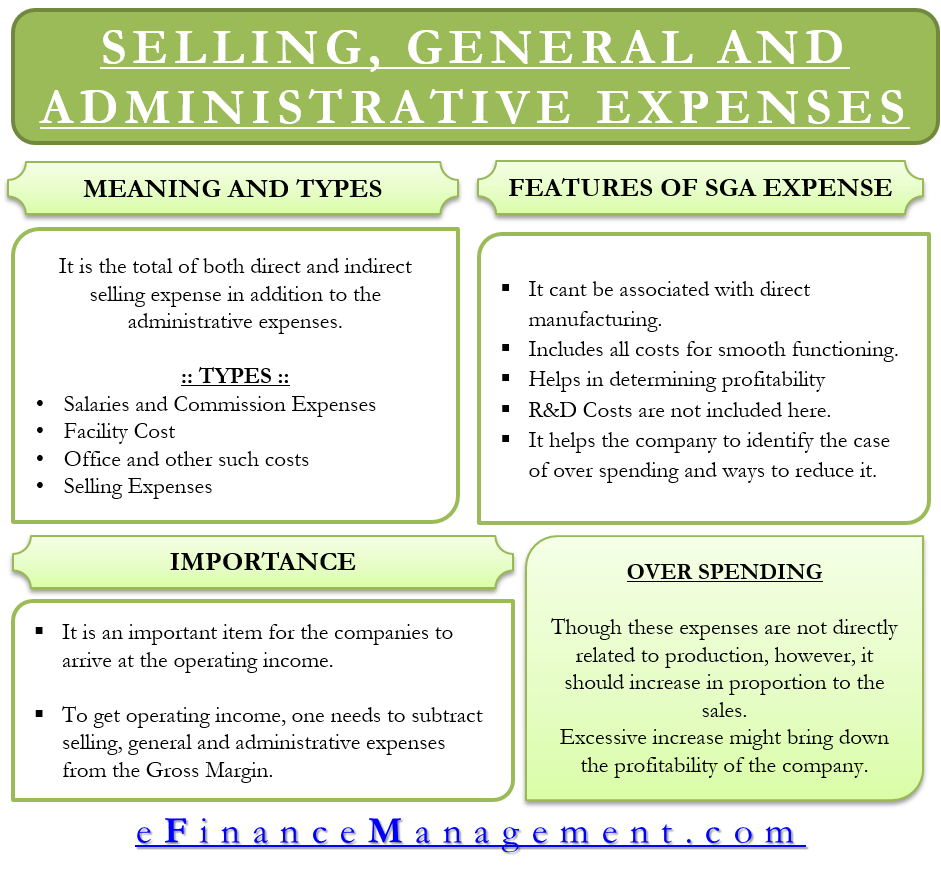

Selling, general and administrative expenses (or SG&A) are the total of both direct and indirect selling expenses in addition to the administrative expenses. The company records these expenses on the income statement. These expenses do not include the costs associated with manufacturing a product or offering a service. These are the costs classified on the basis of their functions.

In simple terms, SG&A includes all costs incurred in selling and delivering the products and services. Further, the item also includes the cost of managing the company.

It must be noted that SG&A does not include the amount that the company spends on research and development. Further, items such as financing costs, interest expenses, and interest income do not come under SG&A as well. If you wonder why these costs are not part of the SG&A, the answer is simple they don’t directly assist in operating the company.

Features of SG&A Expenses

- SG&A is the expenses that can’t be associated with the direct manufacturing of the product.

- It includes all the costs essential for the smooth running of the business and the manufacturing process.

- SG&A helps in determining the profitability of the company.

- Research and Development costs do not come under SG&A.

- It helps the company to identify the case of overspending and ways to reduce it.

Types of Selling, General, and Administrative Expenses

Expenses that come under SG&A are – Accounting and Legal expenses, Facility expenses, Corporate expenses, Sales and marketing expenses, and more. Let’s understand some of these in detail:

Salaries and Commission

Salaries and commissions paid to the employees not directly involved in the manufacturing process come under SG&A. Further, wages and salaries paid to the sales team, engineers, and accountants also come under salaries and commission.

Facility Cost

When a company incurs the cost of running a facility, it falls under SG&A. These costs include utilities, insurance, rent, and more. Further, any repairs attributable to the buildings, office equipment, plant, and machinery also come under Selling, general and administrative expenses. Depreciation of assets is also a selling and administrative expense.

Office and Others

A company that is incurring costs on office supplies and other equipment includes these expenses under SG&A. Also, postage and printing costs, any membership fees that a company pays to trade associations, and so on are also part of selling and administrative expenses.

Selling Expenses

One can divide selling expenses into direct and indirect costs that a company incurs during selling a product. A company incurs direct expenses after selling the product—for instance, delivery charges, shipping supplies, sales commissions, etc.

Also Read: What is Expense? – Definition and Meaning

On the other hand, indirect expenses are the ones that a company incurs during the manufacturing process, for example, product advertising, promotional expenses, traveling expenses, telephone bills, and more. A major difference between the two is that the item is not necessarily sold when indirect expenses are incurred.

General Administrative Expenses

Also known as overhead costs in the company books, General Administrative expenses are the daily costs that the company bears to keep the office running. These costs could include mortgage costs, insurance, utilities, etc. The G&A cost can also include the salaries paid to the non-sales personnel.

Importance of SG&A cost

It is an important item for the companies to arrive at the operating income. To get operating income, one needs to subtract selling, general and administrative expenses from the Gross Margin. It is one of the most important elements in understanding the profitability of the company.

A company can’t ignore these costs cannot as they are important in understanding how effectively the business is running. And, management should exercise tight control over such costs as they can raise the break-even point for the company.

At times, to increase profitability, a company needs to cut these costs. Also, a company looking to acquire another company considers these costs closely. For example, soon after the merger of DuPont and Dow Chemical in 2015, management came out with an announcement to cut 5,400 jobs to save $750 million in expenses.

Forecasting SG&A

Since SG&A help in determining the EBIT for a company, an analyst or management usually forecast these expenses for budgeting purpose and also to forecast its profits. One can easily forecast SG&A using the following methods – a fixed dollar value, a growth rate over the last year, or a percentage of sales revenue.

Choice of the method will depend on if SG&A is a one-line item in the income statement or if it is broken down into individual items. If it is a one-line item, an analyst can use any of the above methods to forecast the SG&A.

If SG&A includes individual items, then an analyst must use different methods to forecast them. For instance, rent would be a fixed dollar value as it won’t change from last year. Advertising may vary with sales, so it must be a percentage of sales revenue.

Overspending of SG&A Expense

Though selling, general, and administrative expenses are not directly attributable to the manufacturing and selling of products, they should increase in proportion to the sales. If these items keep on increasing, but the sale is dropping, the company must bring down these expenses. Excessive increase in the SG&A costs might bring down the profitability of the company.

Companies can bring down selling and general and administrative expenses by adopting various cost-cutting and restructuring measures. Such as reducing the non-sales personnel salaries, decreasing travel costs, lay-offs, and more.

Moreover, a company should maintain tight control over these costs with the help of continual review of discretionary costs, comparisons of the budget with actual costs, trend analysis, zero-based budgeting, and more.

Final Words

Selling, general and administrative expenses are crucial for a company’s operating income (Gross Margin – SG&A = Operating Income or EBIT (Earnings before interest taxes)). Therefore, an increase in SG&A expenses results in a drop in EBIT. But, since these expenses are crucial for the day-to-day running of a business, a company must monitor these expenses closely.

This is really financial management advice in laymen terms.

Thanks, Graig, for your appreciation.