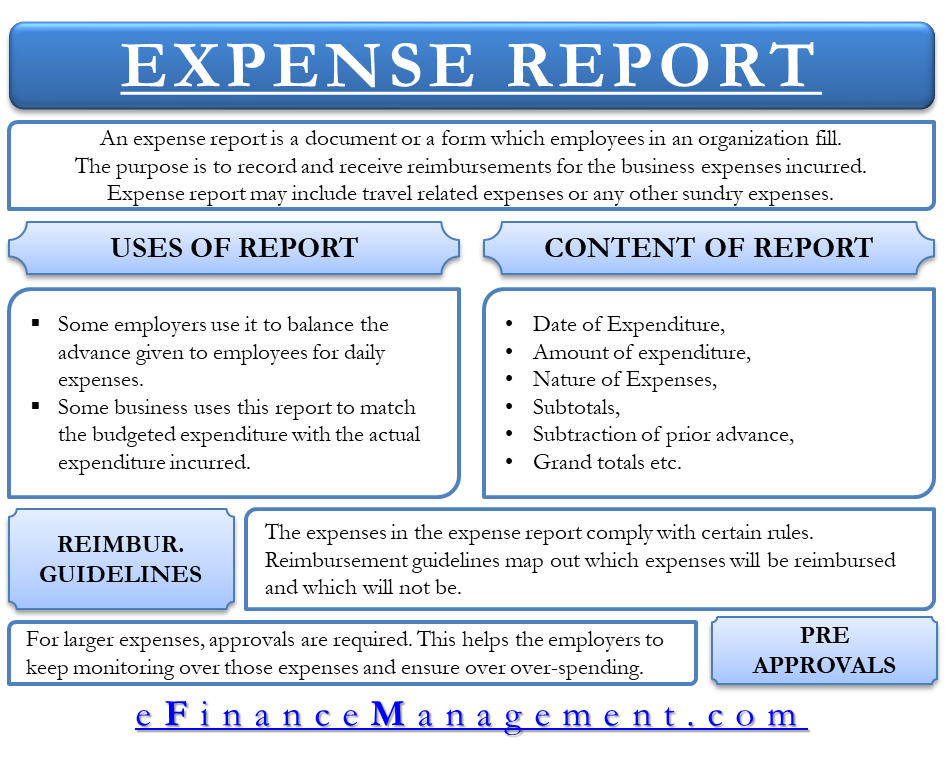

For any business with employees, the expense report is an important part of its accounting process. It saves the business time and effort and makes it easier for both the accounts department and the employees to do their jobs.

It is a document or a form that employees in an organization fill out. Here, the purpose is to record and receive reimbursements for the business expenses incurred. These are commonly used for recording the travel expenses of employees and other sundry expenses. Some common expenses include:

- Hotels, trains flights, and other transport expenses.

- Taking regular customers for meals at a restaurant.

- Gifts for employees, customers, or suppliers.

- Purchase of office stationery and supplies.

Some proof of the expense must accompany an expense report. Employees usually must attach receipts (proof) with the report if the amount of expenditure exceeds a certain minimum amount. The employer (usually the accounts department) then collects all the expense reports filed by the employees. He then examines them for validity and accuracy and pays employees the requested amounts.

Uses of Expense Reports in a Business

Some employers use this to balance expense reports with advances given to employees to meet such routine expenses. E.g., an employer may give his employees a small amount every month to meet routine business expenses. He may then ask employees to prepare an expense report every month to account for the advance money given.

Also Read: What is Expense? – Definition and Meaning

Some businesses also use expense reports to match budgeted expenditure with actual expenditure. For this use, employers ask all the units on a department basis to prepare an expense report for all the expenses that take place in the business. Employers then compare the expense report with their expectations and find out the cause of the discrepancy. The objective here is to control the expenses of different departments by finding out where the money of each department is going.

Contents of an Expense Report

Although the formats will vary in different businesses but some of the common elements are:

- The date on which the expenditure was incurred.

- Amount of expenditure.

- The nature of the expense (travel expense, freight charges, cleaning expenses, etc.)

- A subtotal of each type of expense.

- A subtraction of any prior advance given to the employee for such expenses.

- The grand total of the reimbursement amount.

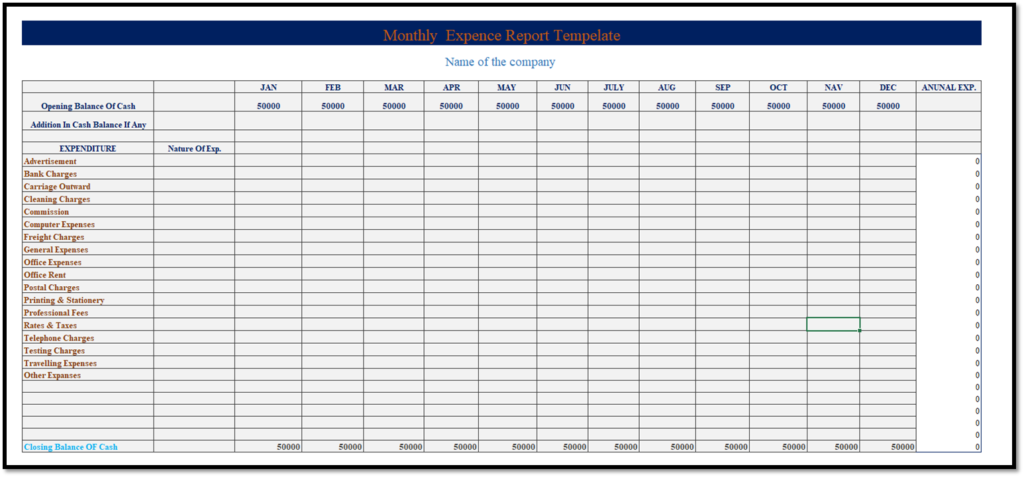

Expense Report Excel Template

Reimbursement Guidelines in an Expense Report

The expenses in an expense report must comply with certain rules. Reimbursement guidelines map out which expenses will be reimbursed and which ones will not be. You cannot possibly list out all the expenses and all the conditions of your reimbursement policy. But, you can map out some major guidelines which will cover most of the cases. These guidelines can be:

- In case of a meal at a restaurant, the names of the guests and the reason for the meal must be present.

- To claim reimbursement for a night at a hotel, the hotel must be located say, more than 30 miles away from the company office or should be more than an hour-and-a-half’s drive from the employee’s home.

- “Business gifts” must be of a reasonable amount and the reason should be clear.

In addition to the above conditions, employers are free to define their own conditions for the employees to follow.

Pre-Approvals

For larger expenses, some employers require the employees to get approval before making the purchase. That way, employers can monitor reimbursements and ensure that employees don’t overspend. E.g., an employee may have to take approval to book a flight ticket for a business trip. Employees then attach approvals with the expense report while asking for reimbursement.

Continue reading – What is Expense? for more and also read full-time equivalent to learn about the total working hours of employees.