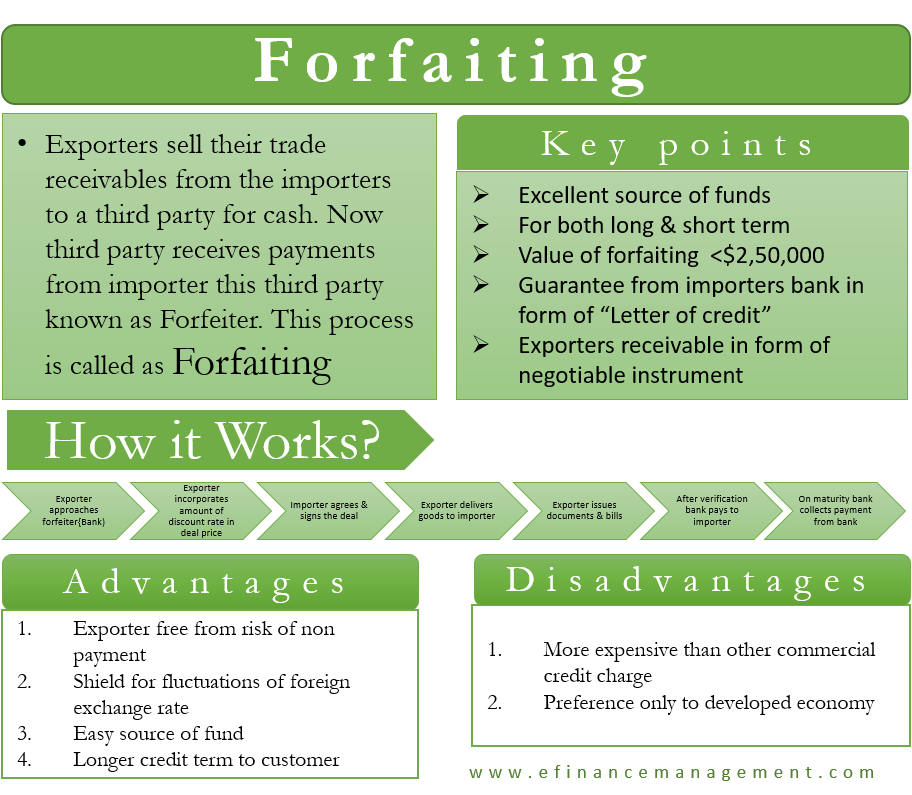

In forfaiting, exporters sell their trade receivables from the importers to a third party. This means that the exporters exchange their trade receivables with a third party for cash. Receiving payment from the importers then becomes the job of that third party who purchased the receivables. This third party is known as the forfeiter. Exporters use forfaiting as a source of finance.

In forfaiting, if the importer (who owes the money) does not pay the due amount and defaults, it is not the responsibility of the exporter. It is the liability of the forfaiter. Hence, in such transactions, the forfaiter is undertaking the risk of possible defaults by importers. Also, the forfaiter will chase the money from importers and have to take the pains of collecting money from importers. Hence, of course, the forfaiter does so for a margin or a service fee. They get this margin in the form of a discount rate. So, if a bill receivable is for an amount of $100 and the forfaiter’s discount rate is 8%, the forfaiter will purchase the bills receivable at a price of $92, and the $8 will be the forfaiter’s margin or service fee.

This forfaiting is usually done by banking and financial institutions that specialize in import-export financing.

Key Points

- Forfaiting is an excellent source of funds for exporters. They can get 100% instant financing of the value of the contract/bills receivables.

- Forfaiters finance medium and long-term bills receivables. So, the credit period can be between six months to seven years. Most of them fall between a period of one to three years.

- Forfaiters usually do not take contracts valuing less than $2,50,000.

- In most cases, the forfeiters seek a guarantee from the importer’s bank. Such a guarantee is provided by the Importer’s bank in the form of a letter of credit.

- The exporter’s receivables are usually in the form of negotiable instruments which are legally enforceable. Thus, the forfaiting companies also cover up their risks.

- Forfaiting companies can finance the project in any of the major currencies.

How Forfaiting Works

- The exporting firm approaches a forfaiter (say, a bank) before agreeing to a deal with the importer.

- Once the bank agrees to finance the deal and sets a discount rate to finance the project, the exporters usually incorporate the amount of discount rate in the deal price.

- Once the importer agrees to the terms and signs the deal, the exporter gets a commitment from the bank.

- The exporter then delivers the goods to the importer as per the terms of the contract.

- After this, the exporter produces the necessary documents, including bills receivables, before the bank.

- Upon verification, the bank discounts the trade receivable and pays the exporter.

- Upon maturity of the trade receivable, the bank collects the payment from the importer.

The forfaiters today, however, engage for more than just purchasing the bill. They help structure the deals, the credit terms, the guarantees sought, and decide the pricing structure. So, the forfaiter’s role can start much before the exporter needs finance.

Risks in Forfaiting

First is the transaction risk, which arises to the forfaiter. Since the exporter is not liable if the importer defaults, the forfaiter runs the risk of making heavy losses if the importing firm goes bankrupt. Hence, it is important for forfaiters to determine the paying capacity of the importer. They do so by looking at typical financial indicators like total assets owned by the importer, total debt and other liabilities, credit score, etc. Another way of taking care of this risk is by seeking a letter of credit from the importer’s domestic bank.

Also Read: Time Draft

Other risks arise from political factors such as the non-availability of foreign exchange with the importers’ country or if the importer’s country gets into a war with some country. Both these factors are risky and inflict huge damage to the forfaiter’s liquidity and profitability.

Advantages of Forfaiting for Exporter:

- Forfaiting sets the exporter free from the risk of non-payment by the importer. It becomes the bank’s (forefaiter’s) headache to collect the payments. The exporting firm can concentrate its energies on growing the business rather than chasing dues.

- Forfaiting also shields the exporter from the adverse risk arising due to foreign exchange rate fluctuations. This risk arises when the deal is signed in the domestic currency of the importer. So, no matter what the prevailing foreign exchange rate of the importer’s domestic currency is, he will pay the exact amount only. Now, if the importer’s currency depreciates, the same amount will convert to a lesser sum in the exporter’s currency. This can possibly result in losses for the exporter. But forfaiting absolves the exporter from this risk.

- Forfaiting makes for an easy source of funds for exporters. Payments involved in cross-border transactions are usually large, and goods are generally sold on credit terms. So, a new firm entering the exporting business may not have the quantum of funds to sustain its business. Forfaiting, on the other hand, provides such businesses with financial support to continue their business.

- Forfaiting helps exporters to offer longer credit terms to their foreign customers. This helps the exporter to get more and more customers on board while maintaining a steady flow of funds. The profits made by selling to an additional customer because of longer credit terms can largely compensate for the discounting charges.

Limitations

- Though forfaiting protects the exporter from many of the risks, forfaiters charge considerably for undertaking this risk. This charge, or service fee, is higher than other commercial credit charges. This translates into higher costs for the exporter. Usually, the exporter tries to push these costs into the deal price, but there will be a limit to that. Hence, forfaiting may help exporters grow their top line, but the bottom line may not grow proportionately.

- Another limitation arises from the fact that forfaiters typically choose to finance only those projects which come from major developed economies. They do so to save themselves from the risk of non-availability of foreign exchange with the developing countries. Additionally, only those currencies are taken into forfaiting, with high international liquidity. These factors limit the exporters ability to enjoy the services of such institutions.