Creditors Voluntary Liquidation: Meaning

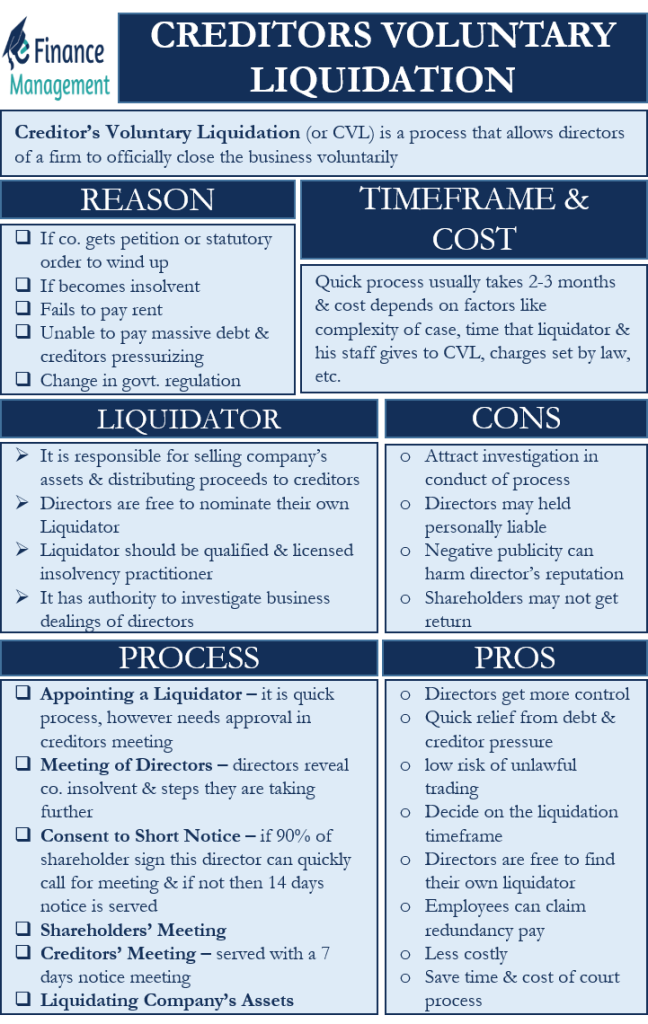

Creditor’s Voluntary Liquidation (or CVL) is a process that allows directors of a firm to officially close the business voluntarily. Directors usually choose this liquidation as an alternative to being forced by the creditors to compulsorily liquidate the company. After a company is liquidated, its debt is wiped out along with the company itself.

Directors generally go for such liquidation when the company is insolvent. When taking such a decision the directors must ensure to minimize the loss to creditors. If they fail on this count then they may be held personally responsible for it.

- Creditors Voluntary Liquidation: Meaning

- Reasons for Creditor’s Voluntary Liquidation

- Liquidator

- Creditor’s Voluntary Liquidation Timeframe

- CVL: How Much Does it Cost?

- Advantages and Disadvantages of Creditor’s Voluntary Liquidation

- Creditor’s Voluntary Liquidation: Process

- Why is it Better than Compulsory Liquidation?

- What after Creditor’s Voluntary Liquidation?

- Final Words

Reasons for Creditor’s Voluntary Liquidation

In the following cases, directors can decide to use CVL:

- If a company gets a petition to wind up or statutory order from a creditor.

- When a company already has an insolvent balance sheet, i.e., liabilities being more than the assets. Also, losses continue to rise, and directors believe that a turnaround is not possible within a reasonable period.

- If a business fails to pay the rent. And the landlord appoints bailiffs to confiscate the assets of the business.

- If a company gets a winding-up petition for failure to pay HM Revenue & Customs.

- If a firm has a massive debt, and due to this, it is unable to meet its current liabilities, and creditors are pressurizing for payment.

- A sudden and significant change in government regulations has made it extremely difficult for the company to operate profitably.

Liquidator

Unlike the usual liquidation, in the case of a CVL, directors are free to nominate their Liquidator. However, the appointee liquidator should be a qualified and licensed insolvency practitioner. We need to understand and appreciate that such an appointee insolvency practitioner will be the liquidator of the creditors. Though here the directors propose the name of the liquidator, however, the appointment could be confirmed only upon the approval of the creditors.

The primary responsibility of the liquidator in CVL is to sell the assets of the company and distribute the receipts to the creditors. The liquidator must act in good faith, as well as minimize loss to the creditors.

Also, a licensed Insolvency Practitioner (IP) has the authority to investigate the business dealings of the directors. After IP takes over the liquidation process, the role of directors ends. IP, however, can call on directors to provide details if there is a need.

Creditor’s Voluntary Liquidation Timeframe

Placing a business into a Creditor’s Voluntary Liquidation is a quick process. And, it generally takes a fortnight to a few months. The liquidation process takes some time to conclude as it includes realizing (selling) the company assets. Generally, the timeframe for the process depends largely on the size of the business and the type of assets it owns.

We can get an idea of the time frame from the CVL process (discussed later).

CVL: How Much Does it Cost?

Talking about the cost of CVL, it is an important consideration when taking up this liquidation. If directors believe the cost of liquidation to be high, then they may delay the process. And this could force the company into compulsory liquidation by creditors.

A point to note is that the cost of CVL is usually taken from the proceeds that a company gets by selling its assets. But if the proceeds fall short, then directors may have to bear the remaining cost. So, directors may not be required to bear and pay the cost in all the circumstances. Here the redundancy entitlements of the directors can not be used for payment of this excess cost.

The liquidation cost under CVL usually depends upon various factors. Some of these factors are the complexity of the case, the time that the liquidator and his staff give to CVL, charges set by law, and more.

Advantages and Disadvantages of Creditor’s Voluntary Liquidation

Below are the advantages of CVL:

- Directors get more control than in the case of compulsory liquidation.

- It gives businesses quick relief from the debt and creditors’ pressure

- It lowers the risk of unlawful trading.

- The business may get an opportunity to get back the assets.

- Directors are free to their insolvency practitioner. Moreover, directors can also decide on the timeline for the liquidation that best suits them.

- All the debts and liabilities of the company are completely written off. Similarly, the company will have the right to cancel all the leases.

- Employees can claim redundancy pay.

- The cost of CVL is relatively less than other types of liquidation.

- The CVL also helps to do away with the costly and time-consuming court processes.

Below are the disadvantages of CVL:

- A liquidation process usually attracts an investigation into the conduct and business dealings of the directors.

- There are chances that in an investigation, the Directors may be held guilty. And in that situation, they may be personally liable to make the payment to the creditors.

- Insolvency attracts a lot of negative publicity, and this could harm the reputation of the directors on an individual level.

- Shareholders may not get any return in case of such liquidation.

Creditor’s Voluntary Liquidation: Process

Following is the usual process of Creditor’s Voluntary Liquidation:

Appointing a Liquidator

Once decided to proceed with the CVL, then the first step the directors need to take is the appointment of a liquidator. The process of appointing an Insolvency Practitioner (Liquidator) is quite fast. The appointment, however, will not be confirmed and final till it is cleared or approved by the creditors. This approval by Creditors happens at the meeting of the creditors called for this specific purpose.

Meeting of Directors

After the appointment, the directors need to hold a meeting to reveal to the stakeholders that the firm is insolvent. Also, the directors need to reveal the steps they are taking for the CVL. Directors can quickly call this meeting if their company is small with few directors.

Consent to Short Notice

If 90% of the shareholders sign ‘Consent to Short Notice,’ then the directors can quickly call a shareholders’ meeting. If shareholders do not agree, then a 14-day notice need to be served before a shareholders’ meeting can be held.

Shareholders’ Meeting

Generally, a shareholders’ meeting is held immediately before the creditors’ meeting. After shareholders approve the liquidation, they can also confirm the appointment of the liquidator.

Creditors’ Meeting

Creditors’ meeting usually occurs immediately after the shareholders’ meeting and, if possible, on the same day. Normally, creditors are served a 7-day notice of the meeting.

Liquidating Company’s Assets

After all the approvals, the company’s liquidation process can move ahead. All activities of the assets sale are carried out by the liquidator. The Liquidation time depends upon the quantum and complexity of the assets.

Usually, the whole CVL process takes between 2-3 months. But more complex cases can take between 12-24 months.

Why is it Better than Compulsory Liquidation?

Following are the reason why CVL is better than liquidation:

- Directors get more control over the process.

- Lowers chances of wrongful trading.

- Removes pressure on the creditors.

- Directors may be able to buy back the assets going ahead.

What after Creditor’s Voluntary Liquidation?

Once the liquidator sells the assets and pays all the creditors, the name of the company is struck off the register. The company then effectively ceases to exist. Since the debt is on the company, the liabilities, if any, end with the end of the firm. If in case directors have personally guaranteed any debt (or debts), and any such debt is not fully paid off. Then the creditors have a right to claim the unpaid debt from the directors.

Also, the liquidator usually investigates the role of directors in case of liquidation. If the liquidator finds nothing on directors, then all ends well. Directors will be able to start a new firm, but there are restrictions on using the name of the old company.

Final Words

Creditor’s Voluntary Liquidation is a quick and cost-effective way to liquidate. Such a method works very well if all parties reach a consensus. If the company somehow finds enough money to repay the creditors, then it can stop the CVL process. However, if the assets of the firm are liquated, then the company can not stop the liquation process. In such a case, the company has the option to buy back the assets through the liquidation process at a fair value.