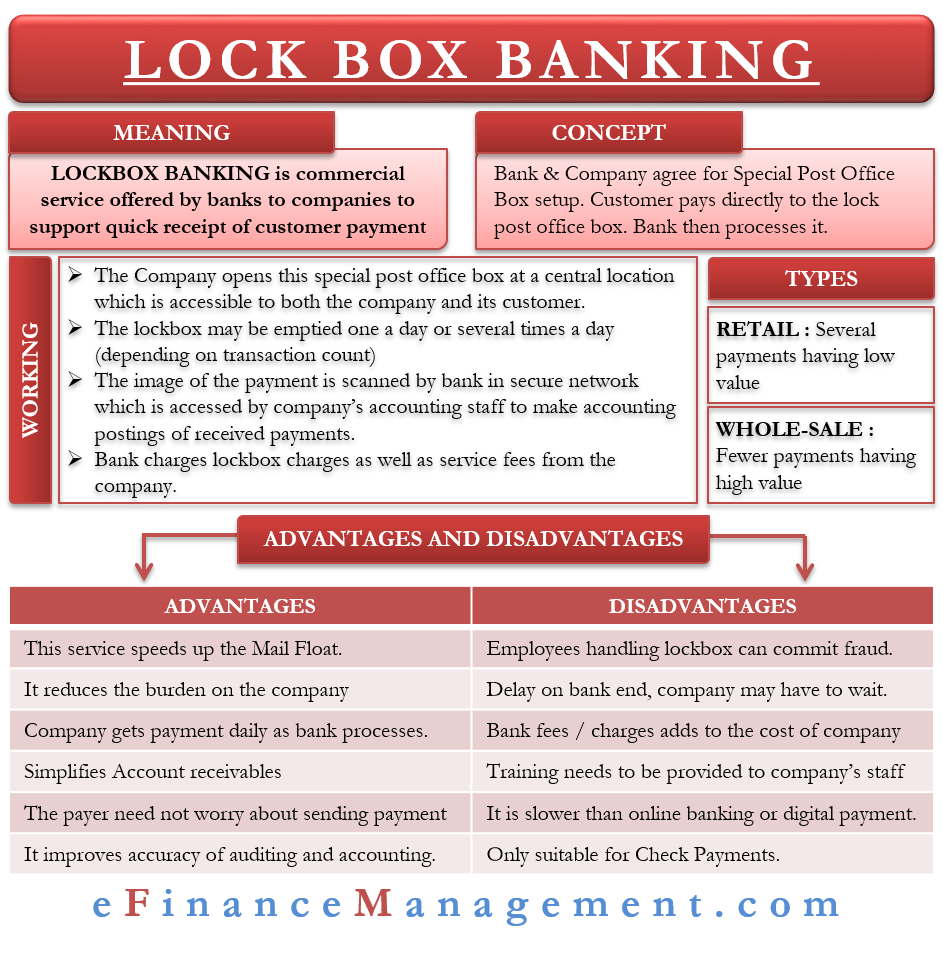

Lockbox Banking is a commercial service offered by banks to companies to support the quick receipt of payments from customers. Under this, the bank and the company agree to set up a special post office box. The company then directs its customers to send the payments to this post office box. Bank takes out the payment – mostly checks – from that box, processes it, makes accounting entry, and deposits it in the company’s bank account.

However, such a banking service is losing its importance in the current digital world. As in the digital environment, one can easily send money to anyone with a click of a button.

Lockbox Banking – How it Works?

Lockbox is opened with a post office at a central location for easy accessibility of the bank and the customers. Depending on the number of transactions, the bank may empty the box once or several times a day. Once the bank processes the payment, they inform the same to the company. Usually, the bank staff scans the images of the amount and posts them to a secure website. The company’s accounting staff accesses the image from that website and makes the entries accordingly.

A company may have one more of such an account at several locations. Companies that have offices in different cities may take a lockbox facility near those offices. It will ensure that customers’ payment is sent to the company quickly, which can then use it for productive purposes.

Banks generally take a monthly fee for a lockbox banking account. Also, banks charge a service fee for processing each payment. Periodically, banks review the locations of these lockboxes to ensure that it benefits all. The bank may move the lockbox to a more customer-centric location and notify about the same to the company, which in turn communicates it to its customers.

Types of Lockbox Banking

Usually, there are two types of lockbox banking services that the bank offers:

Retail Lockboxes – Such a service is of use for businesses that get several payments but of lower value.

Wholesale Lockboxes – As the name suggests, it is for companies that get comparatively fewer but high-value payments.

Apart from these two types, banks can also customize their lockbox banking services based on customer needs.

Benefits of Lockbox Banking

Following are the benefits of lockbox banking:

- This service speeds up the Mail Float or collection float. It is the time that payment via check takes to travel from the payer to the payee. Often the payer takes advantage of the slow mail system and tries to delay the payment by saying that the check is on the way. But, with the lockbox facility, the payer can’t say so as the bank usually processes the payment on the same day.

- It reduces the burden on the company of going through the mail, accepting, and receiving payments.

- Since the bank processes the payment daily, the company can use the money as soon as it gets information from the bank.

- Such a service helps to simplify the accounts receivable.

- A company doesn’t have to worry about sending the checks and payments that it gets from customers to a bank.

- The service improves the accuracy of auditing and accounting. A company can ask the bank to upload the payment data directly into the company’s accounting system.

- It gives visibility to the company’s cash flow as businesses receive timely information from the bank when they process the payment.

Drawbacks

Following are the drawbacks of lockbox banking:

- Bank employees with access to the lockbox can easily commit fraud. The most common fraud with such services is to counterfeit a check because checks in the lockboxes carry all information to make counterfeits quickly.

- Any delay in processing by the bank would mean that the company has to wait to use the money.

- It increases the cost for the company as banks charge a fee for the lockbox and for processing each transaction as well.

- The company needs to train its accounting staff on how to access the payment information that the bank sends.

- Even though a lockbox facility is faster than the traditional mail system, it is still slower than online banking or digital payment.

- Lockbox banking is mostly suitable for payments via checks. However, the usage of cheques is on the decline among most businesses.

Final Words

Such a service is beneficial for companies that have a large customer base spread across the country, for instance, mortgage firms. However, utility companies that receive smaller payments from customers also use such a service. Moreover, such a service is beneficial for those having several branches in different parts of the country or having a large number of customers in a single or few distant locations.

This service is not recommended for a small company with a local customer base as it may add more to the costs. Even among larger companies, lockbox banking is losing its importance with the advent of online banking and digital payment.

If you still want to use it, you should compare the cost of the service with the benefits you get from it. Also, you should negotiate the price of the service with the bank if you present yourself as a potential client. You should also carry a research on the bank’s security practices.