What is Bankruptcy Fraud?

Bankruptcy gives a chance to an entity to start fresh or restructure its operations. But it is very important that an entity is honest and follows all the rules and regulations. If there are any dishonest dealings in the bankruptcy, it could lead to bankruptcy fraud.

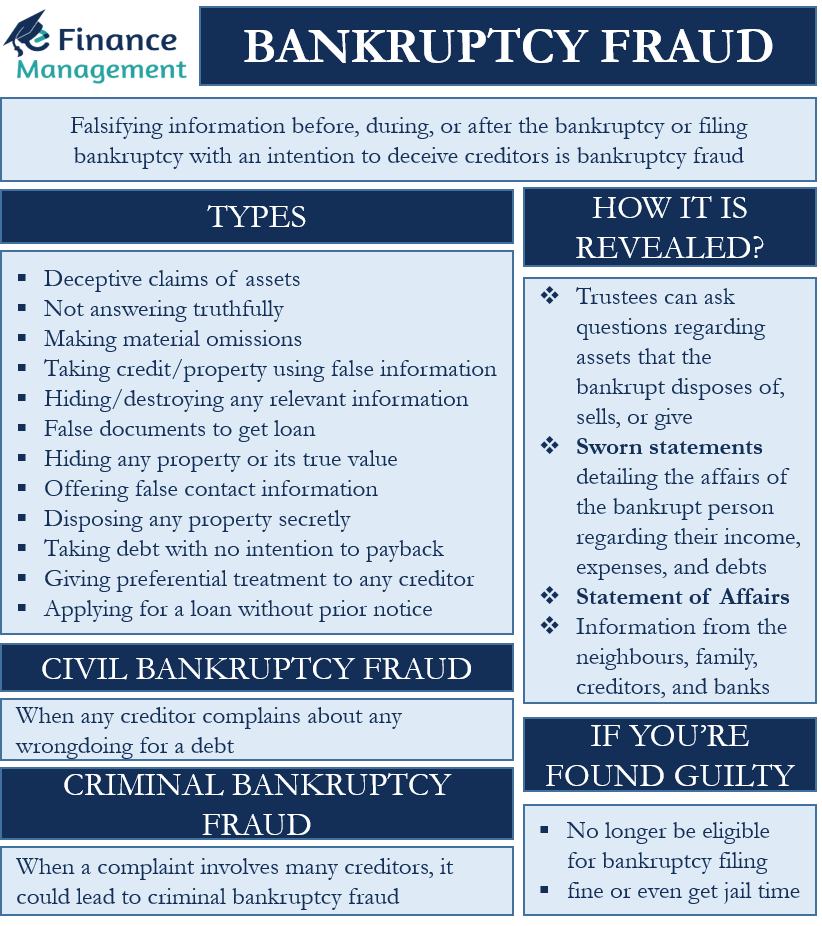

So, we can say that falsifying information before, during, or after the bankruptcy or filing bankruptcy to deceive creditors is what constitutes bankruptcy fraud. Such types of fraud are common in the U.S., and a significant portion of bankruptcy claims are fraudulent.

Types of Bankruptcy Fraud

There can be several types of bankruptcy fraud. However, most of these frauds have one thing in common: the lack of transparency in sharing information with creditors and/or trustees. Following are the some of the most common types of bankruptcy fraud:

- Making deceptive claims of the assets before or after the bankruptcy filing.

- Not answering truthfully the questions that can significantly impact the bankruptcy process.

- Giving false information or deliberately making material omissions about the bankruptcy.

- Deliberately hiding or destroying any relevant information or document after or within one year of the bankruptcy filing.

- Taking any credit or property using false information after or within one year from the date of bankruptcy.

- Drafting or coming up with false documents to get a loan or any valuable asset.

- Hiding any property you own or hiding the true value of the property.

- Deliberately offering false contact information.

- Disposing of any property secretly.

- Taking on debt with no intention to pay it back.

- Leaving the country with an amount that is more than what you are legally allowed to take.

- Giving preferential treatment to any creditor. If found of such treatment, the court can overturn any such treatment.

- Applying for a loan without prior notice to the relevant bankruptcy authorities.

Bankruptcy Fraud – How it is Revealed?

Several built-in checks help in identifying bankruptcy fraud. Trustee, for instance, asks for sworn statements detailing the affairs of the bankrupt person. These statements could be regarding their income, expenses, and debts. Moreover, trustees can ask questions regarding the assets that the bankrupt disposes of, sells, or give away.

Also Read: Bankruptcy

If the bankrupt person can answer all such questions completely and truthfully, then they could easily avoid bankruptcy fraud. An entity needs to give a document called a “Statement of Affairs” when they file for bankruptcy. It is crucial to provide all correct information in the statement to avoid bankruptcy fraud.

For instance, if one transfers any asset to a family member before filing bankruptcy, one must reveal the same to the trustee. The trustee will review the transfer to decide whether it was lawful or not. Even if a trustee decides that the transfer was not lawful, it will not constitute bankruptcy fraud. Instead, not revealing the transfer would be a fraud.

Another check on the fraud is the information from the neighbors, family, creditors, and banks. In case of bankruptcy, all stakeholders can share the information they have with the relevant authorities. They can even share the information on the website of the bankruptcy department.

What if One is Found Guilty of Bankruptcy Fraud?

Bankruptcy frauds are a serious crime; thus, entities must avoid it. If they are found guilty of fraud, there could be penalties. The penalties would vary case by case. For instance, the bankrupt person could be asked to return the profits from the fraudulent activities.

Also, if found guilty of fraud, the bankrupt entity may no longer be eligible for a bankruptcy filing and consequential benefits or rescue. Moreover, one may also face a fine or even get a jail sentence if found guilty.

On the other hand, if it is felt that the petitioner has committed any such fraud but is not yet charged, the debtor must immediately speak to his legal advisor. If one can prove that he did not do it intentionally, then the petitioner may not face any charges or face fewer penalties.

Civil and Criminal Bankruptcy Fraud

We can categorize bankruptcy frauds based on their civil or criminal nature as well. The severity of the consequences is different for civil and criminal bankruptcy frauds. Let us take a look at what these two types of frauds mean:

Civil Bankruptcy Fraud

Such types of fraud come up when any creditor complains about any wrongdoing for a debt. If a creditor proves wrongdoing, then the court can dismiss the case and cancel any bankruptcy filing for a certain period. The court can also cancel the debt discharge or put any other sanction.

Criminal Bankruptcy Fraud

When a complaint involves many creditors, it could lead to criminal bankruptcy fraud. The FBI (the Federal Bureau of Investigation) and U.S. DOJ (Department of Justice) generally investigate such cases. Along with bankruptcy trustees, creditors, and debtors, such cases can also result in the conviction of third parties. A point to note is that most bankruptcy frauds fall in the criminal category, such as concealing of assets, concealing and falsifying information, identity issues and unauthorized filings, and bribery and embezzlement. Consequences of criminal bankruptcy fraud could include fines up to $250,000 and up to 20 years in prison.

Final Words

Most people who go for bankruptcy are honest. Some, however, file for bankruptcy with fraudulent intentions. Such entities must keep in mind that there are several checkpoints in place to spot the fraud. On the other hand, there could be people who are charged with fraud with no fault of theirs. One effective way to stay away from such fraud is to reveal all the information completely and accurately. Once you share all details completely and accurately, no one can charge you for bankruptcy fraud.