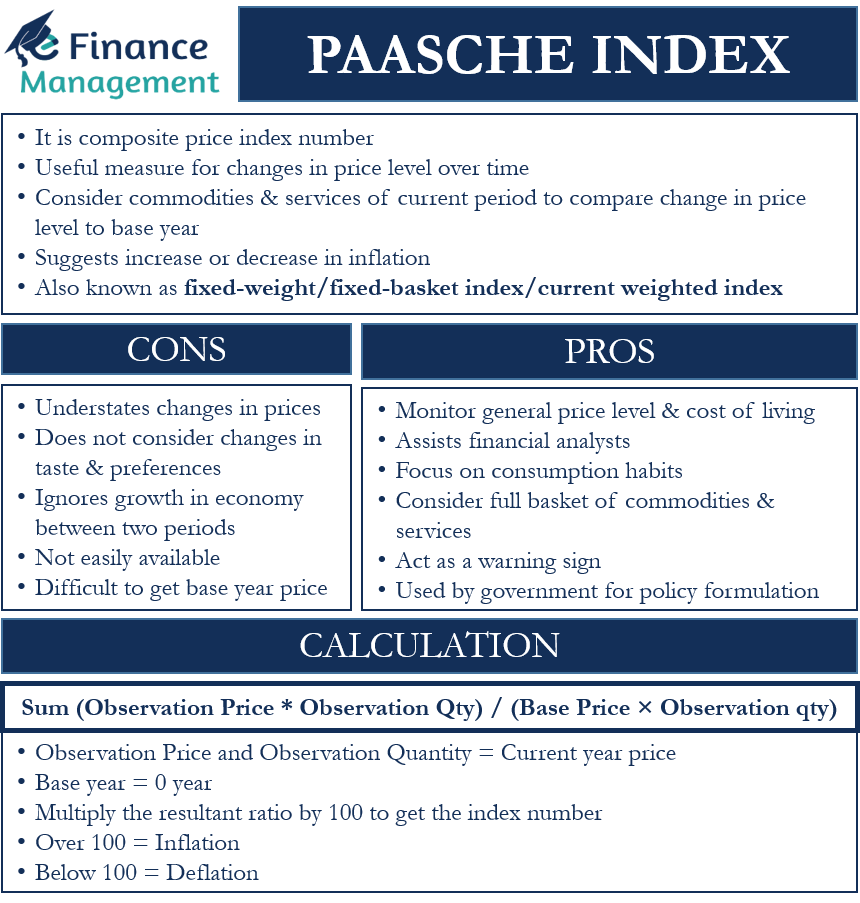

Paasche Index is a composite price index number that is a useful measure of the changes in the price level over time. It considers the basket of commodities and services of the current period to come up with the change in the price level vis-a-vis its base year.

In simple words, we can say the question it answers is how much the basket of commodities that one consumes in the current period or current year would have cost in the base period or base year. And thus, it suggests an increase or decrease in inflation and how much inflation has been there. In the mid-19th century, German statistician Paasche Hermann was the first to come up with this method for calculating the price level changes.

We also call this index a fixed-weight, or fixed-basket index, or current weighted index. This is because it uses the quantity (weights) of goods or services of the current period. This weight or quantity of current period comparison makes this index different than other such indexes, such as the Laspeyres price index. The Laspeyres index uses the weights of the base year and not of the current period.

To learn more about the differences between Laspeyres Index and Paasche Index, you can refer to our article: Laspeyres Vs. Paasche Index

Even though this index is simple to understand, it tends to understate the rise in prices. A major reason for this is that it reflects some of the changes in consumption patterns that consumers make because of the rise in prices.

Paasche Index – How to Calculate?

We use the weighted sum method to calculate the composite index number. Or, we can say, it is the ratio of the sum of prices of the commodities or services of the actual year or actual period to the sum of the prices of the same commodities or services in the base year. Moreover, these sums of the prices are weighted as per their respective quantities in the actual year or current period.

We multiply the resultant ratio by 100 to get the index number. While calculating, the base year or zero year index value is taken as 100. If the resultant number is over 100, then it represents inflation, and if the number is less than 100, then it represents a drop in price level or deflation.

Below is the formula to calculate the Paasche Index:

= Sum (Observation Price * Observation Qty) / (Base Price × Observation qty)

Observation Price and Observation Quantity is the price and quantity of the commodities in the current period or the period for which we need to calculate the index.

Base Price refers to the price in the year zero that is the base year for the same set of commodities.

Example

Following are the prices of commodities X, Y, and Z in Year 0: $20, $30, and $40, respectively. Following are the prices of commodities X, Y, and Z in Year 1: $50, $60, and $70, respectively. And following are the prices of commodities X, Y, and Z in Year 2: $80, $90, and $100, respectively.

Following are the quantities of commodities X, Y, and Z in Year 0: $20, $40, and $60, respectively. Following are the quantities of commodities X, Y, and Z in Year 1: $30, $50, and $70, respectively. And following are the quantities of commodities X, Y, and Z in Year 2: $40, $60, and $80, respectively. Year 0 will be the base year.

Now first, we will calculate the Paasche Index for Year 1.

Putting the values in the formula, we get = {($50*30) + ($60*50) + ($70*70)} / {($20*30) + ($30*50) + ($40*70)}

So, Paasche Index for Year 1 will be 191.84.

Now, we need to calculate the index value for Year 2.

Putting the values in the formula, we get = {($80*40) + ($90*60) + ($100*80)} / {($20*40) + ($30*60) + ($40*80)}

So, Paasche Index for Year 2 will be 255.17.

The above values suggest a rise in the prices in Year 1 and Year 2. This is because the value of the index rose from 100 in Year 0 to over 191 in Year 1 and then to over 255 in Year 2. So we can conclude that there is a rise of over 2.5 times in the prices of the commodities under observation from the base year to Year 2.

Advantages and Disadvantages of Paasche Index

These are the benefits of the Paasche Index:

- It helps monitor the general price level and the cost of living in an economy.

- It assists financial analysts in assessing the monetary development in an economy with regard to inflation.

- This index focuses on consumption habits as it considers the current level of available quantities.

- It takes into account the full basket of commodities and services. This is because it includes high and low-cost items.

- The authorities can use the index number as a warning sign for a significant change in the prices and cost of living.

- Government can use it to devise monetary and fiscal policies.

These are the drawbacks of the Paasche Index:

- It understates changes in prices because it captures the change in consumer behavior due to the rise in prices.

- This index does not consider the changes in taste and preferences of the consumers over the years and their impact on the index.

- It also ignores the growth in an economy between the two periods.

- This index uses the current data, but it may not always be easily available.

- Sometimes it isn’t easy to get the prices of a basket of commodities and services in past years or base year. This may be due to the non-existence of such products and services in the base year. Or it may be that the prices in the base year may be introductory prices.

Final Words

Paasche Index is a popular measure of inflation, as well as the changes in the price level in an economy. One big advantage of this index is that it considers consumption patterns as well as does not suffer from an upward price bias like the Laspeyres Price Index. However, it ignores the growth in the economy and may tend to understate things.