What is Abnormal Return?

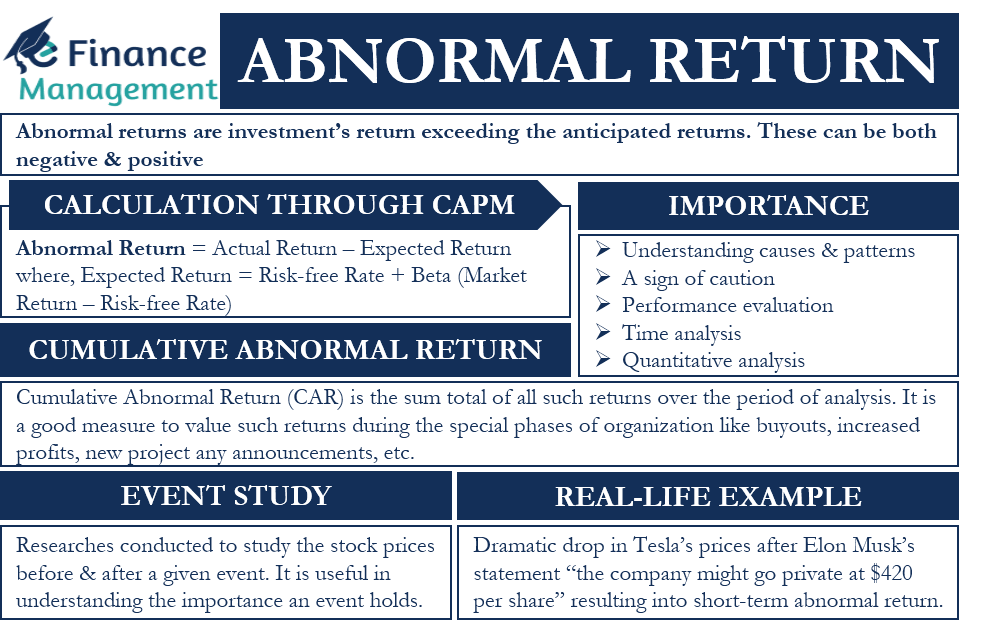

An abnormal return is defined as ‘an unexpected, not-anticipated return on investments throughout a period of time. The reason can be a mystery; it can be due to the over-reaction of the market or an indication of a scam or manipulation. Many analysts develop an asset pricing model which predicts its long-term return and gives a ballpark figure for its prices. When an investment’s return exceeds the anticipated return, it is known as an abnormal return. Abnormal returns can be both negative and positive. A negative one means losses, while a positive one will indicate profits.

In the financial world, the abnormal return or above-average return is triggered by certain events. These events can be mergers, de-mergers, lawsuits, subsidies, sudden rise in demand or shortage of products, taxation relief, copyright or trademark issue, new product development or any strategic partnership, etc.

Calculation of Abnormal Return through CAPM

The abnormal return calculations can be done through various different methods. CAPM (Capital Asset Pricing Model) is one of the most common ones. CAPM measures the excess return on the stock as compared to the market return. The equation is as follows:

Expected Stock Return = Risk-free Rate + Beta * (Market Return – Risk-free Rate)

Looking at the equation, it is the excess of market return over the risk-free rate multiplied by the beta of the stock. Beta measures the movement of stock in accordance with the market.

| Abnormal Return = Actual Stock Return – Expected Return |

If the amount is positive, an investor has realized a profit, whereas a negative amount equals losses.

Example

Let us understand this by an example. Assume,

Risk free Rate: 5%; Beta: 0.5; Market return: 10%.

Hence the market return should be:

Expected return = 5% + 0.5 (10% – 5%)

Expected return = 7.5%

So if the actual return for the time period is 10% then the positive abnormal return is 2.5% (i.e., 10% – 7.5%). But if the actual return is 5%, then the negative abnormal return is 2.5% (i.e., 5% – 7.5%).

Importance of Abnormal Return

To Reason Out Causes

Assessing reasons for excess returns can prove to provide many reasons for the situation.

- It helps us understand the mindset and attitude of investors toward the stock and the hidden meaning behind it.

- Another important factor includes the duration of the continued returns or if there is any specific cause attached to it.

- A company is soon to carry out an acquisition; there could be many reasons.

It is important to reason out the cause and its pattern.

A Sign of Caution

Continued abnormal returns may warn us about the true picture of the firm. It raises awareness among the investors and demands further investigation to determine the cause of lower returns. Early identification can help one to exit their positions.

Performance Evaluation

It can also act as a criterion to value a portfolio manager’s performance. Good abnormal returns can indicate an accurate selection of stocks that, in turn, increase the credibility of the manager as higher returns are made up of stocks that are generating higher returns.

Time Analysis

Cumulative abnormal return is the correct measure to analyze the pattern of abnormal returns. It provides an overview of the performance of the firm over a certain period of time.

High on Quantitative Analysis

To calculate beta, experts use regression analysis to derive the true certainty of stock movements. As beta is used in the formula of CAPM, an accurate figure will increase the accuracy and hence the prediction. A correct prediction can help one gauge the true picture.

Cumulative Abnormal Return

Summing up, all the abnormal returns form the cumulative abnormal return (CAR). In other words, it is the sum total of all such returns over the period of analysis. This monitoring happens using small windows of the time period, say days, to closely understand the causes of the abnormal returns. Short windows are preferable as it does not create a bias because of the daily compounding. CAR is a good measure to value such returns during a special phase of the organization like buyouts, increased profits, new project announcements, etc.

Event Study

Many researchers conduct studies that track the stock prices before and after a given event. Say, for example, we want to study the influence of the declaration of annual financial statements. A study of the situation before an event and after an event is done to study the effects and impact of the event. So if the study time is a month, then the study captures the movement of stock prices a month before and after the results. After studying the movements and calculating beta, CAPM calculation happens, which is later on used to determine the excess return. This process is useful in understanding the importance that an event holds. Many investors use such methods to make quick profits on their investments.

Read Ex-ante & Ex-post to learn more about the price before and after an event.

Real-life Example of Abnormal Return

The prices of Tesla dropped dramatically after Elon Musk gave a statement that the company might go private at $420 per share. Resultantly, the share price dropped, and panic among investors surged. This is an example of short-term abnormal returns because of a particular statement.