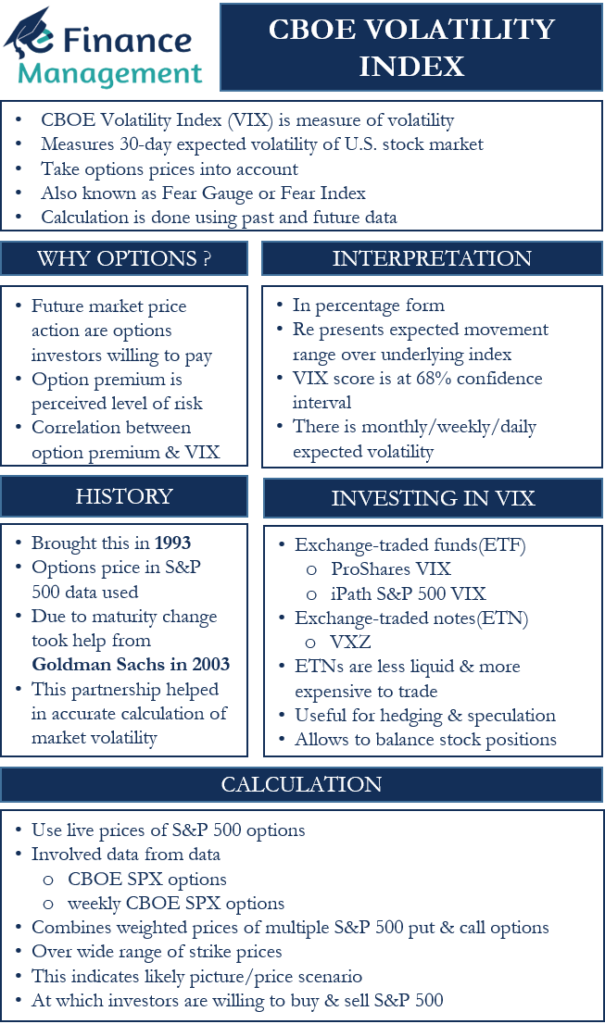

CBOE Volatility Index, or just VIX, is the measure of volatility or a real-time volatility index. It basically measures the 30-day expected volatility of the U.S. stock market. This index considers the options prices on the S&P 500 Index, which is a significant indicator of the broad stock market in the U.S. Now, this index is available for other countries, including India.

Volatility, in simple words, means the magnitude of the price changes in a period of time. The more the price change, the more volatility is. So, it will not be wrong to say that the VIX indicates uncertainty in the market. “Fear Gauge” or “Fear Index” are other names for this index.

Calculation of volatility can happen in two ways. One uses the past data, and the other uses the future. As we discussed initially, this index is based on the S&P 500 Index. Hence, to calculate this CBOE Volatility Index, one needs to aggregate the weighted prices of all the calls and put options prevailing on the S&P 500. So, we can say that this Volatility Index is forward-looking because it considers future market price action to predict the variability.

Why Options?

A point to note is that when looking at the future market price action, we are actually looking at the premiums that the options investors are willing to pay. The option premium is a good representation of the perceived level of risk in the market. The rule of thumb is that the more the risk, the more premium people are willing to pay for options. On the other hand, if the options premiums drop, the VIX also goes down. Therefore, there exists a direct correlation between the option premium and VIX.

When investors expect big price movement in the stock prices, they resort to options to hedge their positions. Such sentiments result in an aggregate jump in the option prices, reflecting the greater uncertainty or volatility in the market. This, in turn, results in a rise in the VIX, suggesting more chances of volatility rising in the market.

History of VIX

The CBOE first came up with this index in 1993. At the time, the index used data from the options price in S&P 500. But, in 2003, due to the changing maturity in the derivatives market, the CBOE asked for help from Goldman Sachs to better the index score. Such a partnership is helping to further accurate the calculation of the future market volatility.

On the basis of the past VIX scores, we can say that when the VIX goes below 20%, it indicates a relatively moderate but healthy risk market. And, if the VIX score is more than 20%, it indicates rising uncertainty and fear in the market and a higher-risk scenario.

For instance, at the time of the 2008 Financial Crisis, the VIX score was more than 50%. It suggests that option traders were expecting massive swings (more than 50%) in the stock prices. Moreover, the VIX score was over 85% at one point of time during the crisis.

We may also need to keep in mind that the VIX score may reach extreme levels during crises. But, such an extreme level of the score may not sustain for a long time. Because understanding and appreciating the swing and moves in the market, the traders will take swift action to reduce their exposure depending upon the market conditions. Such corrective action helps to reduce the fear and uncertainty in the market, and so does the VIX.

Calculating CBOE Volatility Index

The CBOE uses live prices of S&P 500 options to come up with real-time VIX scores. The calculation involves the data from the CBOE SPX options and weekly CBOE SPX options. The former has an expiry on the third Friday of every month, while the expiry for the latter is every Friday. For an option to be considered for the VIX calculation, it needs to have an expiry between 23 and 37 days.

The VIX calculation involves very complex mathematics, so we will not go into that. But one needs to understand the concept behind the calculation. Its calculation combines the weighted prices of multiple S&P 500 put and call options over a wide range of strike prices. This will indicate the likely picture or the price scenario at which the investors are willing to buy and sell the S&P 500.

Also, the options that go into the calculation of the VIX should be at the money. This shows the overall market perception of the strike prices that would hit before the expiry. And in turn, this indicates the market sentiments regarding the direction of the market price (sentiment analysis).

Interpreting CBOE Volatility Index

The VIX score is always shown in a percentage form and represents the expected movement range over the period for the underlying index. And the reason why the score is in percentage form is that volatility considers the movement in the stock price and not the price itself. So, when you trade volatility, your concern is not the direction of the price but rather how much (and how frequently) the price is changing. This is why the VIX score is in percentage form.

Moreover, the VIX score is at a 68% confidence interval. For example, suppose the VIX is 19%. This suggests that the annual movement (up and down) in the S&P 500 should not exceed 19% within the next year. And, the chances that such an assumption or interpretation is valid or accurate are 68%.

We can use the annual volatility number of the CBOE to come up with the monthly, weekly, or daily expected volatility.

Investing in CBOE Volatility Index

Several securities that depend on the VIX offer investors exposure to the CBOE Volatility Index. Moreover, investors can also trade VIX options and futures contracts.

Another much simpler way to invest in the VIX is through ETFs (exchange-traded funds) and ETNs (exchange-traded notes) that depend on the VIX futures. Since these two are exchange-traded securities, one can easily buy them like they buy shares.

One such popular ETF is the ProShares VIX Short-Term Futures ETF (VIXY). This ETF has a 30-day maturity. There are also ETFs that traders can use to speculate for up to six months in the future. For instance, the iPath S&P 500 VIX Mid-Term Futures ETN (VXZ) allows you to invest in the VIX futures with 4 to 7-month maturities.

There are, however, a few concerns when investing in these ETNs and ETFs. Some of these securities are not much liquid. ETNs specifically are less liquid and are more expensive to trade.

Despite these limitations, the VIX-linked instruments are popular among traders. And one major reason for this is their strong negative correlation with the stock market. This means the VIX would go up when there is a decline in the S&P 500 and vice versa. Such a feature makes these instruments useful for hedging and speculation. Also, taking a position on VIX allow traders to balance out their other stock positions.

For example, suppose you are bullish on one of the stocks that is part of the S&P 500. Though you are confident about its long-term prospects, you still plan to reduce your short-term exposure to that stock. For this, you initiate a buy position on the VIX, expecting the volatility to go up. This, in turn, helps you to balance out the positions. And, in case your expectations prove wrong, and volatility does not go up, you would incur losses on your VIX position but make gains on your initial position.

Long or Short on VIX

When you trade on the VIX, you have two basic positions to select: long or short as said above that, when trading volatility, you do not focus on the direction of the price movement but instead on the volume and frequency of the change.

So, your position on the VIX indicates your expectations of the volatility levels. For instance, those who go long on the VIX expect the volatility to rise. And, when a trader takes a short position on the VIX, it suggests that they are expecting the volatility to drop or the S&P 500 would rise.