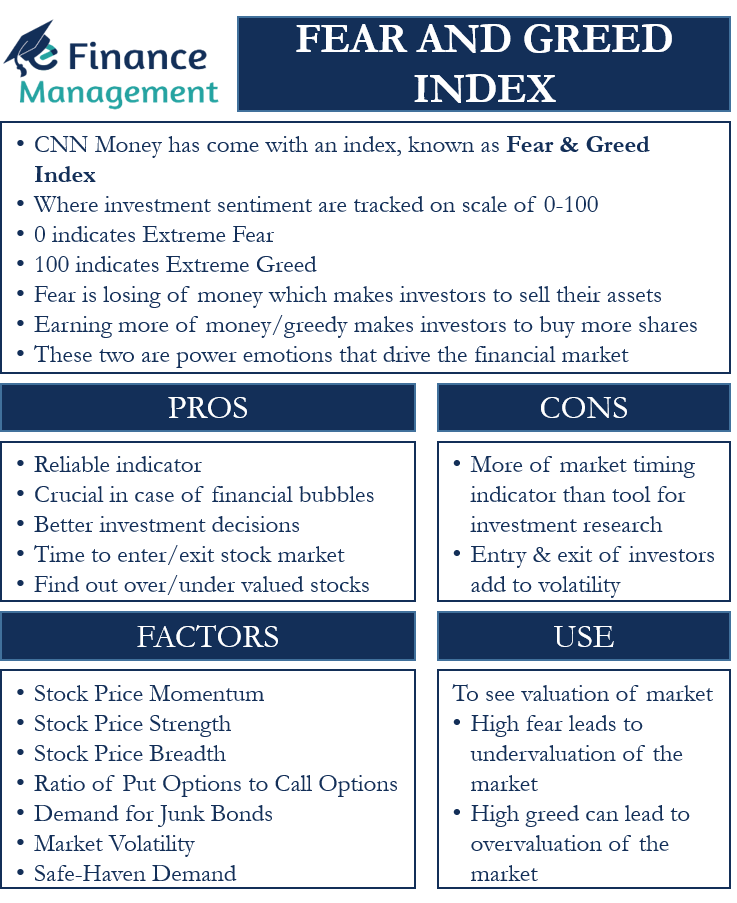

Two powerful emotions that guide the financial markets around the world are fear and greed. When more investors fear that they may lose the money, then they start to sell their assets. And, when they believe they could earn more, or get greedy, then they buy more shares. Thus, if one knows where the sentiments of most investors are shifting, they could make better decisions (sentiment analysis). But one can not quantify these two emotions. CNN Money, however, has come up with an index to quantify these two powerful emotions, and this is the Fear and Greed Index.

CNN Money publishes this index daily. Also, it maintains the weekly, monthly and annual indexes. This index tracks the above two sentiments of the investors across the entire stock market at any given point. The index tracks the investor sentiments on a scale of 0 to 100, with zero being “Extreme Fear” and 100 being “Extreme Greed.” An index score of around 50 suggests neutral emotions.

On paper, when this index nears zero, it means that investors are selling heavily and are undervaluing the stock market. And, if the index moves towards 100, it suggests that investors are buying heavily, and the market could be overvalued.

Similar to the stock market, there is a Fear and Greed Index for cryptocurrencies as well. This index, however, is presently for Bitcoin only.

Fear and Greed Index – Pros and Cons

Below are the pros of the Fear and Greed Index:

- This index is a reliable indicator of the shift in the investors’ sentiments and could prove extremely crucial in case of financial bubbles. For example, the Dot Com bubble was primarily driven by investors’ greed to get more money from internet stocks.

- One can use the index score to make better investment decisions.

- It helps determine investors’ moods and market trends at any given point in time. And thus, it suggests the right time to enter or exit the stock market.

- It also helps to find out whether over or undervalued stocks.

Below are the cons of the Fear and Greed Index:

- This index is more of an indicator of market timing than a tool for investment research.

- It may encourage investors to move in and out of the stock market and thus, may add to the volatility.

Calculating Fear and Greed Index

This index depends on seven factors that together determine the final score of the index. These seven factors are:

Stock Price Momentum

It considers the Standard & Poor’s 500 Index and compares it to its 125-day moving average. If the index’s performance is more than the average, it suggests a bullish scenario or greed. And, if the index performs below average, then it indicates that the investors are fearful or the market is going through a bearish tendency.

Stock Price Strength

For this purpose, it considers the stock price movements at the NYSE (New York Stock Exchange). It basically considers the number of stocks hitting the 52-week high and the number of stocks hitting the 52-week lows. If more numbers of companies are hitting a 52-week high, it indicates a bullish market or greed. And similarly, if more number of stocks are hitting 52-week lows, then it indicates a bearish market or fear.

Stock Price Breadth

It considers the volume of stocks that trade on the NYSE. Or, we can say, it compares the volume of stocks whose prices are rising and the volume of stocks whose prices are dropping. So, in a way, it takes into account the activity, as well as the behavior of the market. The market is greedy if there is more trading of the price-positive shares. And, the market is fearful if there is more trading of the price-negative stocks.

Ratio of Put Options to Call Options

This compares the number of call options and the number of put options that traders buy. Call options suggest a bullish position as investors expect the prices to move up. So, this indicates greed on the part of the traders. On the other hand, put options suggest a bearish outlook as investors expect the prices to drop. So this indicates the fear among the traders regarding the prices of securities.

Demand for Junk Bonds

This factor considers the spread between the yields of investment-grade and junk bonds. If the spread is less, it suggests a preference towards high-risk, high-reward junk bonds and in turn, greed in the market. And, if the spread is wider, it means investors prefer less risk and avoid junk bonds. So, this indicates fear and the bear market.

Also Read: High Low Index or Breadth Indicator

Market Volatility

The most popular and widely considered index for volatility is the CBOE Volatility Index or VIX. It considers the 30-day expected or forward-looking volatility based on S&P 500 options. However, CNN uses a 50-day moving average for the Fear and Greed Index. The more volatility, the more is the fear among the traders. And, if the volatility is less, it indicates more greed.

Safe-Haven Demand

This factor considers the stock returns and the return of the Treasury bonds of the past 20 days. If the stock prices go down, then investors usually go towards buying Treasury bonds. This suggests a fear among the traders that the stock prices would drop. And, if the stock market returns are more than the Treasury bonds, then it suggests greed.

Fear and Greed Index – How to Use

The best way to use this index is to see it as an indicator of when the market is over or undervalued. Generally, fear can lead to a stock market crash, while greed could lead to rallies.

At times of high fear, investors start to pull money out of the stock market and sell assets at less than normal prices. Such a situation could result in the undervaluation of the stock prices and the market. For the long-term investors, this could be a good time to invest the money as the prices are low with potential for upward movement.

On the other hand, more investors enter the stock market at a time of high greed. In the hope to earn more returns, investors buy shares at higher-than-normal prices. This results in the overvaluation of the market. Therefore, such a scenario is considered bad from an investment perspective. And analysts advise the investors to refrain from making further investments or entering the market.

For example, Mr. A is planning to invest in the stock market, and his advisor also recommends investing now. However, Mr. A plans to base his decision on the Fear and Greed Index, which is presently on 90. A score of 90 means extreme greed. Thus, it suggests overvaluation in the market, and so Mr. A should not deploy his capital now. Instead, he should wait for a correction at the current level before entry.

History also shows that the Fear and Greed Index has made accurate predictions about the equity markets. For instance, the index sank to a score of just 12 on September 17, 2008. At the time, the S&P 500 fell to record lows following the Lehman Brothers bankruptcy. And in September 2012, the index was up to over 90 when there was a rally in global equities following the quantitative easing from the Federal Reserve.

Final Words

Since the Fear and Greed Index gives importance to the share prices and trading volume, it is more of a technical analysis than fundamental analysis. So, it is recommended that investors should use this index to guide them on their market timing, i.e., when to buy or sell shares.

RELATED POSTS

- CBOE Volatility Index – Meaning, Calculation, and Interpretation

- Market Momentum – Meaning, Indicators, and Use

- Trend Analysis – What It Means, Uses, Types And More

- Greater Fool Theory – Meaning, Examples, and More

- Paasche Index – Meaning, Benefits, Example, and Calculation

- Bullish And Bearish – Meaning, Relevance And More