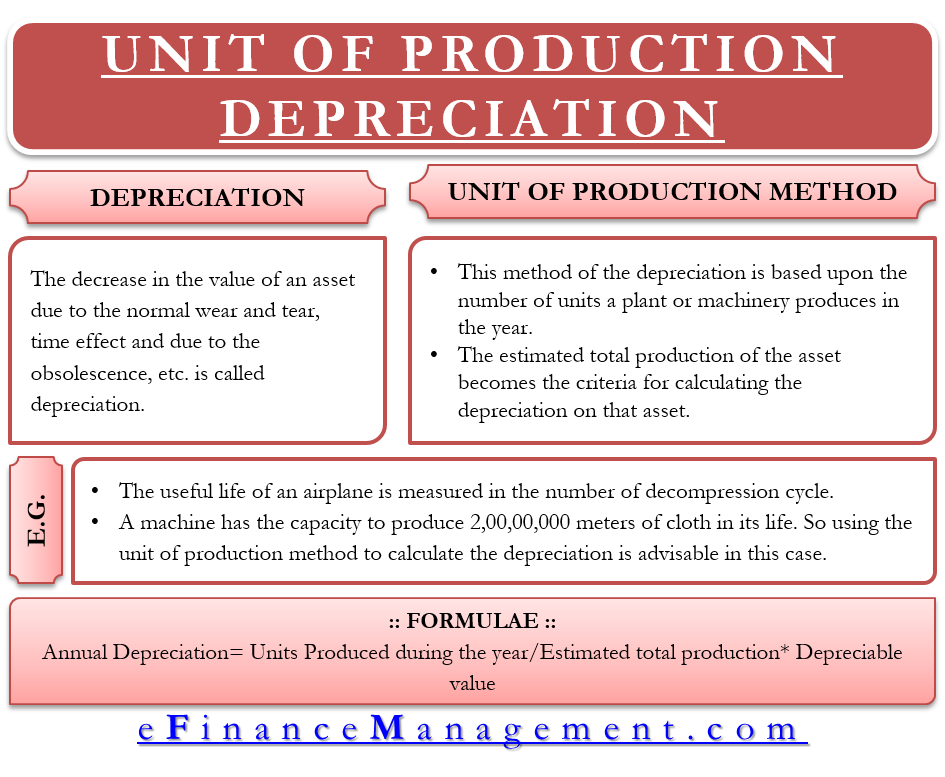

The decrease in the value of an asset due to normal wear and tear, time effect, obsolescence, etc., is called depreciation. Amortization is also a part of depreciation. The unit of production depreciation is a method to calculate the depreciation on an asset.

Unit of Production Method

The unit of production depreciation method is applicable in the case of assets like plants and machinery. Because, in the case of plants and machinery, the wear and tear will depend on their usage.

This method of depreciation is based upon the number of units a plant or machinery produces in the year. The estimated total production of the asset becomes the criteria for calculating the depreciation on that asset. This method is applicable where the value of an asset is closely related to the units it will produce.

Unlike the usual depreciation method, this method does not give importance to the age of the asset. Since the depreciation in this method is usage-based, therefore, in the year when production is high, the depreciation charge in that year will be high. Similarly, in the year when productivity is low, the depreciation charge in that year will be low. In this way, the plant which is running at its 40 percent capacity will generate 60 percent less depreciation charge.

Also Read: Units of Production Depreciation Calculator

The useful life of an airplane is measured in the number of decompression cycles, i.e., the number of take-offs and the number of times the plane is exposed to the pressure. Therefore, in this case, the unit of production method can be relevant to calculate the depreciation of the fuselage and cabin of the plane.

Similarly, a machine can produce 2,00,00,000 meters of cloth in its life. So using the unit of production method to calculate the depreciation is advisable in this case.

Unit of Production Method Depreciation-Calculation

To calculate the depreciation under the units of production method, we have to divide the asset’s depreciable value by the number of units it is estimated to produce in its lifetime. We then multiply the resultant number with the production of that year to get the depreciation for that particular year.

Formula

Annual Depreciation= Units Produced during the year/Estimated total production* Depreciable value

Where depreciable value is calculated by subtracting the salvage or scrap value from the original cost.

Depreciable value= original cost- salvage or scrap value

Example

A numerical example for a unit of production method

XYZ Ltd. purchases a piece of machinery for Rs. 3,00,000 on 1st April. The estimated useful life of the machinery is ten years, and the estimated scrap value is of Rs. 30,000. The company sells the asset at the scrap value at the end of the 10th year. The machine is expected to produce 20000 units during its life. The production pattern is as follows:

Also Read: Depreciation

| Year | Production |

| 1-3 | 3000 units per year |

| 4-7 | 2000 units per year |

| 8-10 | 1000 units per year |

Calculate the amount of depreciation. Pass the necessary journal entries.

Solution:

Calculation of Depreciation using Units of Production method

Depreciable Value= Original cost – Scrap value= 3,00,000-30000=2,70,000

Annual depreciation = Produced during the year/Estimated total production* Depreciable value

| Year | Annual Depreciation |

| 1-3 | 3000/20000*2,70,000=40500 |

| 4-7 | 2000/20000*2,70,000=27000 |

| 8-10 | 1000/20000*2,70,000=13500 |

You can also use the Units of Production Depreciation Calculator.

Accounting

To account for depreciation under this method, a company needs to go thru the three essential phases:

- As usual, like for any other means, make journal entries for the depreciation amount.

- Maintain records with complete details for each of the depreciable assets to determine the value and usage.

- Arrive at a depreciation rate or schedule based upon the expected usage.

Let’s see the journal entries for the above example.

Journal Entries in the books of XYZ Ltd.

| Date | Particular | Amount(Dr.) | Amount(Cr.) |

| 1st year | |||

| 01-Jan | Machinery A/c Dr. | 300000 | |

| To Cash A/c | 300000 | ||

| (being machinery purchased) | |||

| 1st -3rd year | |||

| 31-Dec | Depreciation on machinery A/c Dr. | 121500 | |

| To Machinery A/c | 121500 | ||

| (being Depreciation charged (40500*3)) | |||

| 31-Dec | Profit and loss A/c Dr. | 121500 | |

| To depreciation on machinery A/c | 121500 | ||

| (being depreciation on machinery transfer to profit and loss A/c) | |||

| 4th-7th years | |||

| 31-Dec | Depreciation on Machinery A/c Dr. | 108000 | |

| To Machinery A/c | 108000 | ||

| (being Depreciation charged (27000*4)) | |||

| 31-Dec | Profit and loss A/c Dr. | 108000 | |

| To depreciation on machinery A/c | 108000 | ||

| (being depreciation on machinery transfer to profit and loss A/c) | |||

| 8th-10th years | |||

| 31-Dec | Depreciation on Machinery A/c Dr. | 40500 | |

| To Machinery A/c | 40500 | ||

| (being Depreciation charged (13500*3)) | |||

| 31-Dec | Profit and loss A/c Dr. | 40500 | |

| To depreciation on machinery A/c | 40500 | ||

| (being depreciation on machinery transfer to profit and loss A/c) | |||

| 10th year | |||

| 31-Dec | Cash A/c Dr. | 30000 | |

| To Machinery A/c | 30000 | ||

| (being machine sold) | |||

| 31-Dec | Machinery A/c Dr. | 0 | |

| To Profit and loss A/c | |||

| (being no profit or no loss from sale) |

Machinery A/c of XYZ Ltd.

| Date | Particular | Amount | Date | Particular | Amount |

| Year 1-3 | Year 1-3 | ||||

| 01-Jan | To Cash A/c | 300000 | 31-Dec | By Depreciation A/c | 121500 |

| 31-Dec | By Balance c/d | 178500 | |||

| 300000 | 300000 | ||||

| Year 4-7 | Year 4-7 | ||||

| 01-Jan | To Balance b/d | 178500 | 31-Dec | By Depreciation A/c | 108000 |

| 31-Dec | By Balance c/d | 70500 | |||

| 178500 | 178500 | ||||

| Year 8-10 | Year 8-10 | ||||

| 01-Jan | To Balance b/d | 70500 | 31-Dec | By Depreciation A/c | 40500 |

| 10th year | 10th year | ||||

| 31-Dec | To Profit And Loss A/c | 0 | 31-Dec | By Cash A/c | 30000 |

| (no profit in sales) | (Sales) | ||||

| 70500 | 70500 |

When And When Not To Use?

Mainly manufacturing firms use this method as the depreciation amount is directly proportional to production. This method is relevant where one can carefully attribute the asset value to its contribution to producing several units. So, it is primarily suitable for charging Depreciation on Plant and Machinery.

A company must not use this method if there is no significant difference in the usage of assets from year to year. It would lead to a waste of time and resources in tracking asset usage. The result would be almost the same depreciation every year that one would have gotten by using the straight-line method.

If the management does not use the resulting information from this depreciation method in decision-making, then also it is better not to use it. This scenario will again result in unnecessary costs in tracking the usage of assets when management does not care much.

Also, one must not use this method if there are chances of an asset getting obsolete before its useful life due to technological advancements.

This method should not be used if there are chances of a machine sitting idle for some days in a year. For instance, a machine operates for 300 days and sits idle for the rest of 65 days that year. We need to calculate the depreciation for 300 days only in this case. It could complicate things.

Advantages of the Unit of Production Method

The following are the benefits of this method:

- It allows companies to take more depreciation at a time when the asset is more productive/ more used.

- This method also helps with tax deductions. More significant depreciation expense in productive years helps to offset higher costs and higher revenue in the year when the production is higher.

- This method also more accurately relates to the wear and tear of the asset.

- It helps a business track the profit and losses more accurately than other depreciation methods, such as MACRS.

- This method also helps to exploit the full value of assets. The depreciation starts when the asset begins to produce units. And ends when the asset equals its estimated production capacity or when its cost is fully recovered, whichever is first.

- It assists in determining the efficiency of assets.

- Depreciation is in-line with production and revenue.

Disadvantages of the Unit of Production Method

Following are the disadvantages of this depreciation method:

- This method only considers usage to calculate depreciation. But, in reality, several factors lower the value of assets over time.

- Often this method might not be practical. It is because, in the real world, a manufacturing company has several assets that help to make one product. So, keeping track of each asset is very difficult.

- This method may result in a different value (Depreciation and book value) of the two same assets. It, in turn, could lead to confusion.

- For tax purposes, the unit of production depreciation is not advisable.

- This method of depreciation is not usable in several scenarios (already discussed under ‘When and When Not to Use’).

- One can only use this method for manufacturing assets. We have to use other depreciation methods for other assets, such as buildings and furniture.

- This method may fail to give accurate depreciation value as it ignores the efflux of time.

- Not all businesses can use this method, such as trading companies, the service industry, etc. Only manufacturing companies can use this depreciation method.

Is It Better Than The MACRS Method?

Under MACRS (modified accelerated cost recovery system), we depreciate an asset on a declining balance for a set time. We then switch to a straight-line depreciation method for the rest of its useful life.

Even though units of production depreciation more closely align with the production, MACRS is the standard to calculate depreciation for tax purposes. The IRS (Internal Revenue Service) also requires businesses to use MACRS. However, the agency does allow companies to exclude property from MACRS if one can depreciate the asset accurately using another method.

To use the units of production depreciation in this case, the owner needs to exclude MACRS before the return due date. For more information on this, you can visit the IRS website.

Conclusion

In conclusion, this method is useful when the life of an asset is calculated in terms of the output (number of units the machine will produce), working hours (hours the machine will be of service), or mileage (used by the transport industry). But, it is hard to apply this method in real-life situations because the asset does not depreciate only based on production levels. Multiple factors lead to the depreciation of the asset. Therefore, charging depreciation only on the basis of production level will not be appropriate. Also, it is not easy to estimate the total number of units the particular asset will produce over its useful life.