When it comes to assessing the financial markets and individual securities, analysts or investors refer to fundamental and technical analysis. Both techniques help with research and predict future share prices. Although the goals of both techniques are the same, their methods differ from each other. To understand both techniques, it is very important that we know the differences between fundamental vs technical analysis.

The primary difference between fundamental vs technical analysis is that the former analyzes the stock on the basis of its fair value. At the same time, the latter predicts future price performance on the basis of charts and trends.

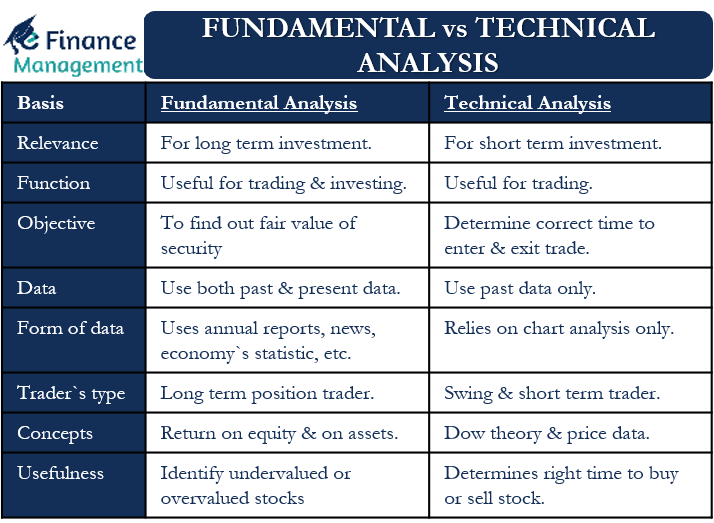

Other differences between the fundamental vs technical analysis are listed below:

Fundamental vs. Technical Analysis – Differences

Here are the differences between the fundamental vs technical analysis:

Relevant For

Analysts generally use technical analysis to predict the short-term price movement of stocks and are therefore suitable for short-term investments. In contrast, fundamental analysis helps determine the fair value of a stock and is therefore suitable for long-term investments.

Function

Since the technical analysis is short-term, we can say that it is generally useful for trade, but on the other hand, the fundamental analysis is useful for investing, as well as for trading.

Also Read: Technical Analysis

Objective

The primary objective of technical analysis is to help investors determine the right time to enter and exit a position. In contrast, fundamental analysis helps determine the fair value of a security.

Data

Fundamental analysis is based on all the information available about a company, including past reports, statistics, and more. Technical analysis is based on past prices and market trends. So we can say that Fundamental Analysis uses both past and present data, while Technical Analysis is based solely on past data.

Form of Data

The fundamental analysis is based on annual reports, news, economic statistics, and industry data, while technical analysis is based exclusively on charts, trade volumes, and trend analysis.

Future Prices

One can use fundamental analysis to predict the future prices on the basis of past and present performance, as well as the company’s future earnings visibility. On the other hand, technical analysis uses charts and indicators to forecast prices.

Also Read: Fundamental Analysis

Type of Trader

Usually, a trader taking up a long-term position uses fundamental analysis. On the other hand, swing traders and short-term day traders use technical analysis.

Factor for Buying Stock

In fundamental analysis, the trigger for the investor is to wait and invest when the stock/security prices are below their intrinsic value. In technical analysis, an investor buys a stock if he believes that the stock is in the uptrend, so he can make quick profits by selling at higher prices. Similarly, as per the technical analysis, if the stock is in a downtrend, then the trader will sell the stock and earn by buying it back at lower prices. So the key difference is that in fundamental analysis, the buying happens with a higher target. However, a trader can trade in both situations through technical analysis, whether the market is going upward or downward.

Finding Trend

An analyst or investor does not focus on the past share price or price fluctuations in fundamental analysis. On the other hand, technical analysis assumes that past trends will be repeated and that the current price movement can help predict future prices.

Concepts

The fundamental analysis primarily relies on the return on equity and return on assets. The capacity and opportunity available to the company to ramp up its revenue, profits, and returns are the key factors for fundamental analysis. Technical analysis, in contrast, relies on Dow Theory, price data, volume, and trends.

Assumptions

Fundamental analysis is not based on too many assumptions. On the other hand, the technical analysis makes many assumptions, including the key one that says prices will follow a similar trend.

Usefulness

Fundamental analysis helps analysts and investors identify undervalued or overvalued stocks/securities. And thus to make an investment or be out of it whenever the analysis indicates so. The crux of the technical analysis is the timing of the trade, and it helps determine the right time to buy or sell a stock.

Fundamental vs Technical Analysis – Advantages and Disadvantages

Fundamental Analysis

The following are the advantages of the fundamental analysis:

- There is not much room for personal bias, as methods and approaches depend on financial data.

- It considers all factors to obtain fair value, including economic, demographic, technological, and consumer trends.

- It is a systematic approach to arrive at a fair value of security.

- As it deals with accounting and financial data, it provides a better understanding and confidence of the underlying security.

Following are the disadvantages of the fundamental analysis:

- It is very time-consuming because it depends on 360-degree analysis, including company, industry, and economy. And, of course, aggregation and analysis of these multiple and different data points call for a lot of tedious and hard work.

- When it comes to forecasting, assumptions play a crucial role in fundamental analysis. Therefore, it becomes important to consider the best and worst-case scenarios. Moreover, there always remain subjective influences as one also has to see the future prospects.

Technical Analysis

Here are the advantages of the Technical Analysis:

- It gives a good idea of the volume, supply, and demand in the market. Thus, it provides a lot of information about the mood and psychology of traders.

- It helps investors determine the right time to enter and exit the market.

- Since it assumes that current prices reflect all available information, it helps provide up-to-date information without much hard work, like in the case of fundamental analysis.

- It helps identify the pattern by which a purchase or sale decision can be made.

The following are the disadvantages of the technical analysis:

- If an analyst depends upon too many indicators, it may result in confusion.

- It does not consider the company’s underlying fundamentals. One needs to understand that ultimately, in the long run, the security or stock value has to relate to its performance and fundamental attributes.

- The technical analysis is too technical, and therefore laypeople cannot understand it.

Fundamental vs Technical Analysis – Which is Better?

The debate over which of the two is better has been going on for decades. But, a point that many veteran investors have come up with is that both have an equally important role to play. Moreover, the professionals have somehow reached a common point over the years and prefer fundamental analysis for making long-term investments. And similarly, for short-term trading and bets, they use technical analysis. Moreover, an investor can refer to technical analysis if he wants to get a picture of market sentiment. And, when it comes to determining undervalued or overvalued stocks, one has to stick to fundamental analysis.

In addition, investors can also combine the two approaches to plan their investments in the medium to long term. Another use of combining the two is using fundamental analysis to come up with an undervalued stock and then use technical analysis to know the right time to buy (and exit) that stock.

It is, therefore, better for an investor to use both approaches efficiently to manage his portfolio.

Frequently Asked Questions (FAQs)

Fundamental analysis uses both past and present data for analysis and future prospects for arriving at the intrinsic value, while technical analysis depends exclusively on past data.

Both fundamental analysis and technical analysis hold equal importance. Fundamental analysis helps determine whether the stock is undervalued or overvalued, and technical analysis determines the right time to buy or sell a stock.

In the case of fundamental analysis, investments are made if the share price is less than the intrinsic value. Whereas investors invest under technical analysis if there is a chance to sell the stock at higher prices. Or Sell the stocks in advance when there is a chance to buy them back at lower prices afterward.

RELATED POSTS

- Trend Analysis – What It Means, Uses, Types And More

- Market Momentum – Meaning, Indicators, and Use

- Top-down vs Bottom-up Investing: Meaning, Differences and More

- Equity Valuation Methods

- Sentiment Analysis – Meaning, Explanation, and Indicators

- Methods of Financial Statement Analysis – All You Need to Know