What is the Negative Sharpe Ratio?

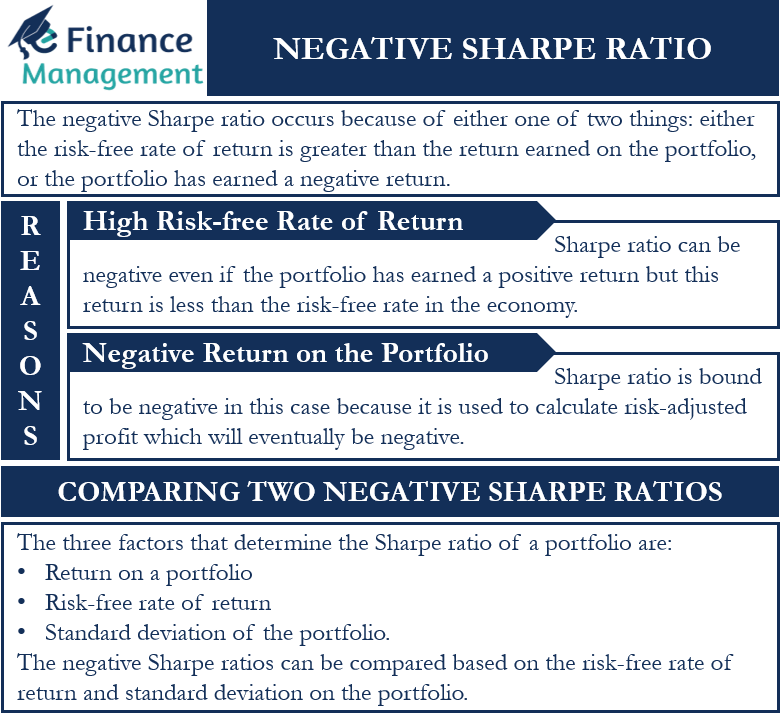

The Sharpe ratio is a measure of risk-adjusted return. The risk-free rate of return, return of the portfolio, and standard deviation of the portfolio are three major components for the analysis of a portfolio using the Sharpe ratio. The negative Sharpe ratio occurs because of either one of two things:

- Either the risk-free rate of return is greater than the return earned on the portfolio

- Or, the portfolio has earned a negative return.

- Higher Risk-Free Rate of Return: The Sharpe ratio measures the extra compensation an investor receives over the risk-free rate of return for bearing additional risk. The risk-free rate of return is generally based on the government bond rate of the economy. For example, the risk-free rate in the USA is based on treasury bills or T-bills. The Sharpe ratio can be negative even if the portfolio has earned a positive return but this return is less than the risk-free rate in the economy. Therefore, a portfolio manager needs to outperform the risk-free rate of return to get a positive Sharpe ratio.

- Negative Return on the Portfolio: A negative return means that the portfolio made a loss. Hence, the investors have incurred a loss on the portfolio. The Sharpe ratio is bound to be negative in this case because it is used to calculate risk-adjusted profit which will eventually be negative.

Comparing Two Negative Sharpe Ratios

In the above paragraph, we have already mentioned the three factors that determine the Sharpe ratio of a portfolio. Except for the return on a portfolio, the negative Sharpe ratios can be compared based on the risk-free rate of return and standard deviation on the portfolio.

Risk-Free Rate of Return

In the numerator part of the formula, we subtract the risk-free rate of return from the return on the portfolio. For comparing two negative Sharpe ratios it is important to have a uniform risk-free rate of return. If the risk-free rate of return is different for the calculation of each portfolio’s Sharpe ratio, then we cannot compare the two Sharpe ratios just based on the ratio calculated. Therefore, the risk-free rate of return must be a factor under consideration for comparing two negative Sharpe ratios.

Standard Deviation of the Portfolio

The denominator part of the Sharpe ratio is based on the standard deviation of the portfolio. Standard deviation is the measure of how dispersed the data is in relation to its mean. It calculates the risk associated with an investment in the portfolio. Each investment or portfolio can have a different level of risk or standard deviation associated with it. The Sharpe ratio of two different portfolios with the same return and risk-free rate of return can turn out to be different because of the difference in standard deviation. Therefore, the difference in the risk factor, which in this case is standard deviation, can majorly impact the risk-adjusted return or the Sharpe ratio of the portfolio.