Covariance is a statistical tool for measuring the relationship between two random variables. It essentially indicates the direction between the two variables. It is noteworthy that it does not say the dependence between the variables. As it is a statistical measure, we have seen students confused when they get a negative covariance, or they often come up and ask: Can Covariance be Negative?

To a certain extent, this question – Can Covariance be Negative? – it may sound stupid, but it is a valid question. Knowing and understanding its answer will help you to clearly comprehend the concept of covariance.

Can Covariance be Negative?

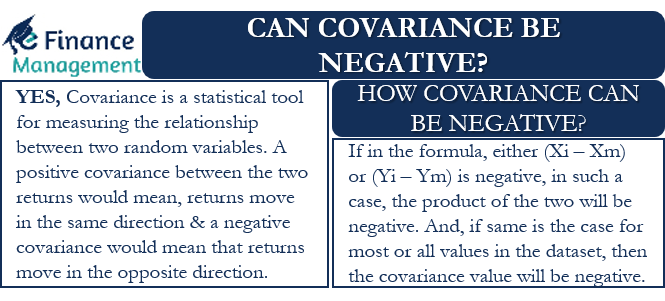

A straightforward answer to this question is – Yes. But you need to understand why the value of the covariance can be negative.

We use covariance to determine the directional relationship between two variables in the financial world. These two variables, for example, could be returns of two assets. If we obtain a positive covariance between the two returns, this would mean that returns move in the same direction.

And if the cov. is negative, that would mean that returns move in the opposite direction. This means when the return on one asset increases, the return on another asset decreases, and vice versa. However, covariance says nothing about the strength of the relationship between the two variables. By strength here, we mean how much of change in one results in a change in the other.

This is where the correlation comes into play. Correlation helps to calculate the power of the connection between the two variables. (Read Correlation vs. Covariance to learn more).

How Covariance Can be Negative?

To understand how cov. can be negative, we need to understand the formula of covariance. Following is the formula to compute the covariance:

Cov (X,Y) = Sum [(Xi – Xm) * (Yi – Ym)]/ (n-1)

Here Xi is the value of X in a data set, Xm is the mean of X, Yi is the value of Y in the data set corresponding to Xi, Ym is the mean of Y, and n is the number of data points.

On the basis of the above formula, we will get the cov. value as negative if either (Xi – Xm) or (Yi – Ym) is negative. In such a case, the product of the two will be negative. And if the same is the case for most or all values in the dataset, then the covariance value will be negative.

Let us take an example to better understand how this statistical measure can be negative.

|

X |

Y |

Xi – Xm |

Yi – Ym |

(Xi – Xm) * (Yi – Ym) |

|

10.00 |

8.00 |

– |

0.33 |

– |

|

15.00 |

5.00 |

5.00 |

(2.67) |

(13.33) |

|

5.00 |

10.00 |

(5.00) |

2.33 |

(11.67) |

|

10.00 |

7.67 |

(25.00) |

In this, we have taken two data sets, X and Y, with three values each. The mean for X is 10 and for Y is 7.67. Using the above formula, we came up with the product of variances of X and Y. The sum of the product of those variances is -25.

So, the covariance, in this case, will be -12.5. Thus, we get a negative covariance here.

To confirm whether or not our answer of negative cov. is correct, we can compare the values of X and Y. By looking only at the values, we can determine that when the value of X increases, the value of Y falls and vice versa. So, this way, these two data sets have a negative covariance.

Final Words

Now you know the answer to the question – Can Covariance be Negative? – and also understand the circumstances that lead to negative cov. You can now use the concept to build a balanced portfolio of stocks to maximize your return. We need to understand clearly that there is a difference between covariance and co-relation.

Frequently Asked Questions (FAQs)

The negative covariance between two variables indicates the direction of both variables. If the covariance is positive, both move in the same direction, and if it is negative, both move in the opposite direction.

If the covariance is zero, it simply means that there is no linear relationship between the two variables.

As covariance indicates the relationship between the direction of two variables, a positive covariance indicates that if there is a loss in one variable, there will be a loss in another variable too. However, a negative covariance tells that if there is a loss in one variable, there will be profit in another variable. So it indicates a relationship only for making various decisions. So there is nothing like which one is better. It depends upon the circumstances and variables.

Thanks for sharing this insightful article.