Costing is the practice or process of determining, estimating, and evaluating the cost of the products or services. It considers costs at every production stage and includes fixed and variable costs. Cost assessment is very important as this facilitates determining the final selling price of a product or service by adding a profit margin to the cost so arrived at. Most companies go with cost-based pricing, so determining cost serves its purpose here. Costing is done for the internal purposes of the company only, and the company does not share this data with outsiders. There are several types of costing or costing methods that help an entity record and analyze its cost of production or supply of services. Understanding all these types of costing methods is extremely crucial to assessing business costs.

Different industries (and even different companies) have different requirements. Thus, there are different types of costing methods that serve the purpose of different industries. Moreover, companies can also use the costing method that suits them. For example, the costing method that a building contractor uses will be different from what a transport firm uses.

The type of costing method that an entity selects can lead to a substantial difference in costs. Thus, it is very important that we carefully select the costing method. We will discuss the various types of costs in the following paragraphs.

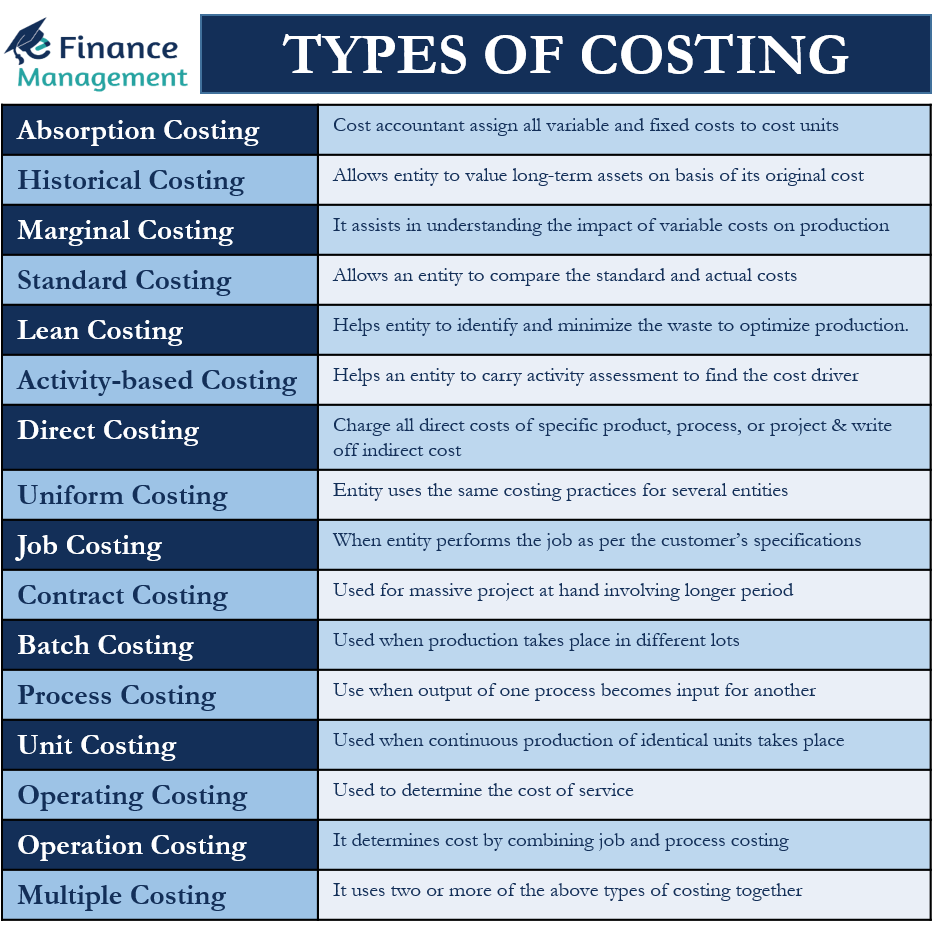

Types of Costing

Following are the most popular types of costing methods that entities use for cost accounting purposes:

Absorption Costing

Under the absorption costing method, an accountant assigns all variable and fixed costs to cost objects. Moreover, an entity’s total overheads are allocated based on the entity’s activity level. Also, the accountant assigns the manufacturing overheads towards stock valuation irrespective of whether or not the entity was able to sell it in the same period. Such a method results in the higher value of the closing stock and lower expenses in the income statement. All sorts of the costs of the period are loaded to or absorbed by the quantity of production.

Also Read: Types of Cost Accounting

Historical Costing

We generally use this to determine costs after they have already been incurred. Such a costing method allows an entity to value an asset based on its original cost. Entities generally use this method to record the value of long-term assets in the balance sheet statement. In this method, we need to subtract the total accumulated depreciation from the asset’s original cost.

Marginal Costing

Such a costing method assists in understanding the impact of variable costs on production. In this method, we add one extra unit to production to understand the impact of variable costs on different output levels and the operating profit. We can say that such a costing helps an entity analyze the profitability of new products and the selling price of the current products. Simply speaking it means the cost incurred by the entity for the production of an additional unit.

Standard Costing

Standard costing is a method of comparing a standard cost, i.e., the predetermined cost of different elements of the cost, with its actual cost. After comparison, it analyzes the reason for the deviation and works to improve it. Whatever remains the difference between the actual cost vis-a-vis this standard cost is known as the cost variance. And this variance can be positive or negative. The detailed analysis of such cost variance at the level of cost components is known as Variance Analysis. Variance analysis is a very very important process in cost accounting.

Lean Costing

Lean costing assists in improving an entity’s financial management practices. This approach assigns value-based pricing to the costs of production. This, in turn, gives an idea about the waste and how an entity can minimize the waste to optimize production.

Also Read: Product Costing

Activity-based costing

In this approach, an entity assigns overhead costs to specific goods or services. This approach depends on an entity’s activities. Such activities are usually the cost drivers as they account for a significant part of the total production costs. Another name for activity-based costing is ABC, and it helps an entity to carry out an activity assessment to find the cost driver. If not the ABC approach, then an entity will have to assign the costs on a general basis. So, we can say that ABC gives more accurate information on the total production cost and profitability.

Direct Costing

Under this method, the company charges all the direct costs of a specific product, process, or project directly. And write off all the indirect costs to the profit and loss account.

Uniform Costing

Under this costing, a company uses the same costing practices for several entities under it. This helps with the comparison of one entity with another in the same company and eliminates inefficiencies.

Types of Costing – Another Classification

The above types of costing were the techniques that an entity uses to analyze the cost of production. Separately, we can also categorize costing based on its target, i.e., for what we want the costing for. The following are such types of costing methods:

Job Costing

When an entity performs the job according to the customer’s specification, there is no standard cost to compare or get an idea of the cost. Thus, we also call it specific order costing. The objective of Job costing is to determine the cost of each job.

Contract Costing

Entities generally use such a costing when they have a massive project at hand involving a longer period. Another name for such costing is terminal costing. The objective of such a costing is to determine the cost of each contract separately. For example, a firm dealing in the construction of dams uses such a costing.

Batch Costing

Batch costing is used when production takes place in different lots/batches. Here we consider each batch as a cost unit and determine its costing. The total cost of the batch so arrived is finally divided by the total number of units in that batch. And thus we arrive at the cost per unit. Biscuit makers, for example, use such a costing.

Process Costing

Such a costing is common in industries with multiple processes. In such industries, the product goes through several processes in a sequence. And therefore the finished product or output of a process becomes the input of another process till it reaches the final stage. Or, Continuous costing is another name for this costing. We create a separate account for each process in this costing process to determine the total cost (and per-unit cost) at the end of each process. The Chemical and paper industries are examples that use process costing.

Joint Costing

Joint costing is a technique of deriving the cost of products that emerge while producing a product. These are known as joint products. Joint products include by-products, co-products, and scrap. There are various methods under joint costing to arrive at the cost of a joint product.

Unit Costing

Companies with continuous Production of identical units opt for such costing. In this costing, we come up with a cost sheet based on labor cost, materials cost, and overheads. The cost sheet reflects the total cost incurred as well as the unit cost of the production. The unit cost is arrived at by dividing the total cost of the production by the number of units manufactured in that process. Oil drilling units and brickworks are a few examples of industries using such a costing.

Operating Costing

Companies that offer services use this costing to come up with the cost of service. For example, the operating cost for a bus company will be the cost of carrying passengers per kilometer.

Operation Costing

It is a mix of process and job costing. Generally, companies producing bulk products using several different raw materials end up using a common process use this type of cost method. For example, companies making handles for bicycles use this costing. Making handles for bicycles involves cutting steel sheets, molding, polishing, and more.

Multiple Costing

It means using two or more of the above types of costing together. Companies that make many parts separately and then assemble them into one product use such costing. Composite costing is another name for multiple costing.

Peanut-Butter Costing

Read peanut-butter costing for detailed article

Backflush Costing

Read backflush costing for a detailed article

Refer to Product Costing to read about various situations where costing is used.

RELATED POSTS

- Cost Accounting and Management Accounting

- Cost Accumulation: Meaning, Types, and More

- Cost Accounting Systems – Meaning, Importance And More

- Job Costing – Meaning, Benefits, Process and More

- Cost Object – Meaning, Advantages, Types and More

- Cost Accounting vs. Financial Accounting – All You Need to Know