Correlation and Covariance are popular terms used in Maths, specifically Statistics. Both the concepts help in establishing a relationship between two different factors. Due to their similarity in use, both terms are often used interchangeably to convey the same thing. However, in reality, both the terms are very different and come into use differently. To better understand the meaning and usage of both terms, we need to see the differences between correlation vs covariance.

Before the differences, let’s see what both terms mean.

Correlation vs Covariance – Meaning

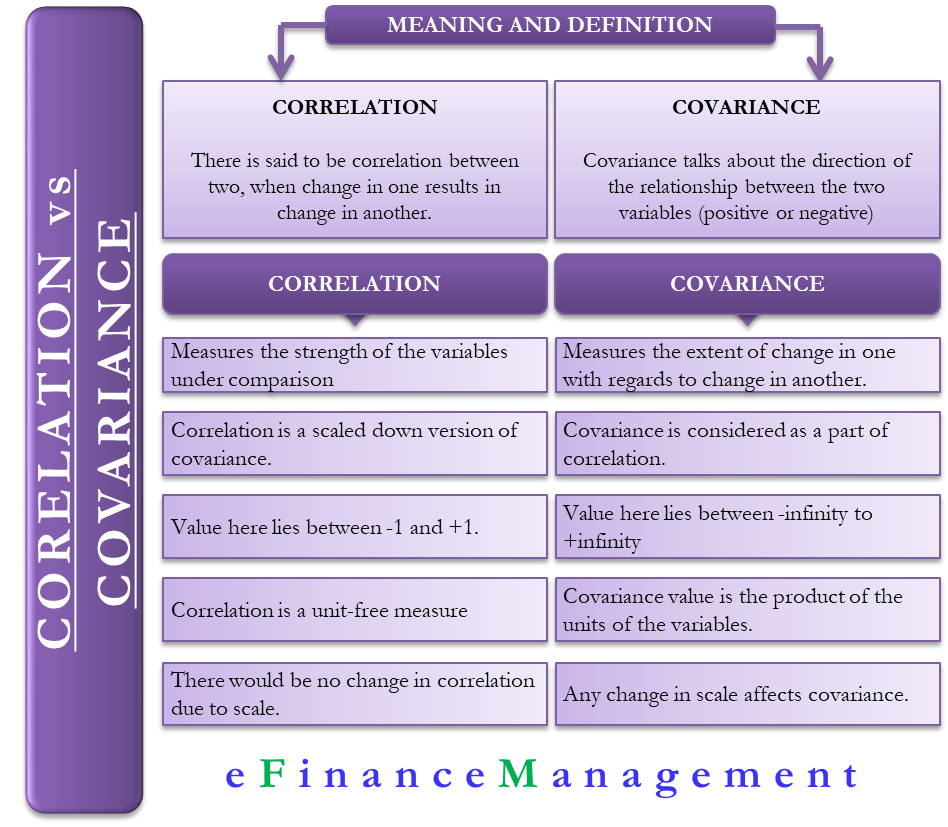

Though both terms help determine the relationship between the two factors, there is a big difference in both. In simple terms, we can say there is a correlation between two variables if a change in one results in a change in another as well. On the other hand, Covariance takes place when two factors vary together.

We can also say that covariance talks about the direction – positive or negative – of the relationship between two variables. But, correlation talks about the direction and the strength of the relationship between the variables.

Covariance could be anywhere between -∞ to +∞, and the more the value, the better the relationship between the variables. For instance, a positive number would mean a direct relationship, meaning an increase in one would result in a corresponding increase in another. A negative number would mean an inverse relationship between two variables.

Also Read: Can Covariance be Negative?

On the other hand, correlation is a better approach as it helps in quantifying the relationship between two variables. Or, we can say it measures how variables change with respect to each other. Unlike covariance, correlation can take a value between +1 and -1, where +1 means a direct and strong relationship, and -1 means a perfect inverse relationship. The correlation could also be zero, meaning two variables are independent.

Now that you would have got some idea about what both these terms mean let’s see the differences between correlation vs covariance.

Correlation vs Covariance – Differences

Following are the differences between correlation vs covariance:

What it Measures?

Covariance tells the extent to which two variables change in accordance with each other. On the other hand, correlation tells the strength of the relationship or how strongly two variables relate to each other.

How Two are Related?

Covariance can be said to be a part of correlation. On the other hand, correlation is a scaled-down version of covariance.

Value

Correlation can take any value between -1 and +1, while covariance value is between -∞ and +∞.

Change in Scale

Any change in scale affects covariance. This means that if we multiply all values of one variable by a constant and all values of another variable by the same or another constant, then the covariance will change. On the other hand, there would be no change in correlation due to scale.

Unit-free Measure

Correlation is a unit-free measure that defines the relationship between variables. However, the covariance value is the product of the units of the variables.

Number of Variables

Covariance usually determines the relationship between the two variables. On the other hand, correlation can help involve relationships between multiple variables.

Final Words

Both Correlation and Covariance find their uses beyond mathematics as well. Financial analysts use both the concepts to determine various stock market strategies and for financial models as well. Even though both the concepts are similar to each other, given a choice, an analyst would go for correlation. Any change in scale, location, and dimension does not affect correlation. Also, since it is always between -1 to +1, one can easily use it for comparison.