What is Overhead a Cost?

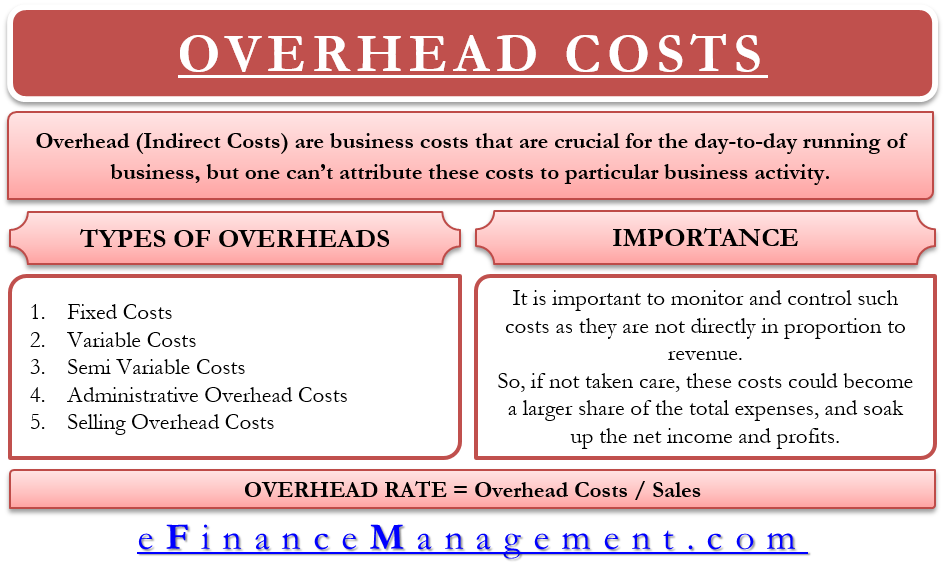

Overhead are the business costs that are crucial for the day-to-day running of the business, but one can’t attribute these costs to particular business activity. Also known as indirect or burden costs, overhead costs do not directly result in a profit for the company. But, they are necessary to support profit-making activities.

For instance, a retailer may incur a regular cost (a type of overhead) on maintaining the showroom to ensure a proper selling environment. Though it is impossible to relate such expenses to a particular product, they are necessary for the overall running of the business.

More examples of this cost are administrative salaries, depreciation, property taxes, rent, utilities, accounting, legal expenses, customer relations and service, travel, Licenses, and government fees.

How Are They Different from Direct Costs?

Overhead costs constitute all costs on a company’s income statement, except for those that can be directly attributable to manufacturing a product or service. Those that are directly attributable are the direct costs. Such costs are crucial for manufacturing products and services, like direct materials and direct labor.

For example, the clay and the wheel are direct costs for a potter, while rent for their facility will be overhead. In all, overhead and direct costs are the total cost that a company incurs. A business must set the price of its products and services at levels that cover both these costs.

Types of Overhead

There are three types of overhead costs on the basis of behavior;

Fixed

Overhead costs are usually fixed. This means that they don’t change with business activity. Some examples are rent, mortgage payments, annual salaries, insurance, property taxes, government fees, some utilities, depreciation of assets, and more.

Variable

Some costs vary directly with the sales level. Some examples of such expenses are equipment maintenance, advertising, legal expenses, materials, consulting services, shipping, office supplies, and more.

Semi-variable

Some overhead expenses can also be semi-variable, meaning a business has to incur some portion irrespective of the sales, while some portion depends on the business activity. Some examples are vehicle usage, hourly wages with overtime, the commission of salespeople, and more.

Overhead can be general as well. Such overhead applies to the company’s operations as a whole. A company can allocate such expenses to a specific project or department. For example, expenses like printing or office supplies can be calculated for each department.

One can also differentiate overhead expenses on the basis of operational categories.

Administrative Overhead

it usually includes expenses in relation to basic administration and general business operations, such as salary for accountants or receptionists.

Selling Overhead

Such expense includes the cost of marketing the product or service, such as television commercials, printed materials, and more.

There can be more types of overhead expenses depending on the nature of the business, such as manufacturing overhead, maintenance overhead, research overhead, transportation overhead, and more.

Accounting Treatment

Such expenses appear in the company’s income statement. It is important for the company to account for such expenses to determine the overall profitability of the company.

Importance

It is important to monitor and control such costs as they are not directly proportional to the revenue. So, if not taken care of, these costs could become a larger share of the total expenses and soak up the net income and profits.

Understanding such cost also help a company set prices. One can club overhead costs with the direct cost to know the overall expenses that a company incurs. Also, such costs are important to arrive at the net profit or the bottom line. To arrive at the net profit, one needs to subtract all expenses, including overhead, from the gross profit.

Overhead Rate

One can calculate the overhead rate only after determining each overhead cost for a specific time period. Once you have all the costs, all you need to do is add them together. Now, to get the overhead rate, divide the overhead costs by the sales.

Overhead Rate = Overhead Costs / Sales

For example, if a business has an overhead cost of $3,000 and total sales of $30,000, then the Overhead rate is 10. This would mean that the business spends 10 cents on overhead for every dollar it earns. The general rule is the smaller the overhead rate, the better it is for the company.

Should You Cut Down Overhead Costs?

A business must always strive to cut down such costs to maximize profit. Since raw material and labor are crucial for manufacturing, and thus, a company can’t reduce them, checking and slashing extra overhead costs can help a company be more profitable.

For instance, a company must carry out a review periodically of the staff count. It should analyze if the current level of staff is needed for the current sales or not. If not, it can lower the headcount, which would boost the bottom line.

Also, when a business is in a downturn, cutting the overhead costs is one of the easiest ways to put the company back on the growth track.

RELATED POSTS

- Cost Object – Meaning, Advantages, Types and More

- What is Expense? – Definition and Meaning

- Selling, General and Administrative Expenses – All You Need To Know

- Material, Labor and Expenses – Classification Based on Nature of Costs

- Types of Costs and Relationship of Direct & Indirect Costs with Fixed & Variable Costs

- Cost Structure

I thank for this, Sir Borad. I used it as my reference in my Masters Degree in Business. A big help so much!