Active Return: Meaning

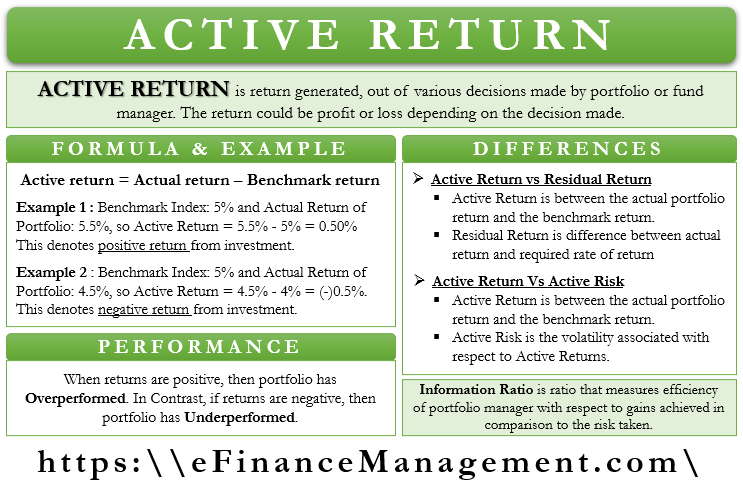

Active Return is the return generated out of the various decisions made by the portfolio manager or the fund manager. Here the returns could be either profits or losses, depending on the accuracy of those decisions. These profits or losses directly link to the decisions made by the portfolio manager. This performance multiple is mentioned in the percentage terms.

The Active fund managers or Portfolio managers pick up the stocks which they think will surpass the benchmark’s gain in the future. Here the ultimate target of the fund manager is to go beyond the benchmark. In other words, the fund managers try to create an alpha return, i.e., a greater return than the given benchmark return for their investors. The selection of the benchmark index is usually declared in advance while rolling out the scheme for public subscription. And the base benchmark could be a sector-specific index, S & P 500, Dow Jones Industrial Average, or any other index. The selection of a respective index for the comparison is a decision of the portfolio manager. Another name for Active Return is ‘Excess Return.’

Active Return: Formula and Interpretation

Calculation of Active Returns happens in comparison with the respective benchmark. It is the variance between the Benchmark return and Actual return. It is the generation of additional returns over and above the benchmark return.

EXAMPLES

Example 1

Benchmark Index: 5%

Actual Return of Portfolio: 5.5%

Therefore, Active Return = Actual Return – Benchmark Index

= 5.5 – 5

= 0.5%

Example 2

Benchmark Index: 5%

Actual Return of Portfolio: 4.5%

Therefore, Active Return = Actual Return – Benchmark

= 4.5 – 5

= -0.5%

Interpretation

Thus, as shown above, the calculation of Active Return is the difference between Actual and Benchmark Return. In Example 1, the Active Gain is positive 0.5%, while in Example 2, it is negative 0.5%. Therefore it means that the portfolio in Example 1 gives positive returns while the portfolio in Example 2 gives negative returns vis-a-vis the benchmark return. If the return of the portfolio is higher than the return of the benchmark, it is a positive return. In contrast to this, if the return of the portfolio is lower than the benchmark, there is a negative return.

Also Read: Active vs Passive Portfolio Management

Thus, according to this concept, the investors will earn the basic benchmark gain. Still, the gain over and above the same is because of the decision-making skills and asset allocation skills of the fund manager. Hence, such funds are termed as actively managed funds.

Overperformance or Underperformance

The fund managers or investors can easily identify whether the portfolio has underperformed or overperformed with the help of Active Returns comparison with the Benchmark performance. According to the earlier illustration given, if the returns are positive, then the portfolio has Overperformed. In Contrast to this, if the returns are negative, then the portfolio has underperformed.

The Overperformance and Underperformance can change if the Benchmark changes. It might happen that for the same portfolio, with one benchmark, it is in the under-performance zone, while with another benchmark, it is in the over-performance zone. Thus positive-negative, over-underperformance completely depends on the Benchmark index taken as a basis. The fund manager and the Asset Management Company decide on this benchmark while seeking subscrtiption from the investors.

Active Asset Management Vs. Passive Asset Management

Inherent Character of the Strategy

Active Return is useful while following Active Asset Management Investment Strategy. At the same time, Passive Return is useful while following Passive Asset Management Investment Strategy. In the case of the former investment strategy, the portfolio manager manages the portfolio by using their skills. Here the fund manager continues to monitor the performance and movements in the portfolio stocks and takes a call to add, reduce, exit, or avoid stocks as per his study. In Passive Strategy, the fund manager is not so actively involved in the analysis and taking a call on the investments. Instead, the fund manager follows the benchmark index and tries his best to mirror or emulate the benchmark index portfolio. It completely replicates some other Index or funds.

Also Read: Actively Managed ETFs

Purpose or Goal of the Strategy

As we have discussed in the above para, the operational style remains different in both the strategy – active or passive. This happens due to the ultimate goal or objective of these strategies. In actively managed funds, the fund manager is supposed to deliver gains greater than the benchmark. His ratings and rankings in the mutual fund industry align with his delivery with regard to the actual performance. That means how consistently he is beating the index, how wide a margin he is beating the index, is he able to deliver the overperformance during all the business cycles, what is the level of churn he is making, etc.

However, in a passive fund, the fund manager’s performance ranking and ratings are decided by how, with minimal tracking error, how close he has been able to deliver the near index return. Here the fund manager needs to deliver the returns, which are generated by the index, with minimum operating cost.

Extent of Risk

The Passive Strategy is comparatively less risky than the Active Investment Strategy. As High risk comes with higher gain, the same thing is shown here also. The Passive Investment Strategy also incurs lesser expenses than the latter one.

Market Perception

According to a few analysts, the benchmark gain occurs by adopting a Passive Investment Strategy. While incremental gain occurs by adopting an Active Investment Strategy. However, few analysts differ and raise a counterargument that in the effort of achieving higher returns than the benchmark, the Active Strategy often ends up earning lesser than the benchmark in the long run. And so, these days, fund managers, at times, combine both the Investment Strategies for better results.

Active Return Vs. Alpha / Residual Return

Active Return and Alpha/ Residual Return are not the same. The former is a difference between the actual portfolio return and the benchmark return. While on the other hand, Alpha is the difference between the actual return and the required rate of return or the extra return over and above the benchmark return. Alpha also considers Systematic risk by taking into consideration Beta. Thus the purpose is almost similar for both the tools, but the inputs for the calculation of these indicators are different.

Active Return Vs. Active Risk

Active Risk is the volatility associated with respect to Active Returns. Tracking error in an active portfolio is also termed as Active Risk. The higher the volatility of getting returns, the higher the Active Risk. Thus the more stable the returns are, it shows the lesser volatility and lesser Risk.

The formula is as follows.

Active risk = √ (∑ (return (portfolio) – return (benchmark)) ²) / (N – 1)

What is Information Ratio?

Information Ratio (IR) is useful along with Active Risk and Return. It is a ratio that measures the efficiency of the portfolio manager with respect to the gains achieved in comparison to the risk taken. Thus, it reflects the return-risk relationship and whether the return is commensurate with the type of risks the fund manager is betting on.

Let’s calculate IR

Information Ratio = Active Return/ Tracking Error

The higher IR means that the portfolio manager is achieving Gains above the benchmark with the current level of risk. While a lower IR concludes that the portfolio manager is not successful in acquiring gains with the level of risk he is taking.

Conclusion

Active Return is the most useful indicator while analyzing the performance of an Actively managed fund. Investors use this multiple to track the performance of a particular Active fund with other funds in this category before investing. It gives the best results when used along with Alpha, Tracking Error, and Information Ratio. However, the only limitation of this multiple is that the Benchmark selection should be fully accurate and relevant to make this comparison work.