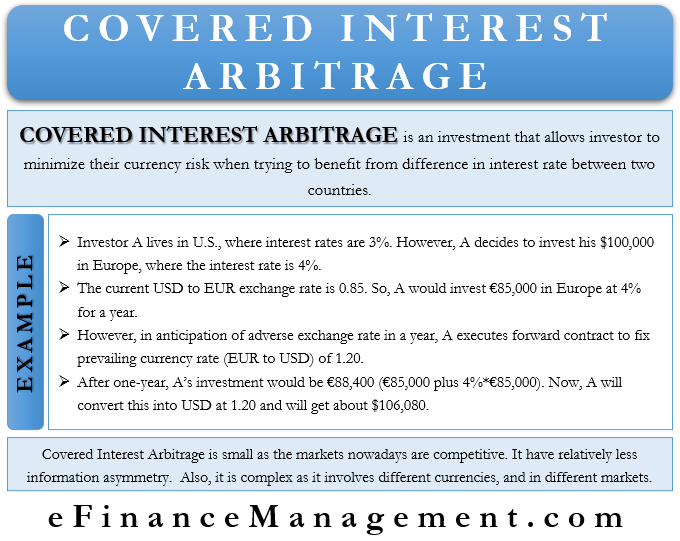

Covered interest arbitrage is an investment that allows an investor to minimize their currency risk when trying to benefit from the difference in the interest rate between two countries. Such a strategy involves the use of a forward contract along with interest arbitrage. It is a type of currency arbitrage.

Why Covered Interest Arbitrage?

Before we explain this arbitrage, we need to know what interest arbitrage is. Different countries have different rates (both deposit and lending). For example, in the U.S., the rate could be around 0.25%, while in the U.K., the rate could be at 0.1%. An investor can make a risk-free profit by using these different interest rates or by borrowing from a low-interest country and investing in the country offering a higher rate. This is interest arbitrage.

Element of Risk

Though it appears to be a risk-free strategy, it does involve current currency risk or the fluctuation risk in the currency due to the time gap in execution and maturity. This is because to invest in another country, the investor had to first convert their currency into a foreign currency. And, then after the maturity of the investment, convert the investment back into the local currency. Since the exchange rate is always changing, this makes the investment subject to exchange rate risk that may become unfavorable at that moment of conversion or maturity.

So, it is possible that the movement in the exchange rate nullify the gain that an investor makes from the interest arbitrage. To minimize this currency risk, the investor can make use of covered interest arbitrage.

Covered Interest Arbitrage Example

To minimize this currency risk in a covered interest arbitrage, an investor executes a usual interest arbitrage and buys a forward contract. The expiry date of the forward contract should be similar to the maturity of the foreign investment. Thus, the forward contract helps the investor to lock in the currency rate and, in turn, nullify the exchange rate.

Of course, with a nominal premium cost for the forward contract.

Let us try to understand the concept better by an example.

Assume investor A lives in the U.S., where the interest rates are at 3%. However, A decides to invest his $100,000 in Europe, where the interest rate is 4%. The current USD to EUR exchange rate is 0.86. So, A would invest €86,000 in Europe at 4% for a year.

A, however, is concerned that the exchange rate after one year may not be favorable, resulting in losses for him. So, to nullify the currency risk, A executes a forward contract to fix the prevailing currency rate (EUR to USD) of 1.20.

Result of the Transaction

After one year, A’s investment would be €89,440 (€86,000 plus 4%*€86,000). Now, A will convert this into USD at 1.20 and will get about $107,328. Had A invested in the U.S., his investment value after one year (at 3%) would be $103,000.

Also Read: Money Market Hedge – How to Implement?

So, by using the covered interest arbitrage, A was not only able to avoid the currency risk but also made a net profit of about $4,328.

Impact of Arbitrage Cost

A point to note is that such a strategy is only successful if the cost of the forward contract is less than the profit that an investor earns from the interest arbitrage. Suppose, in the above example, the cost of hedging the currency risk is $4,500.

In this case, A would have earned more by investing in the U.S. only. The total profit for A by investing in Europe would be ($107,328 less $4,500) $102,828. This is less than what he would have made by investing in the U.S. ($103,000). Another way investor A could benefit is by borrowing in the U.S. and then investing in Europe. This way, A won’t have to use his capital. He can borrow at 3% and invest it to earn 4%. However, this strategy would only be profitable if the cost of arbitrage is less than the net profit he will earn from the interest arbitrage.

Drawbacks

Usually, the return on covered interest rate arbitrage is small as the markets nowadays are competitive or have relatively less information asymmetry. For instance, the opportunity of covered interest arbitrage was more between GBP and USD at the time of the gold standard era. This is because information flows were slower then.

Another shortcoming of this strategy is that it is complex as it involves entering simultaneous transactions in different currencies and in different markets (spot and forward market).

Though the gains are small in percentage terms, the overall gains are massive as the investment generally runs into millions. However, these arbitrage opportunities are rare. Once market participants identify any arbitrage opportunity, they will move quickly to exploit it. This sudden increase in demand will quickly balance any imbalance or eliminate arbitrage opportunities.

Uncovered Interest Arbitrage

An uncovered interest arbitrage is the same as the covered interest arbitrage but without the forward contract. In uncovered interest arbitrage also, an investor invests in a foreign country offering more interest rates. However, the investor does not cover the foreign exchange risk with a forward or futures contract. So, the risk (currency risk) is more in this type of arbitrage.

Final Words

Covered interest arbitrage may look complex, but it is a pretty effective strategy. It is a low-risk strategy, but investors may find it challenging to make a big profit from it. So, this strategy doesn’t reap big benefits unless an investor buys and sells in bulk. This, however, exposes the investor to even more risk. Despite this, such a strategy is very popular among investors.