Checking Account vs Savings Account: Meaning

A bank is a financial institution that offers deposit and withdrawal facilities, loans and advances, as well as investment facilities to its clients. Checking accounts vs savings accounts are two main types of accounts that financial institutions and banks open. A checking account is of use primarily when we make deposits and withdrawals more frequently. There is no limit on the number of transactions that the account owner can perform in such accounts. At the same time, the primary objective of opening of savings account is to park spare money and earn out of it. Individuals opt for it when they do not intend to make frequent deposits and withdrawals from the account.

Savings accounts usually have a limit with regard to the number of withdrawals within a specified period. Banks may even charge a penalty or extra fee if an individual exceeds the number of withdrawals fixed by law or by the respective bank.

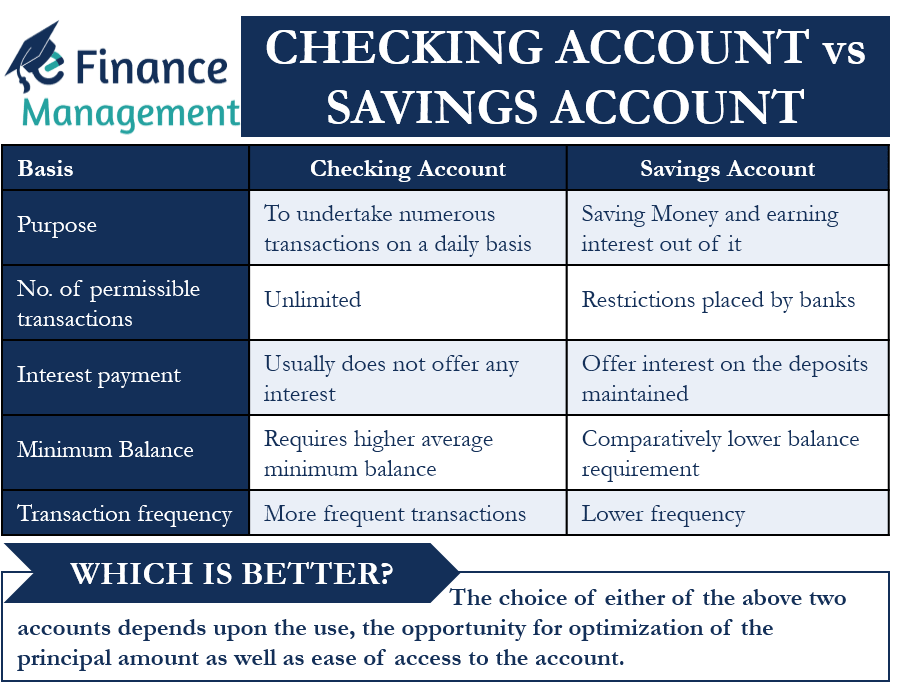

Checking Account vs Savings Account: Differences

Purpose

The main purpose of a checking account is to take care of numerous day-to-day transactions. These transactions could be making deposits, withdrawing money and making payments, paying bills, etc. Hence, such accounts are of use when the goal is to spend money rather than save it.

A savings account is of use for those who intend to save money. It is not for daily spending and transacting purposes—further, savings and earning out of these deposits.

Number of Permissible Transactions

The checking account and savings account both allow deposit of funds through cash and check deposits at the branch, ATM, or through electronic transfers. Similarly, they allow withdrawal of funds through the issuance of checks, cash withdrawals at the branch or ATM, and transactions through a debit card.

However, there is a big difference between the two types of accounts in the number of transactions that one can undertake. An account holder can go on with an unlimited number of deposits and withdrawal transactions with a checking account. Basically, there are no restrictions as such on the number of transactions. And this is the most important and crucial difference between a checking and savings account from an operational or services point of view.

On the other hand, savings account places restrictions on the number of transactions that an account holder can undertake over a specific period. The restriction is primarily on the number of withdrawals one can do from his account. This restriction can be put in place by the bank or the banking regulatory body of the respective country. An account holder exceeding the maximum permissible number of withdrawals over a particular time period can be charged with an excess withdrawal fee or a penalty which will be a loss for him.

Interest Payment

Payment of interest on the funds in the account is the second most important difference between the two types of accounts. A checking account usually does not offer any interest on the funds that an account holder maintains in his account. Some new accounts have recently started offering interest, but the percentage is minuscule. Thus, such accounts are not for those who are looking for interest earnings through deposits in a bank account.

Also Read: Investment Banking Vs. Commercial Banking

However, savings accounts offer interest on the deposits that the holders maintain in their accounts. Moreover, these interest rates are higher as compared to the current checking accounts (if at all they are offering). This encourages them to hold more and more funds in their account and make lesser withdrawals. Thus, such accounts are good for meeting capital accumulation goals while keeping the deposits safe and intact in the bank. The interest payment can be quarterly, semi-annually, or annually. The rate of interest also varies between different types of savings accounts and the balance that one maintains.

Minimum Balance Requirement

Banks usually require that the account holders should maintain a specific average minimum balance in their respective accounts over a period of time. This minimum balance is specified by the bank itself and depends upon the type of account. It may vary from one bank to another. A checking account usually has a higher average minimum balance maintenance clause than a savings account. Thus, account holders have to maintain a higher balance in a checking account as compared to a savings account. Also, the penalty for non-maintenance of the average minimum balance is also usually higher in the case of a checking account.

Transaction Frequency

There is also a difference in the frequency of transactions that an account holder performs in his account in these two types of accounts. An account holder usually has to perform a minimum of one transaction every month in a checking account. This is mandatory to keep his account active and operational.

This number goes down in the case of a Savings account. An account holder has to just perform a minimum of one transaction over a longer time duration, usually six months. If he fails to perform this minimum required transaction, the bank may classify his account as dormant.

Which is Better – Checking Account or Savings Account?

As we now understand the key differences between these two types of accounts, an obvious question is which type of account is better or preferable. The answer to it depends upon a person’s need and purpose, need for interest, number of transactions that he wants to conduct over a period of time, the minimum balance requirement, etc. A person can opt for either of the two accounts on the basis of the above factors.

The choice of either of the above two accounts depends upon the use. Moreover, on the opportunity for optimization of the principal amount as well as ease of access to the account. Both types of accounts offer the facility of cash deposit and withdrawal, payment of bills, account transfers, payment of taxes, etc. Thus, there are some commonalities with regard to the kind of transactions and services between these two types of accounts. However, still there are lots of differences between these two types of accounts. Let us discuss these differences in the following paragraphs.

Moreover, a person can open both types of accounts and operate them separately. In this case, he can use his checking account to perform his day-to-day transactions. And he can use the savings account to fulfill his savings goals. This will provide him with a platform to save his money as well as grow it by earning interest on it too.

Also, read – Dividend-Bearing Checking Account.