Equivalent Annual Cost: Meaning

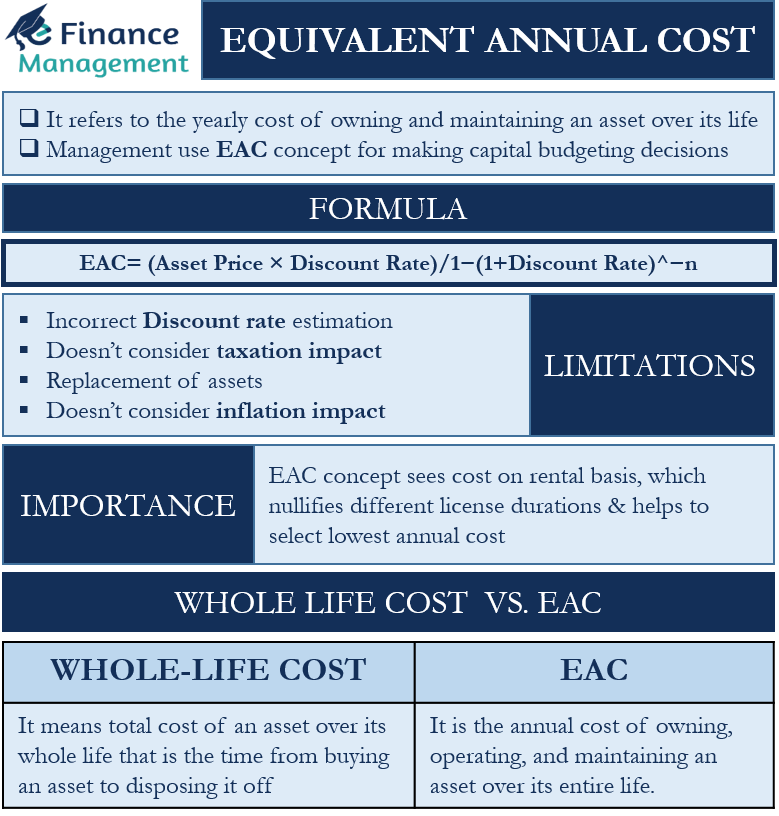

Equivalent Annual Cost (or EAC) refers to the yearly cost of owning and maintaining an asset over its life. It simply means the average annual cost of owning and maintaining the assets over their useful life. To get the EAC we need to divide the present value of the asset’s purchase price, operating cost, and maintenance cost (over its entire life) by the present value of the annuity factor.

Management uses the EAC concept for making capital budgeting decisions. Moreover, it allows entities to compare the cost-effectiveness of assets with varying useful life periods. Similarly, a company can use it to analyze projects of varying life spans.

Another use of the EAC concept is to find out if leasing or buying an asset will be a better option. Also, the EAC analysis assists in understanding the impact of maintenance costs on ownership of the asset. It also helps find out the cost of keeping existing equipment and cost savings requirements to buy a new asset.

Importance of Equivalent Annual Cost

To bring out the importance of EAC, let us consider an example. Suppose a company is considering two software for its operations. Both the software are very similar and work in the same way. But, their cost and license duration are different.

Assume Software A costs $10,000. It has a licensing period of 4 years and carries annual maintenance of $2,000. Similarly, Software B costs $8,000, has a licensing period of 3 years, and carries annual maintenance of $3,000.

Usually, if a company has to select one of the two, then it just needs to calculate the net present value (NPV) and choose the one with the lowest NPV. However, NPV method does not work in comparing projects with different durations. So taking a decision just based on NPV will not give the correct picture.

This is where EAC comes in. The EAC would help bring the cost of both software to an annual and comparable level. Or, we can say the EAC concept sees the cost on a rental basis, which nullifies the different license durations. And thus, we select the one with the lowest annual cost.

The formula for Equivalent Annual Cost

Calculating EAC is easy as it also involves finding the asset’s net present value. Since there is no cash inflow, the net present value will be negative. After getting the net present value (NPV), we need to switch it to annual terms. To convert it to annual terms, we need to treat the net present value as an ordinary annuity with a duration that equals the asset’s life. Therefore, for ascertaining EAC, the NPV of the asset needs to be divided by the present value (PV) of an annuity factor. Thus, the formula to calculate EAC is:

Also Read: Types of Costing

EAC= (Asset Price × Discount Rate)/1−(1+Discount Rate)^−n

To the above equation, we need to add the Annual Maintenance Cost of the asset to get the final EAC.

Equivalent Annual Cost Calculation

One needs to follow the below steps to come up with the Equivalent Annual Cost:

The first and foremost step is to decide or know the ownership price of the asset. Suppose a company is considering buying one of the two trucks – Truck A costs $100,000, and Truck B costs $130,000. These are the asset ownership price.

In the next step, we need to come up with the asset’s useful life. In the above example of trucks, suppose Truck A has a life of five years, and Truck B has a useful life of seven years. This is the number of periods or n.

While moving further we need a discount rate, that will be used for deriving the PV and NPV values. It means the cost of capital or the return that the capital is expected to earn annually. Assume a Discount Rate of 10% for the sake of simplicity.

Lastly, we need to ascertain the annual maintenance cost of the asset. Assume Truck A has an annual maintenance cost of $11,000, while the same cost for Truck B is $8,000.

Once we have all these values available, then we can move on to calculate the EAC by putting all these values in the formula. The calculation in the given example is as below:

EAC for Truck A = $100,000 * 10% / 1 – (1 + 10%) ^ -5 + $11,000 = $37,380

EAC for Truck B = $130,000 * 10% / 1 – (1 + 10%) ^ -7 + $8,000 = $34,702

Since Truck B has lower EAC, so management should prefer Truck B over Truck A.

Limitations of EAC

Following are the limitations of EAC:

- Estimating the discount rate is the biggest limitation of EAC. So, if the estimation is incorrect, we could get a misleading EAC. Thus, experts always recommend combining EAC analysis with other capital budgeting tools. The uncertainty and the chances of a wrong decision can be overcome by the use of other tools for more accurate estimates.

- The EAC analysis does not consider the impact of taxation. Though we can include tax cash flows, calculations would be more complex.

- This analysis assumes that a business can replace the existing asset with the same asset whenever they want. Such an assumption may not always hold because technology is constantly developing. So, we are more likely to get a better version of that asset in the future. Similarly, a business may not need the same over time because the needs of consumers are always changing.

- EAC analysis does not consider the impact of inflation on the cash flows and cost of capital.

How is it Different from Whole-life Cost?

Whole-life cost refers to the total cost of an asset over its whole life. The whole life here means the time from buying an asset to disposing of it. Another name for this is a “life-cycle” cost. Whole-life costs include purchase costs, designing and building expenses, installation expenses, operating and maintenance costs, depreciation, financing cost, and disposing expenses. Environmental and social costs are can also be taken into consideration/included for determining the Whole-life costs.

In contrast, EAC is the annual cost of owning, operating, and maintaining an asset over its entire life. These costs will have a lower value as compared to the Whole-life costs.

Final Words

Equivalent Annual Cost is a very useful concept as it assists managers in evaluating different options and selecting the best one. This, in turn, enables the entities to save money and boost their profit margins. However, managers must ensure they estimate the cost of capital correctly to get an accurate number. Moreover, managers must not solely depend on EAC and use other tools to support their decision.