Meaning of Market Anomaly

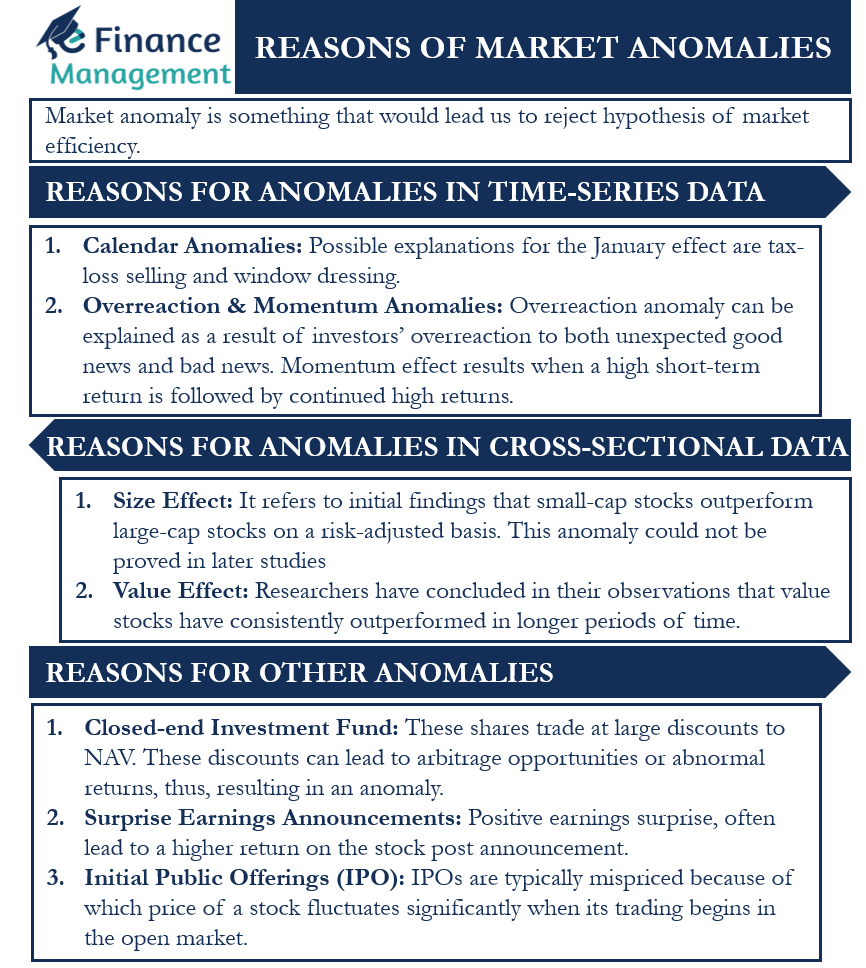

An anomaly is something that deviates from the common rule. The efficient market hypothesis states that all stocks are properly priced, and abnormal returns cannot be earned by searching for mispriced stocks. A market anomaly is something that would lead us to reject the hypothesis of market efficiency.

A market anomaly may be present if a change in the price of an asset or security cannot directly be linked to current relevant information known to the market or to release new information into the market. Any proof of the probable presence of a market anomaly or inefficiency must be reliable over a sizable amount of time. In the widespread search for discovering profitable anomalies, many findings could simply be the product of a process called data mining, also known as data snooping.

Reasons for Anomalies in the Time-Series Data

Calendar Anomalies

In the 1980s many researchers reported a significant increase in return in the first 10 days of January compared to other months of the year. This pattern is known as the January Effect and has been observed in most equity markets around the world. It is most frequently observed for the returns of small market capitalization stocks.

Possible explanations for the January effect are tax-loss selling and window dressing.

- Tax-loss selling is when investors sell losing positions in December to realize losses for tax purposes.

- In window dressing, investors and portfolio managers sell their risky assets in December to remove them from their year-end statements.

There were other calendar anomalies too such as “the weekend effect” and “the holiday effect”, but they are no longer relevant in the market.

Overreaction and Momentum Anomalies

The overreaction effect or anomaly states that a firm with poor stock returns over the previous three or five years has better subsequent returns than firms that had high stock returns over the prior period. This effect can be explained as a result of investors’ overreaction to both unexpected good news and bad news.

Also Read: Abnormal Return

Momentum effect results when a high short-term return is followed by continued high returns. Investors and speculators very commonly use this anomaly. Researchers have argued that the existence of momentum is rational and not contrary to market efficiency. This is because it is plausible that there are shocks to the expected growth rates of cash flows to shareholders and that these shocks induce a serial correlation that is rational and short-lived.

Reasons for Anomalies in Cross-Sectional Data

Size Effect

The size effect refers to initial findings that small-cap stocks outperform large-cap stocks on a risk-adjusted basis. This anomaly could not be proved in later studies. The researchers concluded that either the investors had traded on and as a result eliminated the anomaly, or the initial finding was simply a random result for the time period.

Value Effect

Researchers have concluded in their observations that value stocks have consistently outperformed in longer periods of time. The basis of the calculation of value stocks is financial ratios. Stocks that have below-average P/E ratios and above-average dividend yield are said to be value stocks. This anomaly contradicts semi-strong efficiency because all the information used to categorize this stock is publicly available.

Reasons for Other Anomalies

Closed-end Investment Fund

A point to note is that the shares of closed-end investment funds trade at prices that can deviate from the net asset value (NAV) of the fund. These shares often trade at large discounts to NAV. These discounts can lead to arbitrage opportunities or abnormal returns, thus, resulting in an anomaly. Explanations for closed-end investment funds include management fees, taxes, or an opportunity to future capital gains and share illiquidity.

Surprise Earnings Announcements

An earnings announcement is a portion of announced earnings that the market was not expecting. Positive earnings surprise, higher-than-expected earnings, often lead to a higher return on the stock post announcement. Investors could exploit this anomaly by buying positive earnings to surprise firms and selling negative earnings to surprise firms.

Initial Public Offerings (IPO)

IPO is the first introduction of a company to the stock exchange. IPOs are typically mispriced. Because of this, the price of a stock fluctuates significantly when its trading begins in the open market. The optimism or overreaction of investors can inflate the price of a stock post-IPO.